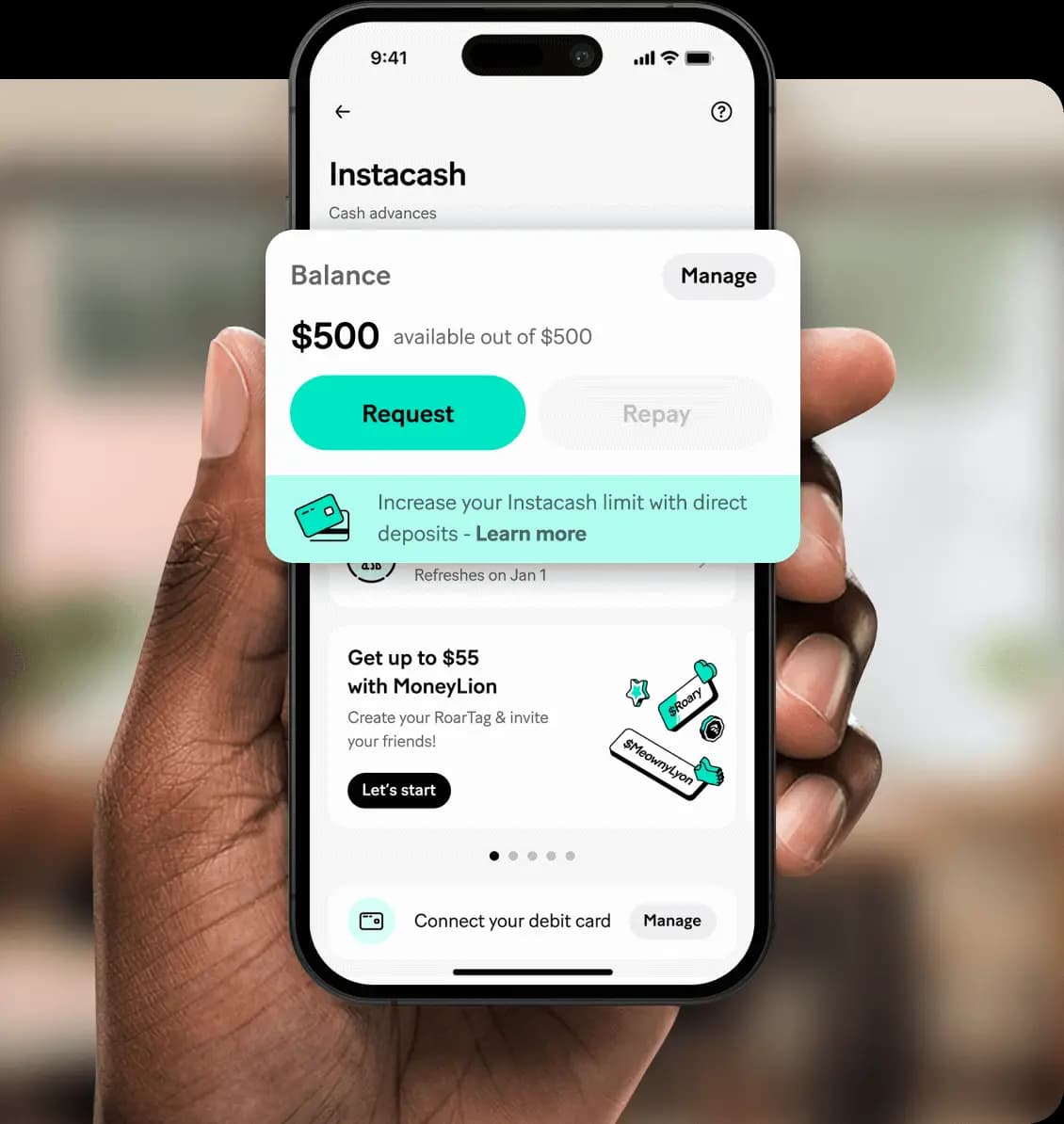

INSTACASH

Get Paid Any Day

Unexpected vet bills, or last minute date night—no worries! If life throws you a curveball, get Instacash cash advances up to $500.

