It’s that classic catch-22: you need credit to build credit, but how do you get started if no one will give you a chance? Enter the credit builder loan, a money hack that can put you on the way to establishing or rebuilding your credit profile without the typical roadblocks.

In this guide, we’re going over everything to know about credit building loans, including how they work and how to get one.

MoneyLion offers a seamless way to explore personal loan offers. Learn what you could qualify for and compare rates, repayment terms, fees, and more.

Table of contents

What is a credit builder loan?

A credit builder loan is designed specifically to help people establish or improve their credit history. Unlike most loans, it’s not about getting money for a purchase; instead, it’s a credit-building tool with a unique structure.

Credit builders are particularly valuable for credit newcomers, those rebuilding after financial setbacks, or anyone caught in the frustrating loop of needing credit to build credit. The genius of a credit builder loan is its low-risk approach to creating the positive payment history that credit bureaus love to see, without requiring a good credit score to start.

How does a credit builder loan work?

Credit building loans might seem counterintuitive at first. After all, who wants to pay for a loan they can’t use right away? But that’s exactly what makes them brilliant for building credit history.

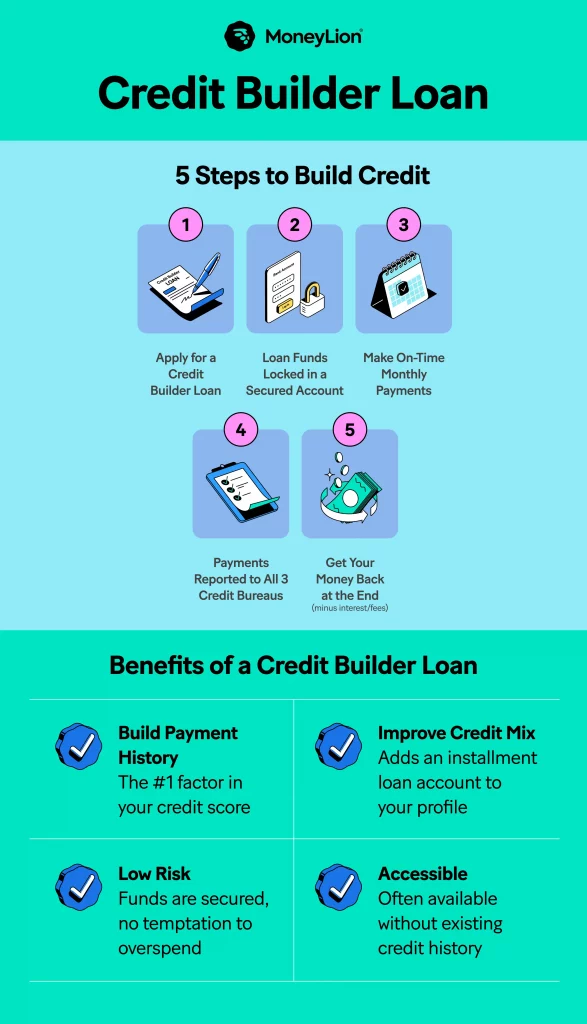

Here’s the breakdown:

- Application: You’ll apply for a credit builder loan through a designated provider, such as MoneyLion, who offers it through a Credit Builder Plus membership, or by exploring marketplaces to compare different loans that help build credit.

- Approval: Once approved, your loan amount will be set aside in a secured account or certificate of deposit (CD).

- Payments: You make fixed payments over a set term.

- Reporting: The lender reports your payment activity to the credit bureaus.

- Completion: After making all payments, you receive the loan amount plus any interest earned (minus fees if applicable).

The magic happens in step 4, as your consistent payments create a positive payment history, which accounts for 35% of your FICO score. On-time payments over time are one of the key ways to build your credit score.

👉 How Are Credit Scores Calculated?

How does a credit builder loan affect your credit score?

