If you need cash quickly, then Cash App Borrow is a legitimate option. This service lets eligible, approved users borrow up to $500 with flexible repayment terms. This detailed guide will break down how to borrow money from Cash App Borrow, including a step-by-step guide, commonly asked questions, as well as some alternatives that might actually be better for your budget.

MoneyLion’s Instacash® lets you access up to $500 with 0% interest: no credit check, no hidden fees*. Use it when you’re stuck between paychecks and need help avoiding a bigger financial hit. It’s not a loan, but a cash advance on your next deposit!

Table of contents

What is Cash App Borrow?

Cash App Borrow is a new service from Cash App that lets eligible users take out a short-term loan of up to $500. There are four main benefits of borrowing through Cash App Borrow:

- Get cash instantly deposited into your Cash App

- Borrow with no hit to your credit score

- Pay only a flat fee of 5%

- Enjoy flexible repayment terms

Keep in mind that Cash App isn’t a bank; it’s a technology platform. It offers banking services and loan products through partners, essentially acting as a middleman.

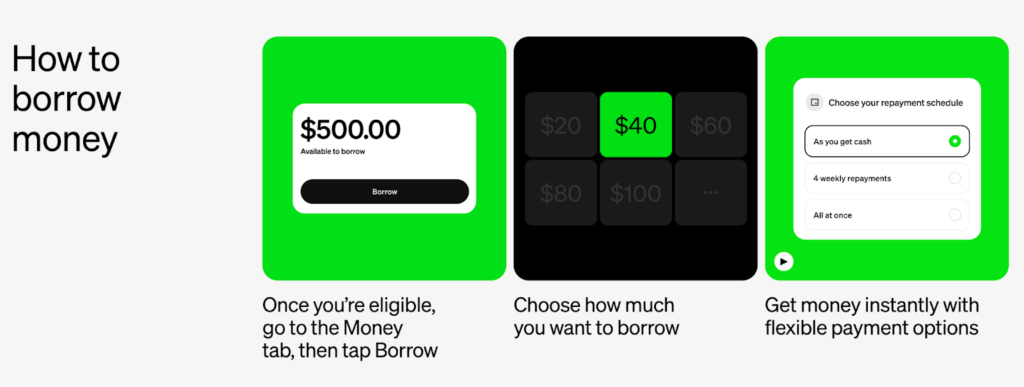

Overview of Cash App’s loan feature

Cash App’s loan feature helps you borrow money instantly through Cash App. Once approved, you’ll be able to tap “Borrow” in Cash App’s Money tab, select how much you want to borrow, and then choose your repayment method.

Steps to borrow money from Cash App

Step 1: Qualify for Cash App Borrow

Cash App Borrow isn’t available to anyone who uses Cash App. You have to meet certain eligibility requirements. Here’s how you can qualify:

- Deposit $300+ per month: Most people qualify when they direct deposit $300+ in paychecks monthly into Cash App, or when they link an external account that receives $500+ in monthly deposits.

- Get a Cash App Card: Applying for and using a Cash App Card can also help you qualify for Cash App Borrow.

- Keep money in your Cash Balance: Cash App notes that keeping your balance funded helps with approval.

- Meet eligibility requirements: You must be 18+ years old, the legal owner of your account (not a sponsored account), and not a resident of Colorado or Iowa. Your account must also be in good standing.

Cash App isn’t clear whether you need to meet all of these requirements, or just most of them. If you’re not eligible for Cash App Borrow, consider checking off more boxes until your account gets approved.

The most important factor for qualifying? Setting up a direct deposit.

Step 2: Access the Borrow feature

Once you’re approved, Cash App’s Borrow feature will be prominently displayed in the Money tab.

Don’t see it? That likely means that your profile still hasn’t been approved.

If you meet all the criteria and still don’t have access to Cash App Borrow, you may want to contact Cash App’s support team. You can also try updating Cash App.

Step 3: Select loan amount and terms

Cash App Borrow lets you borrow as little as $20, all the way up to $500. However, not every user will get approved to borrow $500. The maximum amount you can borrow will depend on your personal credit score.

👉 How to Build Credit: The Complete Beginner’s Guide

Step 4: Accept loan terms and conditions

Once you’ve selected the amount of cash you want to borrow, you’ll need to pick your repayment terms and schedule.

Be sure to carefully review all terms and conditions, even if you’re only borrowing a small amount of money.

Step 5: Receive funds

The good news? Cash App Borrow instantly deposits your cash into your Cash balance, so you can use it right away to pay bills, repay a friend, or transfer it to a different account.

How to repay Cash App loans

Cash App Borrow offers 3 different ways to repay any money you borrow:

- Make weekly installments: Repay your loan in small increments over 4 weeks.

- Pay the entire balance at once: Repay your entire loan in full at a pre-determined date.

- Pay as you receive cash: Transfer a portion of your balance every time you receive cash in your Cash App balance.

If you have any outstanding balance on your final due date, Cash App will automatically deduct it from your Cash balance or linked account.

Cash App’s loans typically come with a flat 5% fee, regardless of how much money you borrow:

- Borrow $50, repay $52.5

- Borrow $100, repay $105

- Borrow $250, repay $262.5

- Borrow $500, repay $525

Consequences of late payments

If you miss a payment, then Cash App may deduct the balance directly from your Cash App account or linked bank account. You could also be on the hook to pay interest, in addition to the flat fee, and may even notice a dip in your credit score.

