Make Money Work For You.

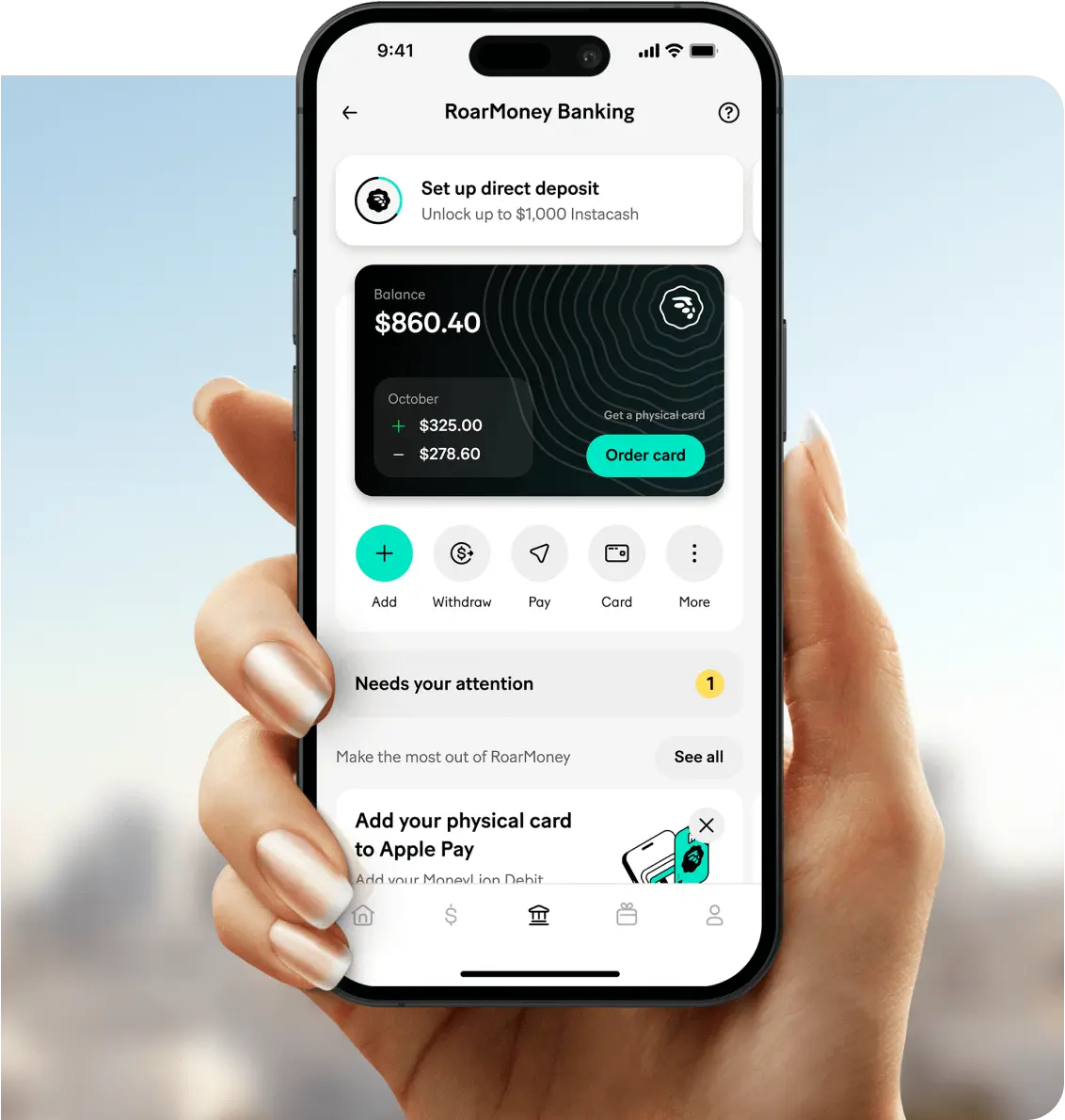

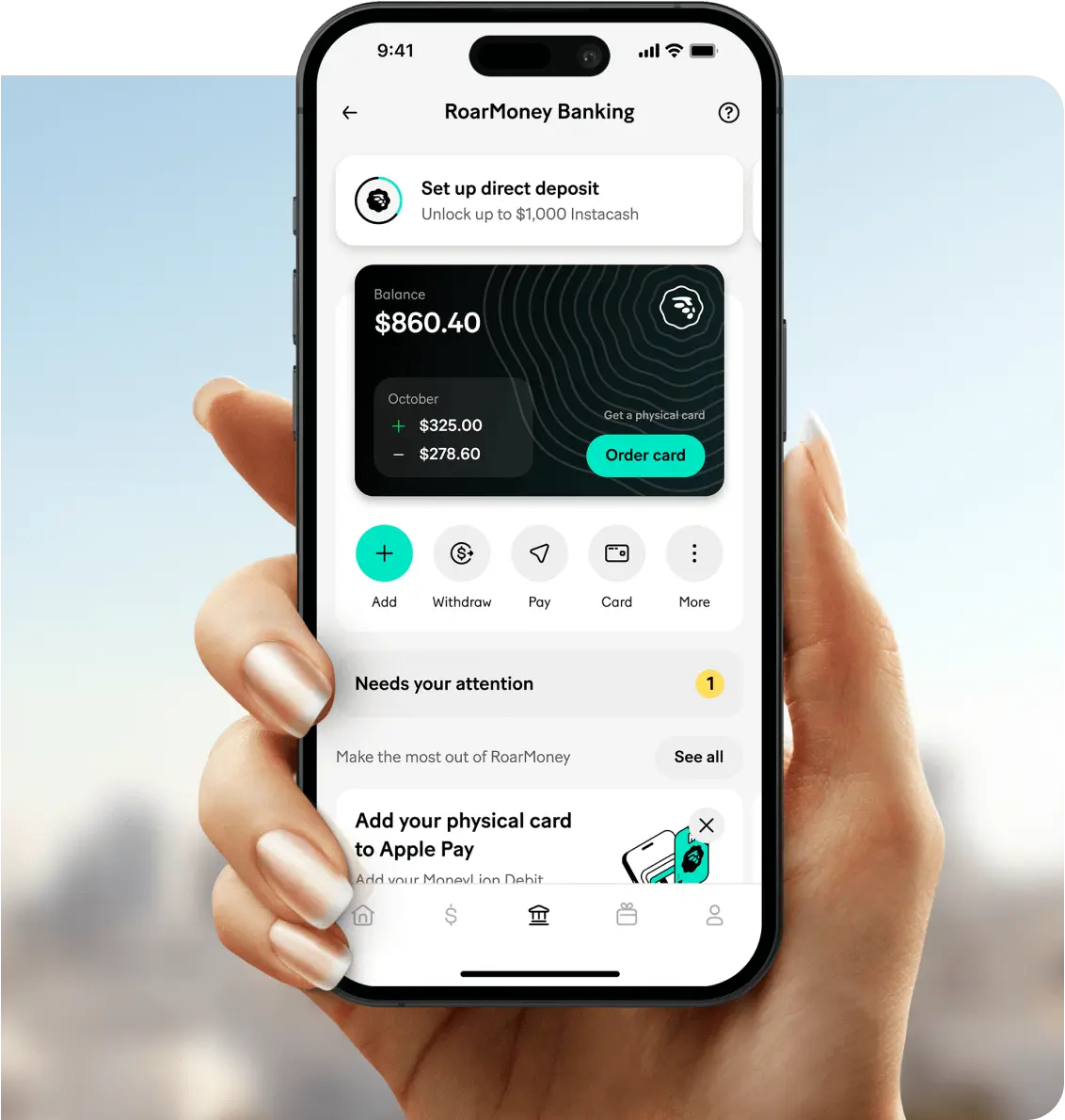

Get paid up to 2 days early.1

Access up to $1,000 of your paycheck with interest-free InstacashSM.2

Buy Bitcoin or start investing with your spare change using Round Ups.3

Make Money Work For You.

Get paid up to 2 days early.1

Access up to $1,000 of your paycheck with interest-free InstacashSM.2

Buy Bitcoin or start investing with your spare change using Round Ups.3

Real Cashback. No BS.

Earn up to $500 when you make a qualifying purchase of $10 or more with Shake 'N' Bank4 rewards.

Get rewarded when you shop at your favorite stores online

Your Cash.

Your Rules.

Deposit funds automatically into your account using a custom schedule.

Add funds to your RoarMoney account through a network of 90K+ retailers nationwide.5

Withdraw from 55K fee-free ATMs.6

Settle up: Send and receive money without fees using MoneyLion Pay.7

Peace of Mind

Funds are FDIC-insured up to $250,000.

