Wondering how to dispute credit report errors? It’s a straightforward process, and the Consumer Financial Protection Bureau (CFPB) breaks it down into two simple steps:

- Notify the credit bureau of any errors

- Contact the company that provided the information

This in-depth guide will break down the exact steps that you can take to remove errors on your credit report and protect your financial reputation in 2026.

Stay on top of your credit and financial wellbeing with MoneyLion!

Table of contents

Understanding your rights under the Fair Credit Reporting Act

Having an accurate credit report is critical because it impacts your ability to borrow money, qualify for an apartment, and more.

The Fair Credit Reporting Act (FCRA) provides consumers with powerful protections against inaccurate credit reporting. Under this federal law, you have the right to dispute any information you believe is incorrect, incomplete, or outdated on your credit report. Credit bureaus are legally required to investigate your disputes within 30 days and must remove or correct any information they cannot verify.

The FCRA also ensures that both credit bureaus and data furnishers (like banks and credit card companies) maintain accurate records. When you file a dispute, they must conduct a reasonable investigation and cannot simply dismiss your claim without proper review. If they find the disputed information is indeed inaccurate, they must correct it across all three major credit bureaus.

In other words, don’t be shy about addressing errors on your credit report – you have a legal right to do so!

👉 Credit Score vs Credit Report: What’s the Difference?

Step 1: Obtain your free annual credit reports

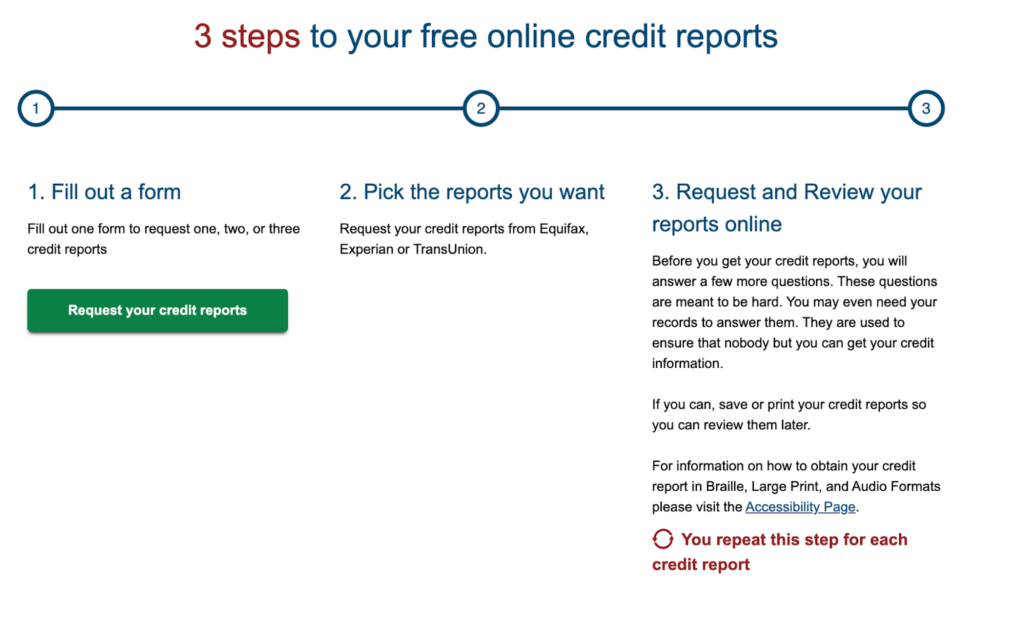

Your first step is to gather your credit reports from all three major credit bureaus: Experian, Equifax, and TransUnion. The FCRA entitles you to one free credit report from each bureau annually through AnnualCreditReport.com, the only federally authorized source for free credit reports.

You may want to consider staggering your requests throughout the year rather than getting all three at once. This strategy allows you to monitor your credit more frequently without additional cost. For instance, request your Experian report in January, Equifax in May, and TransUnion in September.

You may also be entitled to additional free credit reports if you’ve been denied credit, are unemployed and job searching, are a victim of identity theft, or live in certain states with enhanced consumer protections.

Step 2: Review each report thoroughly for errors

Carefully examine every section of your credit reports, as errors can appear anywhere. Be sure to double-check things like:

👉 Personal information: Verify your name, addresses, Social Security number, and employment information. Even minor misspellings can create problems or indicate potential identity theft.

👉 Account information: Check that all listed accounts belong to you and review payment histories, credit limits, and account statuses. Look for accounts you never opened or closed accounts still showing as active.

👉 Public records: Ensure any bankruptcies, tax liens, or judgments are accurate and haven’t exceeded legal reporting timeframes.

👉 Inquiries: Review both hard and soft inquiries, noting any you don’t recognize, which could signal unauthorized credit applications.

Step 3: Identify and document all inaccuracies

Create a detailed list of every error you discover, no matter how minor it might seem. Common types of credit report errors include:

- Incorrect personal information or mixed files with someone else

- Accounts that don’t belong to you

- Inaccurate payment history or late payments you made on time

- Wrong account balances or credit limits

- Accounts showing as open when they’re closed

- Outdated negative information that should have been removed

- Duplicate accounts listed multiple times

For each error, note the specific credit bureau’s report where it appears, as the same error might not exist across all three reports.

Document the correct information and gather any supporting evidence you have, such as bank statements, payment confirmations, or account closure letters.

Step 4: Gather supporting documentation

The more evidence you have, the better. Be sure to collect relevant paperwork that proves the information on your credit report is incorrect. This includes things like:

- Bank statements showing on-time payments

- Canceled checks or electronic payment confirmations

- Account statements from creditors

- Letters from creditors acknowledging errors

- Court documents for resolved legal matters

- Identity theft reports, if applicable

- Correspondence with creditors about account closures or settlements

Organize your documentation chronologically and make copies of everything before submitting your dispute. Consider keeping original documents for your records, as credit bureaus don’t typically return submitted materials.