Tips for using Cash App loans wisely

While Cash App Borrow can be an easy way to get money quickly, there are still a few things you’ll want to watch out for:

- Avoiding over-reliance on loans: Cash App Borrow is accessible, but it’s still a loan. You’re paying a fee every time you borrow, so it’s usually best to treat it as a last resort as opposed to a key part of your budget.

- Assessing your financial situation: Before borrowing, take a quick look at your income, bills, and upcoming expenses to make sure you can comfortably repay the loan when it’s due. Borrowing without a plan can lead to rolling fees or repeated borrowing cycles.

- Setting a repayment plan: Map out exactly how and when you’ll pay the loan back, ideally before you even borrow. Repaying early or on time can help you avoid late fees and keep the loan from becoming a bigger financial burden.

Alternatives to Cash App loans

Cash App loans are accessible, but fairly expensive. You’ll have to pay a flat 5% fee every time you borrow money, which isn’t ideal if your goal is to add long-term spending flexibility to your budget. Luckily, there are several attractive alternatives to a Cash App loan.

1. MoneyLion’s Instacash

Instacash lets you tap into your future paychecks early, making it easier to bridge the gap between paychecks.

Instacash isn’t a loan; it’s earned wage access (EWA). EWA lets you withdraw a portion of your wages before you get paid, rather than waiting for the traditional payday.

This flexibility can be a game-changer if you need cash to help cover your bills, but don’t want to pay hefty fees to borrow money.

MoneyLion’s Instacash has 3 main benefits:

- Access to cash: Tap into your future paychecks whenever you need cash once you qualify.

- It’s easy and affordable: You pay 0% interest and there’s no hidden fees*

- There’s no credit check: Instacash does not require a credit check, making it more accessible than a loan.

| Pros of Instacash | Cons of Instacash |

| ✅ No interest or credit check | ❎ Requires you to link a bank account |

| ✅ Optional Boosts** can help temporarily raise your limit | ❎ Delivery within minutes carries a fee |

| ✅ Super simple and transparent sign-up process |

Help cover bills, handle emergencies, or grab essentials with Instacash®. Access up to $500 with 0% interest: no credit check, no hidden fees*!

2. Other cash advance or paycheck advance apps

Looking for more alternatives to Cash App Borrow? Explore the 7 Best Cash Advance Apps in 2025.

Explore earned wage access offers from MoneyLion’s network of trusted partners.

3. Personal loans

Personal loans give you a fixed amount of money that you repay over a set period (typically anywhere from 12 to 60 months).

Depending on how much you need to borrow, personal loans may be a better alternative to short-term loans because they can help spread your payments out so you’re not stuck facing immediate financial pressure to repay what you borrowed.

They also tend to offer higher borrowing limits, which can help cover larger expenses without turning to multiple small loans. Overall, personal loans may provide a more stable, predictable, and affordable path for borrowing when you need extra funds.

MoneyLion offers a service to help you find personal loan offers. Based on the information you provide, you can get matched with offers for up to $100,000 from our top providers. You can compare rates, terms, and fees from different lenders and choose the best offer for you.

4. Credit cards

Credit cards can also be a valuable tool for creating extra spending flexibility by letting you cover expenses instantly and paying them off over time. Many cards also come with additional benefits like:

- Rewards for spending

- Purchase protection

- Zero-interest intro periods

- Built-in travel or car rental insurance

- Access to lounges or loyalty programs

When used responsibly (keeping balances low and paying on time), credit cards can help you bridge short-term cash gaps without turning to high-fee loan products.

Plus, using a credit card responsibly is one of the best ways to build your credit score, which can open the door to better financial options down the road.

👉 What is a Credit Card? Ultimate Guide on How Credit Cards Work

MoneyLion can help you explore a wide variety of credit card options tailored to different needs and preferences.

How Do You Borrow Money From Cash App?

Borrowing money from Cash App is fairly straightforward, and you can get approved by setting up a direct deposit, keeping money in your Cash App, or using a Cash App card. Once approved, you’ll be able to borrow between $20 and $500 easily, whenever you need it.

However, remember that Cash App Borrow is just one option to get cash quickly. If you’re short on cash, then you can also explore options like earned wage access with MoneyLion Instacash, a personal loan, or a credit card. With the right strategy, these tools can help you stay on top of bills, handle surprises, and build long-term financial confidence.

FAQs

How to borrow from Cash App?

Cash App Borrow lets you take out a short-term loan of up to $500 directly within the app, if you’re eligible. You can become eligible by setting up a direct deposit, keeping money in your Cash App, and using a Cash App card.

How do I activate Borrow on Cash App?

You must meet Cash App’s eligibility requirements, which include consistent deposits, using a Cash Card, and maintaining a funded balance. Cash App automatically reviews your account and, once approved, the Borrow option will appear in your Money tab.

Why won’t Cash App let me borrow?

You may not qualify yet due to insufficient deposits, account history, location restrictions, or Cash App’s internal risk checks. Completing more eligibility steps, updating the app, or contacting Cash App’s support team may help you gain access.

How to get free money on Cash App?

Cash App does not give away free money. However, if approved, you’ll be able to easily borrow between $20 and $500 using Cash App Borrow.

How to get a loan from Cash App?

You can get a loan from Cash App by using Borrow, which offers short-term loans to eligible users.