Pay advance apps are quickly becoming an essential tool for millions of Americans who need quick access to funds, without the burden of a high-interest payday loan or credit card. These fintech platforms provide small advances on your future income, helping you bridge the gap between paychecks.

This comprehensive guide examines the top 8 pay advance apps for 2026, comparing their advance limits, fee structures, eligibility requirements, and standout features to help you make the most informed decision.

Scroll to the bottom to view our ranking methodology.

| App | Advance amounts | Fees | Funding time | Repayment terms: |

| MoneyLion | Up to $500 | No mandatory fees | 1 to 5 business days for free, or in minutes for a fee | Automatic repayment on a pre-determined payment date that aligns with your payday |

| Varo | Starting at $250 or less, but you can work up to $500 with responsible use | 8% of the pay advance | Instant | Due within 30 days |

| Brigit | $25 to $500 | $8.99 per month (Plus plan) or $15.99 per month (Premium plan) membership fees | 1 to 5 business days for free, or in minutes for a small fee | Due within 30 days, but you can extend the deadline with no fee |

| Dave | Up to $500 | $5 per month | 1 to 5 business days with no fee, or in minutes for a 1.5% fee | Due on your next paycheck, or 1 Friday from when you took the advance |

| Tilt | $10 to $400 | $8 monthly fee | 2 to 3 business days with no fee, or in minutes for a small fee | Due on your next paycheck |

| Klover | Up to $400 | No mandatory fees | 1 to 5 business days for free, or in minutes for a small fee | Automatic repayment on a pre-determined payment date |

| Earnin | Up to $1,000 per pay period (max $150 per day) | No mandatory fees | 1 to 5 business days with no fee, or in minutes for $3.99 | Due on your next paycheck |

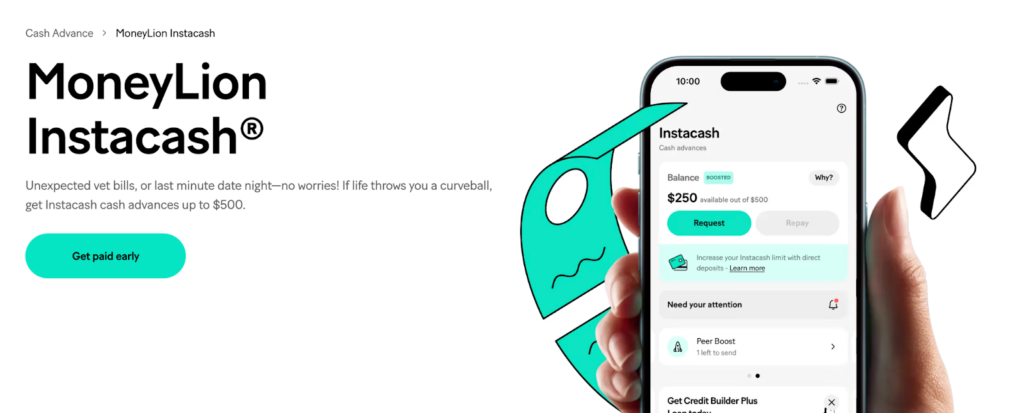

1. Best pay advance app for ease and convenience: MoneyLion Instacash®

MoneyLion Instacash lets users access cash advances up to $500 without a credit check or monthly fees. Instacash is one of the best instant cash advance apps, delivering funds within days at no cost and within minutes for a fee.

Pros of MoneyLion:

- No cost for standard advances

- You could be eligible for a pay advance of up to $500

- Comprehensive financial wellness platform

Cons of MoneyLion:

- You’ll need to link a bank account

- Delivery within minutes may carry a fee

| Advance amounts: Up to $500 | Funding time: 1 to 5 business days with no fee, or in minutes for a fee |

| Fees: No mandatory fees for standard delivery | Repayment terms: Automatic repayment on a pre-determined payment date that aligns with your payday |

2. Best for fast funding: Varo Advance

Varo positions itself as a digital-first banking solution with built-in pay advance capabilities, offering instant access to funds ranging from $20 to $500. If you’re looking for an all-in-one banking provider that also does pay advances, then Varo is a great option.

Unlike many competitors, Varo operates without requiring a monthly subscription. Instead, it charges a flat 8%. If you borrow $20, you’ll pay $1.6. Borrow $100, and you’ll pay $8.