Debit cards are backed by the benefits and reliability of Mastercard including Price Protection, Zero Liability, and Extended Warranty.8

Lock your card instantly in the app anytime.

Track your spending with weekly reports to view your spending habits by category.

Discover new money hacks, content, and personalized insights to level up your finances.9

Funds are FDIC-insured up to $250,000.

Debit cards are backed by the benefits and reliability of Mastercard including Price Protection, Zero Liability, and Extended Warranty.8

Lock your card instantly in the app anytime.

Track your spending with weekly reports to view your spending habits by category.

Discover new money hacks, content, and personalized insights to level up your finances.9

How it works

Create your account

Create your account and choose your money goals to personalize your experience. It takes just a few minutes.

Easily add funds to your account

Easily add funds to your account via four different methods: cash, debit card, direct deposit, or external transfer.

Activate your virtual card

Activate your virtual card in the app to start using it right away, after you add funds.

Make it yours

Make it yours. Choose your favorite color for your physical card and have it shipped to you.

What people say10

We’ve given out over 1 million in cashback to date.

Active rewards paid as of 11/20/2023

I have been using this app for about 2 years now and I love it. If you receive direct deposits, you get paid 2 days early. I always receive my paycheck on a Wednesday instead of waiting until Friday.

Monique D FROM Google Play

4/28/23

You can find ATM everywhere and they are absolutely free and I would rather have MoneyLion over any other well known banks out there.

NYCBoyAC from APP STORE

3/25/23

I absolutely love the Shake N Bank feature, no other app does that.

Trevin H from MoneyLion Discover

9/20/23

Learn more about Banking

Learn MoreIt’s easy and takes just a few minutes! Download the free MoneyLion app from the Apple or Google Play store and register for a MoneyLion account with a few pieces of personal information, including your name and your email address. Once you have created an account, we will need to confirm your identity. To do this, we securely and quickly gather additional information from you, including your Social Security number, address, and date of birth.

Once we have verified your identity, you can tap the RoarMoney banner in the app or select the RoarMoney product from our listing of products to set up your RoarMoney account in just a few steps! To start making the most of your account, you should link an external bank account and transfer funds or set up direct deposit. Note that you must be 18 years or older and a resident of the fifty (50) United States or the District of Columbia to be eligible for RoarMoney.

RoarMoney will not charge you hidden bank fees associated with your account! Any fees will be disclosed to you. You have access to 55,000 free Allpoint ATMs, but if you use an ATM that is outside of the Allpoint network, you will incur an ATM fee of $2.50 + whatever the out-of-network ATM / financial institution charges (typically $2-$5). These fees apply to both domestic and international ATMs.

If you choose to expedite your physical replacement card, this will incur a $25 fee. This will allow you to receive your card within 2-3 business days.

There is a $1 monthly administrative fee associated with your RoarMoney Account. Please see FAQ on administrative fee for additional information. Other fees associated with the RoarMoney Account including, send a paper check for Bill Pay and adding funds via external debit card will apply. See account agreement for more information.

First, you don’t need to wait for your card to arrive in the mail to start using your new RoarMoney account. As soon as you sign up, you can activate your RoarMoney virtual card and set a PIN by calling our automated activation line at 801.736.2453 and use it to shop online, by phone, and everywhere that accepts mobile pay after adding funds into your RoarMoney account. You find your virtual card in the Finances tab of your MoneyLion app.

Before we’ll mail you a card, you need to add funds of any amount or set up a direct deposit in the MoneyLion app. As soon as you do, we’ll mail you a MoneyLion Debit Mastercard®! It typically takes 7-10 business days from the day you add funds into your account until you receive the card. You should expect your debit card to reach you by the end of the 10th business day.

If you haven’t received your card after 11 business days, please double-check that your address on file is correct using the MoneyLion mobile app (you’ll find your address in the Main Menu by tapping your profile picture). If you need to update your address, you can click Edit next to the address.

If you have not yet added funds to your RoarMoney account, please do so by transferring funds from another linked account OR by initiating direct deposit through the MoneyLion mobile app or with your employer. Learn more about how to add money to your account here.

No, we don’t check your credit history when you apply for a RoarMoney account, and applying will not affect your credit score.

Have More Questions?

Read More FAQs