When you make payments on your credit builder loan, the lender reports this activity to the major credit bureaus (Equifax, Experian, and TransUnion). These reports impact your credit score in four key ways:

- Payment history (35% of your FICO score): Each on-time payment adds a positive mark to your most influential credit factor. After several months of consistent payments, this growing history of reliability can significantly boost your score.

- Credit mix (10% of your FICO score): Adding an installment loan to your credit profile diversifies your credit types. Lenders like to see that you can handle different kinds of credit responsibly, not just revolving accounts like credit cards.

- Length of credit history (15% of your FICO score): As your loan ages, it contributes to your average account age. The longer your accounts have been open and in good standing, the more confident lenders feel about your financial stability.

- New credit (10% of your FICO score): Initially, applying for the loan may create a hard inquiry, temporarily lowering your score by a few points. However, this small dip typically recovers within a few months and is far outweighed by the positive impacts.

The beauty of credit building loans is that they strategically improve multiple credit score factors simultaneously, creating a well-rounded credit profile that future lenders can review.

👉 Credit Score vs. Credit Report: What’s the Difference?

Who should consider a credit builder loan?

Credit builder loans aren’t for everyone, but they can be worth considering, especially for people who:

- Have no credit history (credit invisibles)

- Have a damaged credit score that needs work

- Recently moved to the US and need to establish credit

- Want to improve your credit mix (types of credit accounts)

- Have been denied for traditional credit products (credit cards, loans, etc.)

If you’re nodding along to any of these, a credit builder program might be your ticket to building a better credit score.

How to get a credit builder loan: steps to apply

Credit builder loans are typically offered by financial institutions like banks, credit unions, online lenders, and fintech companies. You can also explore credit builder loans by using an online marketplace, such as MoneyLion.

Ready to take the plunge into a credit builder program? Every lender has a process that looks different, but here’s a general breakdown for how to get a credit builder loan step by step.

1. Check basic requirements

Oftentimes, you’ll need a valid ID, an active bank account, some form of income, and your Social Security Number or ITIN. Good news: typically no minimum credit score required, making credit builder loans accessible even if you’ve been rejected for other financial products.

2. Compare your options

Take time to shop around on credit builder marketplaces and comparison sites where you can view multiple offers side-by-side.

Banks, credit unions, online lenders, and apps like MoneyLion all offer loans to help build credit with varying terms. Look for differences in loan amounts (typically $300 to $3,000), repayment periods (6 to 24 months), interest rates, fees, and confirm they report to all 3 credit bureaus.

MoneyLion’s Credit Builder Plus membership offers a credit builder loan that’s been able to help people grow their credit score 27+ points in 60 days. It’s reported to all 3 credit bureaus and you may be able to open a $100 trade line with no hard credit check!

3. Apply with confidence

In most cases, applications typically take several minutes and can usually be completed online. Have your ID, proof of address, and income verification ready. Most lenders provide quick decisions, often the same day, since they’re evaluating your ability to pay rather than your credit history.

4. Set yourself up for success

After approval, set up automatic payments to ensure you never miss a due date. Track your credit score monthly to watch your progress. Remember that consistent on-time payments are the key to credit improvement, so choose a loan amount with monthly payments you can comfortably afford.

💡Money Hack: Before applying for a credit builder loan, create a budget to ensure you can consistently make your payments on time. Your future credit score depends on it!

Pros and cons of getting a credit builder loan

Credit builder loans shine brightest for those starting or rebuilding their credit journey who can commit to consistent payments. They’re less ideal for those who need immediate funds or already have established credit profiles with multiple accounts in good standing.