Step 5: File your dispute with credit bureaus

You can dispute credit report errors through three methods: online, by phone, or by mail. Each approach has distinct advantages:

👉 Online disputes: Most convenient and typically processed fastest, with real-time status updates and digital document upload capabilities.

👉 Phone disputes: Allow for immediate clarification of complex issues, though you won’t have written records of your conversation.

👉 Mail disputes: Provide the strongest paper trail and allow you to include extensive documentation, though processing takes longer.

When filing your dispute, be specific about each error and explain why the information is incorrect. Include your dispute letter, copies of supporting documents, and a copy of your credit report with the disputed items highlighted.

You can find up-to-date contact information for Experian, TransUnion, and Equifax here.

Step 6: Contact data furnishers directly

It’s also a good idea to contact the original creditor or data furnisher reporting the incorrect information. This dual approach – contacting both credit bureaus and the original creditor – often gets faster results because data furnishers can update their records and notify all three credit bureaus simultaneously.

Send a dispute letter to the creditor’s customer service or dispute resolution department, including the same documentation you provided to credit bureaus. Many creditors have specific dispute processes outlined on their websites or customer service phone lines.

The FCRA requires data furnishers to investigate disputes they receive directly from consumers and correct any inaccuracies they discover.

Step 7: Monitor the investigation process

Credit bureaus must investigate your dispute within 30 days of receiving it, though this can extend to 45 days if you provide additional information during the investigation period. During this time, be sure to:

- Check your dispute status regularly through the credit bureau’s website or phone system

- Respond quickly to any requests for additional information

- Keep detailed records of all communications

- Note important dates and deadlines

The credit bureau will contact the data furnisher to verify the disputed information. If the data furnisher cannot verify the accuracy of the information, the credit bureau must remove or correct it on your credit report.

Step 8: Examine and double-check the investigation results

Once the investigation concludes, the credit bureau will send you a written summary of the results, as well as a free copy of your updated credit report if any changes were made. Carefully review these results to ensure:

- All disputed items were properly investigated

- Corrections were made accurately

- No new errors were introduced during the correction process

- The updated information appears correctly formatted

If the credit bureau verifies the disputed information as accurate, they’ll explain their findings and provide contact information for the data furnisher. You have the right to add a consumer statement to your credit report explaining your side of the dispute.

Step 9: Follow up on unresolved disputes

If your initial dispute wasn’t resolved to your liking, you have several options:

👉 File a second dispute: If you have new evidence or the credit bureau didn’t properly investigate your original dispute, you can file another dispute with additional documentation.

👉 Contact the CFPB: The Consumer Financial Protection Bureau accepts complaints about credit reporting issues and will forward your complaint to the credit bureau.

👉 Seek legal assistance: If you’ve suffered damages from inaccurate credit reporting, consider consulting with a consumer protection attorney who specializes in FCRA violations.

👉 File complaints with your state attorney general: Many state attorneys general’s offices handle consumer protection issues and can provide additional pressure for resolution.

Step 10: Maintain ongoing credit monitoring

After successfully disputing errors, establish a system for ongoing credit monitoring to catch future inaccuracies quickly. Here are a few ways to do that:

- Set up free credit monitoring through Moneylion, as well as your bank, credit card company, or legitimate credit monitoring services

- Review your credit reports regularly, not just annually

- Monitor your credit scores for unexpected changes

- Keep detailed records of your credit accounts and payment history

- Report new errors immediately when discovered

Many financial institutions now offer free credit score monitoring as a customer benefit, and several legitimate websites provide free credit score tracking without requiring credit card information.

When to seek professional help

While most credit report disputes can be handled independently, certain situations may warrant professional assistance. These include:

- Complex disputes involving multiple creditors or extensive documentation

- Identity theft cases that may require a comprehensive credit file reconstruction

- Legal issues, such as bankruptcy or divorce, that affect multiple accounts

- Repeated unsuccessful disputes with the same credit bureau

Taking Control of Your Financial Future

Credit bureaus do their best to keep accurate records, but they’re not perfect. Sometimes, it’s up to you to keep them honest. For the credit bureau, an error on your credit report is just a small mistake. But for you, it’s your financial reputation (and future) on the line.

The good news? You’ve got the law on your side, and these companies are legally required to fix their mistakes when you call them out. So grab those credit reports, channel your inner detective, and start marking up errors like a teacher grading a failing paper. You’ve got this.

FAQs

Will disputing errors hurt my credit score?

No, filing a dispute will not negatively impact your credit score. In fact, successfully removing errors can often improve your score if the inaccurate information was dragging it down.

How long does the entire dispute process typically take?

Credit bureaus must complete their investigation within 30 days (or 45 days if you submit additional information). From start to finish, including resolution and updates, expect 4-8 weeks for straightforward disputes.

Can I dispute multiple errors at the same time?

Yes, you can dispute multiple errors in a single submission to each credit bureau. Just make sure to clearly identify and document each separate error with its own explanation and supporting evidence.

Do I need to dispute the same error with all three credit bureaus?

Only if the error appears on multiple reports (each bureau maintains independent records). Check all three reports first, then dispute with only the bureaus showing that specific error.

What should I do if my dispute is rejected, but I know the information is wrong?

File a second dispute with additional evidence, submit a complaint to the CFPB, or add a 100-word consumer statement to your credit report explaining your side of the story. If significant damages occurred, consult a consumer protection attorney.