Pros of Varo Advance:

- Instant access to funds

- No subscription fees

- Flexible, lengthy repayment timeline

- Automatic repayment

Cons of Varo Advance:

- Requires a Varo bank account

- Flat fee to access an advance

- Pay advances start at $250 for all customers

| Advance amounts: Starting at $250 or less, but you can work up to $500 with responsible use | Funding time: Instant |

| Fees: 8% of the pay advance | Repayment terms: Within 30 days |

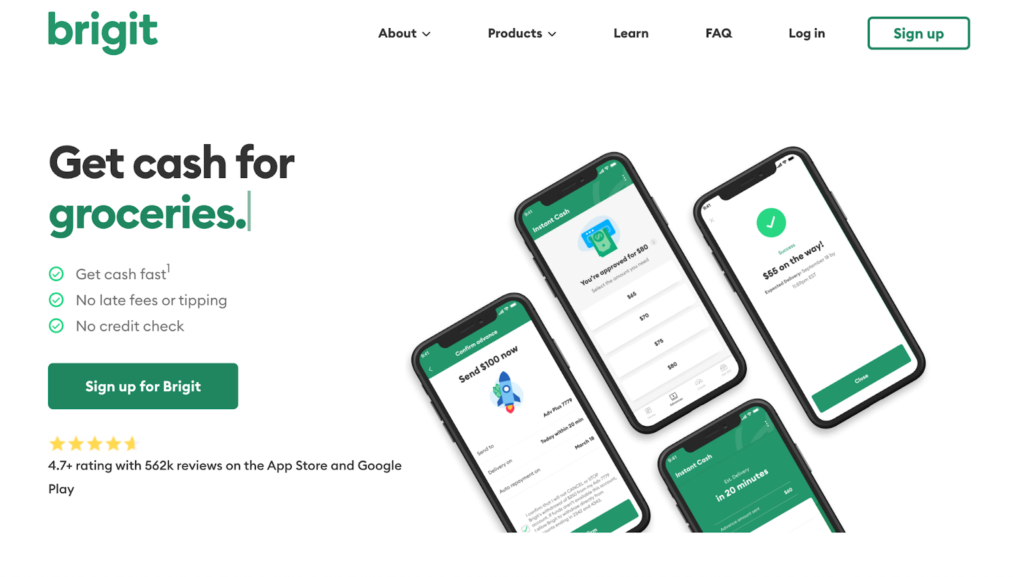

3. Best for basic financial wellness tools: Brigit

Brigit focuses on financial wellness and accessibility, offering advances up to $500 alongside budgeting tools, real-time alerts, and credit-building. The platform requires a monthly membership ranging from $8.99 to $14.99, which unlocks standard advances delivered within 2 to 3 business days at no additional cost. Users who need faster access can pay extra for expedited delivery.

This pay advance app emphasizes financial education and preventive tools. For example, it monitors your account activity and sends alerts before potential overdrafts, helping users avoid costly bank fees. The platform also provides personalized budgeting insights and suggestions for gig work opportunities, creating a more comprehensive financial support system beyond simple cash advances.

Brigit does not perform credit checks, making it accessible to users with limited or damaged credit histories. However, the platform requires consistent income and regular deposits to qualify for advances.

Pros of Brigit:

- Comprehensive financial wellness features

- No credit check required

- No fee to extend your pay advance repayment date

Cons:

- Requires a monthly subscription

- Requires a stable income, with at least 3 direct deposits

- Lower advance limits than competitors

| Advance amounts: $25 to $500 | Funding time: 1 to 5 business days for free, or in minutes for a small fee |

| Fees: $8.99 per month (Plus plan) or $15.99 per month (Premium plan) membership fee | Repayment terms: 30 days, with no fee to extend |

4. Best for fast advances: Dave ExtraCash

Dave built a reputation as a user-friendly paycheck advance app that combines overdraft alerts, budgeting features, and credit-building tools with advances up to $500. The platform charges a $5 monthly subscription, positioning it as one of the more affordable subscription-based options.

Users can access expedited deposits for an additional fee, or they can unlock faster funding by completing small tasks or viewing advertisements within the app. The app’s straightforward setup process and intuitive interface make it particularly appealing to first-time cash advance app users.

