Financial markets have had a rocky start in 2022. Major stock market indices have fallen a few percentage points as investors adjust to sharply higher interest rates, rising inflation, and faster tightening from the Federal Reserve. This has been a shock to markets, but long-term investors have seen episodes like this many times over the past decade. Rather than focusing on short-term market news, it’s more important for investors to stay invested for the long run.

History shows that staying invested with an appropriate portfolio can be the key to long-term success

Doing so helps investors to capture the upside as markets rise over long periods while protecting from the downside when they inevitably decline over shorter ones. In doing so, investors can better resist the temptation to jump out of markets when daily or weekly swings occur.

Just as a sensible sedan, SUV, or minivan may not be able to keep up with a race car on an open highway, they are best-suited to handle the inevitable potholes and traffic jams. And, in the end, can help get you to your destination. Three things to keep in mind

Investors should consider the importance of remaining focused in the weeks and months to come. The goal of long-term investors is not to swerve wildly based on past returns but to stay invested in an appropriate portfolio through both good times and bad. Here’s why.

- Short-term stock market pullbacks are not just normal — they can happen any time. They are not a cause for panic but can serve as a reminder as to why we build portfolios and seek financial guidance in the first place. There are typically four or five market pullbacks of 5% or larger each year that tend to fully recover within weeks or months. Remember, risk and reward go hand-in-hand. Managing risk appropriately while continuing to seek returns is why investors have, historically, been in the long run.

- Rising interest rates and Fed tightening are natural and expected at this stage in the business cycle. However, they often require a period of adjustment which the market is undergoing right now. This was true in 2013 during the Fed taper tantrum, in 2015 when the Fed announced its first rate hike that cycle, last year when the Fed was expected to taper again, and so on.

The Fed’s job is not to keep rates low or to stimulate the economy indefinitely. Instead, the Fed’s goal is to maintain full employment and stable prices. Even if inflation were not at multi-decade highs, the strength of the economy would justify raising rates at this point in the economic expansion. History shows that once markets and businesses adjust, interest rates tend to rise alongside the economy.

- Many factors have pushed markets to ever-higher levels over the past couple of years, and investors should have realistic expectations for the economy and markets. This is important because it may be tempting to exit the market altogether when times seem tough. But once again, history shows that it is often better to simply stay put. In fact, because markets tend to recover unexpectedly and rise over time, the longer an investor stays out of the market, the more they potentially miss.

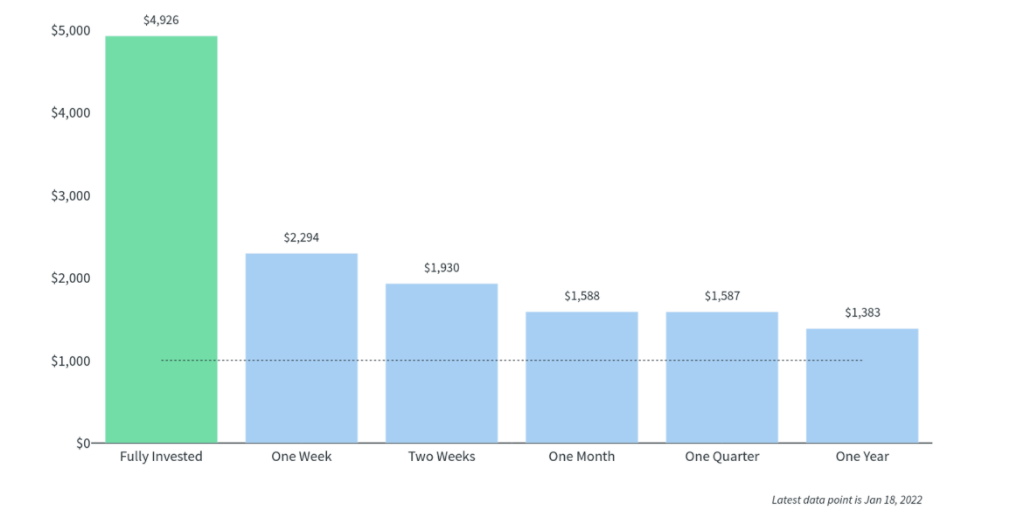

Chart: The importance of staying invested

This chart shows the hypothetical returns of an average investor over the past 25 years who held the S&P 500 compared to those that exited after 2% pullbacks and stayed out for one week, two weeks, one year, etc. Past performance is no guarantee of future returns. Sources: Clearnomics, Standard & Poor’s, Jan 18, 2022.

Disclosures

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, MoneyLion does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information. For more information about MoneyLion, please visit https://www.moneylion.com/terms-and-conditions/.

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclaimers relating to the MoneyLion Investment Account, see Investment Account FAQs and FORM ADV. Accounts are subject to an administrative fee of $1 per month.