Get Up To $500. Fast.

Need More?

No Stress, No Hassle.

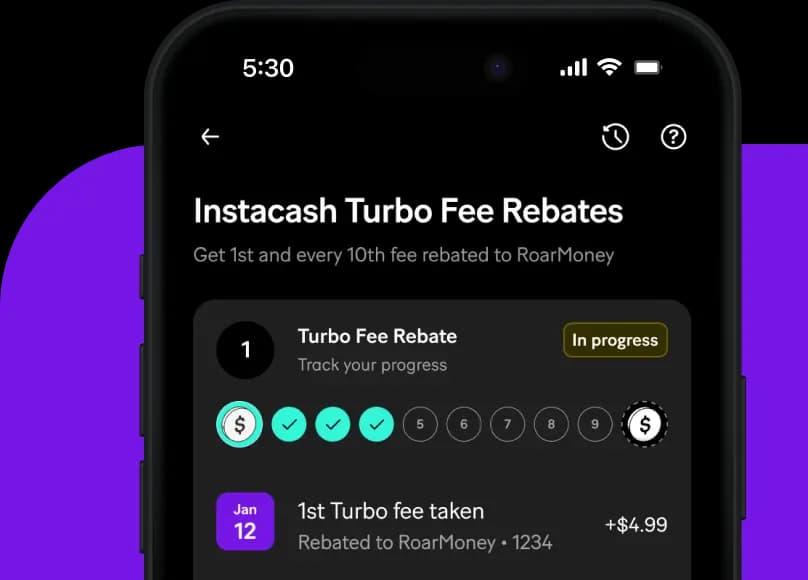

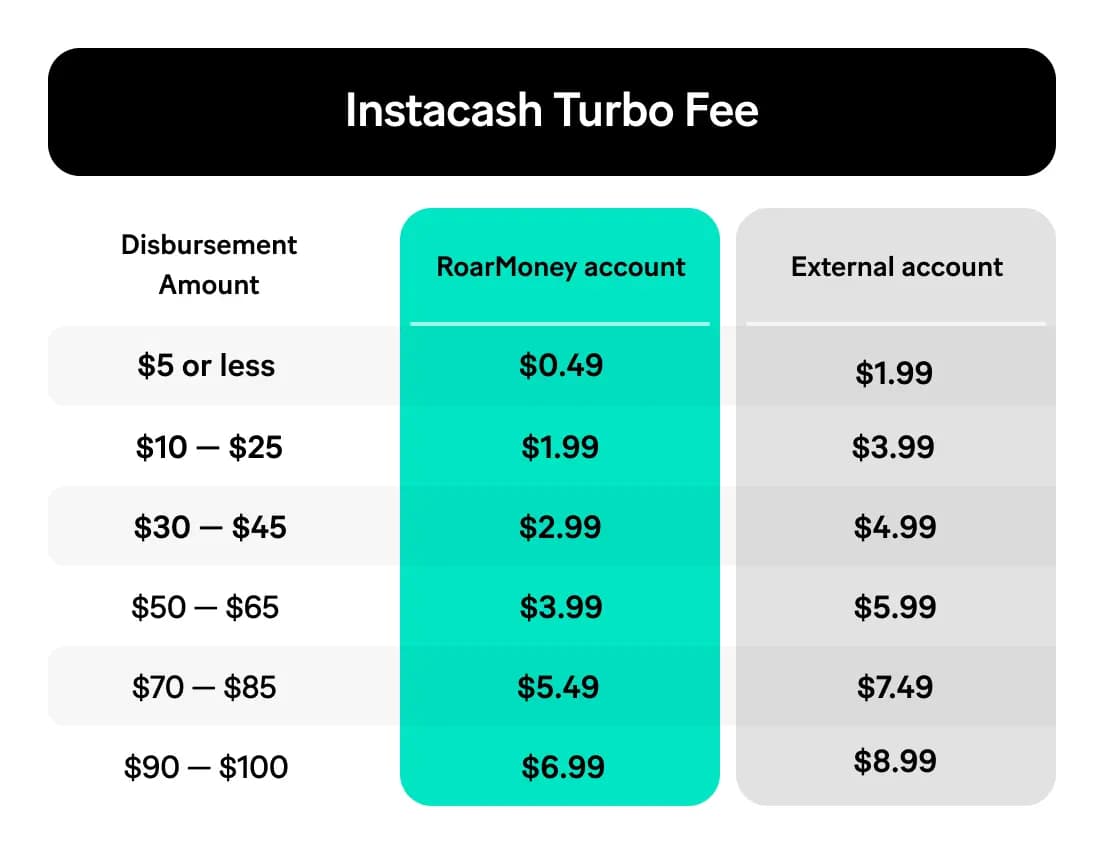

Save On Instacash Turbo Fees

Become a MoneyLion WOW member and get up to a $5 rebate on your first Instacash Turbo Fee and every 10th thereafter.1

How Does it work?

Simple.

Sign Up for MoneyLion or Download the MoneyLion app to sign up for Instacash.

If you already have the app, tap Instacash on the ‘Accounts’ tab

Link the bank account where you receive your paycheck to see if you qualify.

Select the amount you want.

Confirm, and voila! You’re done. Enjoy your cash.

93%

of Instacash customers have felt more in control of their finances since they started using Instacash.88%

of Instacash customers believe Instacash is their best option when they need access to cash.89%

of Instacash customers believe they are better able to take care of themselves and their dependents since they started using Instacash.

- This app was a total life saver. I put myself in a terrible situation right before payday and was able to access funds immediately and now.Melio07 from app store7/27/23

- They are the best when you are in need of fast cash.Cobra12King Adams from google play7/12/23

- MoneyLion is the best cash advance app that I’ve used. The app is very user friendly, and they will work with you as long as you communicate with them. If I ever need a cash advance again, I’m definitely going through Moneylion!ERJr@3232 fROM APP STORE7/27/23

You've got questions. We have answers.

How do I get Instacash?

To apply for cash advances up to $500, tap Instacash on the Home screen of the MoneyLion app. You’ll find out right away how much you can get. There’s no interest, no monthly fee, and no credit check! Here’s more info on qualifying.

It’s easy to increase your available Instacash amount by setting up direct deposits into a RoarMoney account. You’ll unlock cash advances up to $1,000** depending on your qualifying income.

HOW TO USE INSTACASH

- Download the MoneyLion app if you don’t have it.

- Open the app, go to the Finances tab.

- Tap the Instacash button at the top.