| Pros | Cons |

| ✅ Low risk for credit building: Structured payments with no temptation to overspend | ❎ Costs money: You pay interest and possibly fees for the credit-building opportunity |

| ✅ Builds payment history: Consistent reporting to all three major credit bureaus | ❎ Relatively small loan amounts: Typically limited to $300 to $3,000 |

| ✅ Improves credit mix: Adds an installment loan to your credit profile | ❎ Opportunity cost: Money tied up that could be used elsewhere |

| ✅ Predictable outcome: Clear timeline for when you’ll complete the loan | ❎Less flexibility: Fixed payment schedule with potential penalties for early payoff |

| ✅ Progress tracking: Many lenders provide free credit monitoring | ❎Potential for negative impact: Late payments can hurt your credit score |

Tips for maximizing your credit builder loan

Getting a credit building loan is just the beginning. Here’s how to squeeze every possible point out of this credit-building strategy:

1. Never miss a payment: Late payments can counteract all your hard work. Set up autopay or calendar reminders to stay on track.

2. Keep other financial behaviors in check: A credit builder loan works best as part of a holistic approach to credit health. That includes keeping credit card balances low, not applying for too many new credit accounts, and maintaining old accounts in good standing.

3. Track your progress: Monitor your credit score monthly to see your hard work paying off. Many credit builder programs often include free credit monitoring.

Alternative ways to build credit without a loan

If a credit builder loan doesn’t seem like the right fit for your situation, don’t worry, there are several other effective ways to establish or improve your credit profile:

Secured credit cards

Unlike traditional credit cards, secured cards require a security deposit that typically becomes your credit limit. This deposit reduces the lender’s risk, making these cards accessible even with limited or damaged credit. Make small purchases and pay them off in full each month to build up positive payment history without interest charges.

👉 What is a Secured Credit Card? How it Works

Become an authorized user

Ask a trusted family member or someone close with good credit to add you as an authorized user on their credit card. Their positive payment history can boost your credit score, even if you never use the card yourself. Choose someone with a long history of on-time payments and low credit utilization for maximum benefit.

Credit-building apps and services

Several fintech solutions now offer credit-building features without traditional loans or cards. Some report your rent payments to credit bureaus, while others track payments you’re already making, potentially turning your utility bills into credit-building tools.

Store credit cards

Retail store cards typically have more relaxed approval requirements than major credit cards. While they often come with higher interest rates and limited usability, they can be an effective stepping stone if used responsibly, just be sure to pay the balance in full each month.

The gradual approach

For those extremely cautious about taking on credit or anxious about managing debt, start with a small secured loan or card with a minimal limit ($200 to $300). As you build confidence in your ability to manage credit responsibly and establish positive history, gradually expand to a more diverse credit mix.

Personal loans to build credit: Are they a better option?

While standard personal loans to build credit might seem attractive because you get the money upfront, they’re often harder to qualify for with limited or damaged credit. The approval process typically requires a credit check and higher income requirements.

For most credit beginners, a dedicated credit builder loan provides:

- Higher approval odds

- Lower risk (for both you and the lender)

- More structure for developing positive habits

- No temptation to spend the loan amount unwisely

That said, if you need funds for a specific purpose AND want to build credit, secured personal loans or credit-builder cards might be worth exploring.

FAQs

Is a credit builder loan a good idea?

A credit builder loan can be an excellent idea if you have limited or damaged credit history and can commit to making consistent, on-time payments for the full loan term.

Can you borrow money from a credit builder?

No, technically you can’t borrow money up front from a credit builder loan – the funds are held in a secured account until you complete all scheduled payments.

Do you get the money back from a credit builder loan?

Yes, you get the money back from a credit builder loan after completing all scheduled payments, minus any interest and fees charged by the lender.

What happens at the end of a credit builder loan?

At the end of a credit builder loan, you’ll receive the full loan amount you’ve paid (minus fees and interest agreed on in advance). Your (ideally) positive payment history will remain on your credit report, and your credit score typically shows improvement from the established payment history over time.

Can I cancel a credit builder loan?

It depends on your lender. Even if you are able to cancel a credit builder loan, you may still face early termination fees or other consequences, and you’ll usually only receive a portion of the payments you’ve made after fees are deducted.