Pros of Dave ExtraCash:

- Low monthly subscription cost

- Multiple ways to access funds quickly

- Integrated budgeting features

- User-friendly interface

Cons of Dave ExtraCash:

- Requires a subscription

- Fastest funding requires engagement or fees

- May require regular income verification

| Advance amounts: Up to $500 | Funding time: 1 to 5 business days with no fee, or in minutes for a 1.5% fee |

| Fees: $5 membership fee | Repayment terms: Due on your next paycheck, or 1 Friday from when you took the advance |

5. Best for no direct deposit requirement: Tilt

Tilt, formerly known as Empower, makes it easy to access up to $400, reporting that 75% of applicants are approved. It emphasizes that its transactions are fast and easy to obtain, with no credit check for direct deposit qualification. Instead of a direct deposit, Tilt evaluates your eligibility based on your bank account activity and income patterns – making it one of the best pay advance apps for people looking to avoid a direct deposit.

The platform charges an $8 monthly membership fee and provides automatic repayment on your next payday, making it easy to repay your pay advance.

Pros of Tilt:

- High advance limits

- No credit check required

- Fair, transparent pricing

- 75% of people qualify for a cash advance

- Very fast instant funding

- No direct deposit requirement

Cons of Tilt:

- Limited to users who sign up via partner platforms

- Monthly subscription required

| Advance amounts: $10 to $400 | Funding time: 2 to 3 days for free, or in minutes for a small fee |

| Fees: $8 monthly fee | Repayment terms: Due on your next paycheck |

6. Best for low fees: Klover

Klover provides instant cash advances up to $400 with no credit check, interest, or late fees. It also offers tools for personalized financial guidance and budgeting. Users can access funds immediately for free or choose an instant delivery for a small fee.

The platform also lets users unlock larger deposits by watching ads or taking surveys, a feature that separates it from other pay advance apps. Additionally, Klover’s financial advice features provide personalized recommendations based on spending patterns, helping users identify opportunities to reduce expenses and improve their financial stability.

Pros of Klover:

- No credit check required

- Instant funding available

- Financial wellness tools included

- Graduated limit increases

Cons of Klover:

- Low initial borrowing limits

- Requires 3 consistent direct deposits and a linked bank account

| Advance amounts: Up to $400 | Funding time: 1 to 5 business days with no fee, or in minutes for a small fee |

| Fees: No fees | Repayment terms: Automatic repayment at a pre-determined date |

7. Best for high advance pay: EarnIn

EarnIn lets you earn up to $1,000 per pay period with no credit check, mandatory fees, or interest. Unlike subscription-based competitors, EarnIn does not charge mandatory fees, making it one of the most cost-effective cash advance apps.

EarnIn requires users to set up regular direct deposits and verify their income to maximize their advance limits and access all platform features. The app tracks hours worked for hourly employees or uses bank deposits to verify earnings for salaried workers and requires at least $320 per pay period.

It lets you access up to $150 from future earnings daily and up to $1,000 per pay period – making it one of the best free instant cash advance apps with a high limit.

Pros of EarnIn:

- No mandatory fees

- Access to earned wages immediately for a small fee

- High advance limits compared to other cash advance apps

Cons or EarnIn:

- Requires verification with a work email address or GPS tracking

- Daily max advance of $150 ($1,000 per pay period)

- Limits depend on the regular pay schedule

- Maximum benefits require direct deposit

| Advance amounts: Up to $1,000 per pay period (max $150 per day) | Funding time: 1 to 5 business days with no fee, or in minutes for $3.99 |

| Fees: No mandatory fees | Repayment terms: Due on your next paycheck |

What are pay advance apps?

Pay advance apps, also known as cash advance apps, are fintech services that provide small advances on your future income or pay, typically repaid automatically on your next payday or when funds are deposited into your linked account.

These services can help you get spending flexibility when you need it most and avoid high-interest options like a credit card or payday loan. Pay advance apps also evaluate eligibility based on income patterns and account activity, making them accessible to users regardless of credit history.

Here’s how it works:

- Connect your bank account to one of your preferred cash advance apps and grant permission for the platform to monitor deposits and account activity.

- Verify your income through direct deposits, gig platform earnings, or regular account activity that demonstrates consistent cash flow.

- Request an advance up to your eligible limit, which the app calculates based on your income history and account behavior.

- Receive funds either through standard delivery (typically 1 to 3 business days at no cost) or instant delivery (usually within minutes for an additional fee).

- Automatic repayment occurs when your next paycheck or deposit hits your account, with the advance amount plus any fees deducted automatically.

Most pay advance apps use an automated approach, which eliminates the need for manual repayment and reduces the risk of missed payments. Many platforms also offer instant cash advances that make it very easy to get cash quickly for a small fee.