- Tap the Request button

- Select the amount you want, and how soon you would like the funds transferred to your account. Note: there is a maximum of $100 per disbursement.

- When you use Instacash, the amount you’ve taken out is automatically deducted from your account on the repayment date as determined by your pay cycle – with no interest. You can take another Instacash once you repay your last Instacash as long as you maintain your eligibility.

How do I qualify for Instacash?

To unlock 0% APR Instacash advance, tap the Instacash button on the Home Screen. All you need to do is link your checking account to apply. It’s secure and quick. We’ll then verify your checking account and your identity so you can get cash quickly.

CHECKING ACCOUNT MINIMUM REQUIREMENTS

We’ll review your linked account to confirm that it meets or exceeds our minimum qualification requirements. You can improve your chances of qualifying by linking a checking account that meets or exceeds the following criteria:

- It’s not too new: Choose an account that’s been open for at least two months.

- It shows income deposits: Pick the account where you regularly deposit your income/paychecks and have a history of depositing income.

- It has a positive balance: Choose an account where you have consistently maintained a positive balance.

- It’s active: Choose an account that you have used and continue to use regularly!

Any account that cannot be confirmed as a checking account, such as a savings or money market account, will not qualify for Instacash.

IDENTITY VERIFICATION REQUIREMENTS:

We must be able to verify your identity and checking account ownership:

- Enter your info as it appears on your bank account. We’ll check the info you enter against the details we receive from your linked bank to make sure they match.

- Make sure your info matches your public records. We’ll also check the info you enter against electronic public records.

If your account doesn’t qualify, please try again when it has been open longer and/or had more consistent deposits and positive balance — or try another checking account!