👉 How to Borrow Money From Cash App Borrow

Pros and cons of pay advance apps

Is a pay advance app right for you? This list of pros and cons can help you answer that question.

| Pros | Cons |

| ✅ Immediate access to funds: Pay advance apps give you fast cash within minutes when you need it most. | ❎ Recurring fees: Monthly subscription costs plus instant transfer fees and tips can add up quickly. |

| ✅ You can avoid high-interest options: Their low, transparent fees help you avoid the high-cost debt. | ❎ Low initial limits: Many apps start users with small advances, making it hard to cover larger expenses right away. |

| ✅ No credit check required: Most apps approve you based on income, not credit score. | ❎ Income verification requirements: Apps that rely on direct deposits or steady income may exclude gig workers or those with irregular earnings. |

| ✅ Transparent fee structures: You see all fees upfront, with no hidden costs. | ❎ Account exclusivity: Some apps require you to open a bank account with them, reducing flexibility. |

| ✅ Financial wellness tools: Many apps offer budgeting tips and alerts to support better money habits. | ❎ Risk of dependency: Easy access to cash advances can create reliance on frequent borrowing. |

| ✅ Flexible repayment: Repayment is automatic and synced to your payday for convenience. | ❎ Data access requirements: These apps require broad access to your financial data, raising privacy and security considerations. |

Alternatives to pay advance apps

While pay advance apps can offer quick relief, they’re not the only option when you need extra cash. Depending on your financial situation, one of the alternatives below may provide more flexibility, lower costs, or a better long-term solution.

- Personal loans: Borrow a fixed amount and repay it over several months or years, often at lower interest rates than short-term borrowing options. They can be a strong choice if you need to cover larger expenses or prefer predictable monthly payments.

- Credit cards: Enjoy immediate spending power and, in some cases, 0% APR introductory periods that let you borrow interest-free for a limited time. When used responsibly, credit cards can help you manage cash flow while earning rewards or building credit.

- Payday loans: Provide fast access to cash but come with extremely high interest rates and short repayment windows, making them one of the most expensive borrowing options. They’re generally best avoided unless you’ve exhausted all other alternatives.

- Borrow from family or friends: Reaching out to trusted loved ones can offer a low-cost or interest-free way to get financial help. Just be sure to set clear expectations and repayment terms to protect your relationships and avoid misunderstandings.

Pay Advance Apps: Bridging the Gap Between Paychecks

Filtering through the best pay advance apps can be a time-consuming process. But this research is critical to your financial well-being, ultimately helping you get faster access to cash, clearer pricing, and far more flexibility than high-interest alternatives.

By understanding the features, fees, and eligibility requirements of each platform, you can confidently choose a cash advance app that supports your short-term needs while helping you stay on track financially.

FAQs

Is a pay advance app the same as a loan?

No, a pay advance app isn’t the same as a loan. A loan is a form of debt, while a pay advance app simply gives you early access to money you’ve already earned – a concept known as earned wage access.

Do pay advance apps affect my credit score?

No, most pay advance apps don’t affect your credit score because they don’t run credit checks or report your activity to credit bureaus. As long as you repay on time, they typically stay off your credit report.

Are pay advance apps safe or secure?

Yes, reputable pay advance apps use bank-level security and encryption to protect your information. However, it’s important to choose trusted providers.

What is the typical borrowing limit on cash advance apps?

Most cash advance apps offer limits between $100 and $500, though some options – like MoneyLion Instacash – provide up to $1,000 with a qualifying account and direct deposits.

Are there fees associated with cash advance apps?

Some apps charge monthly subscriptions, while others are completely free. It just depends on the pay advance app.

How do cash advance apps differ from payday loans?

Cash advance apps offer smaller amounts with transparent, lower costs, no credit checks, and automatic repayment, making them more affordable and flexible than traditional payday loans that charge high interest rates.

Can I use a cash advance app without a traditional job?

Yes, several apps support gig workers and those with nontraditional income, provided you have regular deposits into your linked bank account that demonstrate consistent cash flow.

Our methodology

To identify the best pay advance apps for 2026, we conducted a detailed analysis of each platform’s core features, including advance limits, fees, funding speed, eligibility requirements, and repayment structures. We evaluated publicly available information from company websites, user agreements, and app disclosures, and we compared these insights against user reviews, industry benchmarks, and product updates.

Our assessment also considered factors such as transparency, customer support quality, financial wellness tools, and suitability for both traditional and nontraditional income earners. By weighing cost, accessibility, and overall user experience, we developed an objective ranking designed to help readers find the safest and most cost-effective pay advance options for their unique financial situations.