Please note: If you’re a Credit Builder Plus member but you have late or missed loan payments, you may not be eligible to take out Instacash advances until your account is in good standing.

Will Instacash affect my credit?

No! We don’t do any sort of credit pull or credit check during or after an Instacash request.

How much does Instacash cost?

You can unlock Instacash for free! Standard delivery (which could take up to 5 business days*) for no cost or you can choose the optional Turbo delivery and get your cash within minutes. Turbo delivery fees vary. There’s no monthly fee and no interest. Any Turbo fees and tips are totally optional. Whether you choose to tip and/or pay a Turbo fee for expedited delivery does NOT impact your access to Instacash or your Instacash limit.

Each time you get an Instacash advance, you can select from these disbursement options, some of which have associated costs:

- Regular delivery (1 – 2 business days*) to your RoarMoneySM** account – $0

- Regular delivery (2 – 5 business days*) to your external checking account – $0

- Optional Turbo delivery (within minutes) to your external debit card or eligible external checking account or RoarMoneySM account – refer to the fee table below:

Lastly, every time you take an interest-free cash advance, you will have a choice to leave a small optional tip in appreciation of the Instacash advance service.

How will my Instacash advance be repaid?

Instacash repayments are automated, making it easy to pay on your scheduled repayment date and replenish your Instacash so it’s ready when you need it next! On each scheduled repayment date, the amount of Instacash you received and any related optional Tips and optional Turbo Fees will be automatically deducted from your authorized payment account or debit card. There’s no interest charged.

Here’s how automated Instacash repayments work:

- When you request an Instacash advance, you authorize us to electronically debit your RoarMoneySM account, a third-party debit card, or an external linked checking or spending account on the scheduled repayment date. If there is not enough balance in your account, we may deduct a partial repayment and make additional debit attempts until the Instacash amounts are fully repaid (subject to your right to withdraw the payment authorization for your payment methods).

- If repayment from the payment methods stated above is not successful, we may attempt a debit on any additional payment methods you have added to your ML Wallet.

Head here to learn more about Instacash repayments.

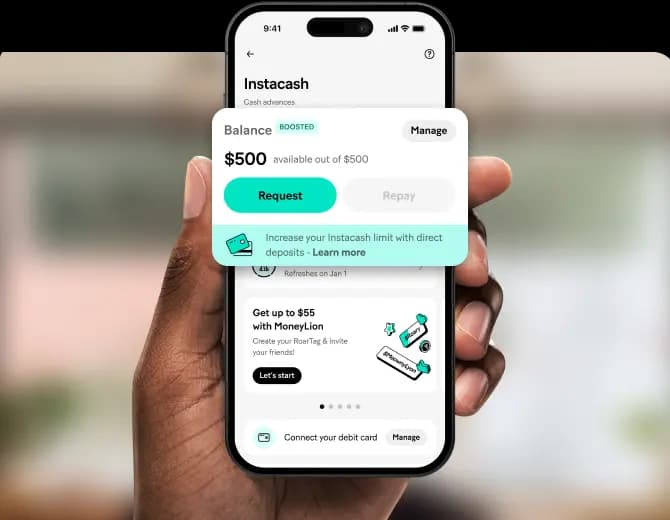

How do I increase my Instacash limit?

After you unlock Instacash, if we can detect qualifying recurring direct deposits in your linked checking account and can predict when your income is deposited into your account, you’ll have access to Instacash limit of up to $500. Typically, higher deposit amounts will unlock higher Instacash limits.

You can increase your Instacash limit up to a maximum of $1000** (depending on the anticipated income amount) by switching your direct deposits into a RoarMoneySM account. It’s easy to do this in the app at anytime or through your employer or other payor. Learn more on how to do so here.

Alternatively, you can sign up for a paid MoneyLion membership, which can also increase your Instacash limit up to $700.

If you are not currently eligible for our complete Instacash experience, you may be eligible for our Trial experience, which allows you to start with a minimum of $10 and unlocks higher limits by advancing through a repayment progression program. See here for more information about Trial Instacash.

Have More Questions?