Even if Social Security is your primary source of income, there are still plenty of ways that you can obtain fast, short-term cash to cover emergency expenses. In 2026, a diverse array of digital cash advance apps, credit card cash advances, and other options make it easier than ever to access future funds when you need them.

While the Social Security Administration does not offer loans, you can use your benefit deposits to qualify with reputable providers. In this article, we break down what counts as income, how approval works, which products to consider, and how to borrow safely.

Table of contents

Understanding cash advances for Social Security recipients

A cash advance is a way to access a portion of your income early, either through a cash advance app or earned wage access.

Cash advances can be beneficial for Social Security recipients by helping them bridge gaps between monthly benefits and bills, rather than for recurring borrowing. For fixed-income households, cash advances can assist with costs like:

- Medical or prescription costs

- Car or home repairs are needed to maintain work or safety

- Utility bills or rent due before benefit day

- Travel for family emergencies

Keep in mind that a cash advance is not a loan.

A loan gives you borrowed money that you must repay with interest or fees, often based on credit checks and traditional underwriting. A cash advance, also known as earned wage access, lets you access money you’ve already earned from your future paychecks, so there’s typically no interest.

This raises the question: Do your Social Security earnings count as regular income?

Eligibility: Using Social Security or SSI for cash advances

Yes, you can use your Social Security or SSI for cash advances. The Equal Credit Opportunity Act prevents financial institutions from discriminating against applicants because they receive income from a public assistance program.

For this reason, almost all cash advance and short-term loan providers accept Social Security, SSI, or SSDI as valid income. They evaluate your ability to repay based on predictable deposits into your bank account rather than traditional employment.

In addition to SSI/SSDI and retirement benefits, many lenders may accept pensions, annuities, part-time wages, alimony, and certain government assistance as legitimate income streams.

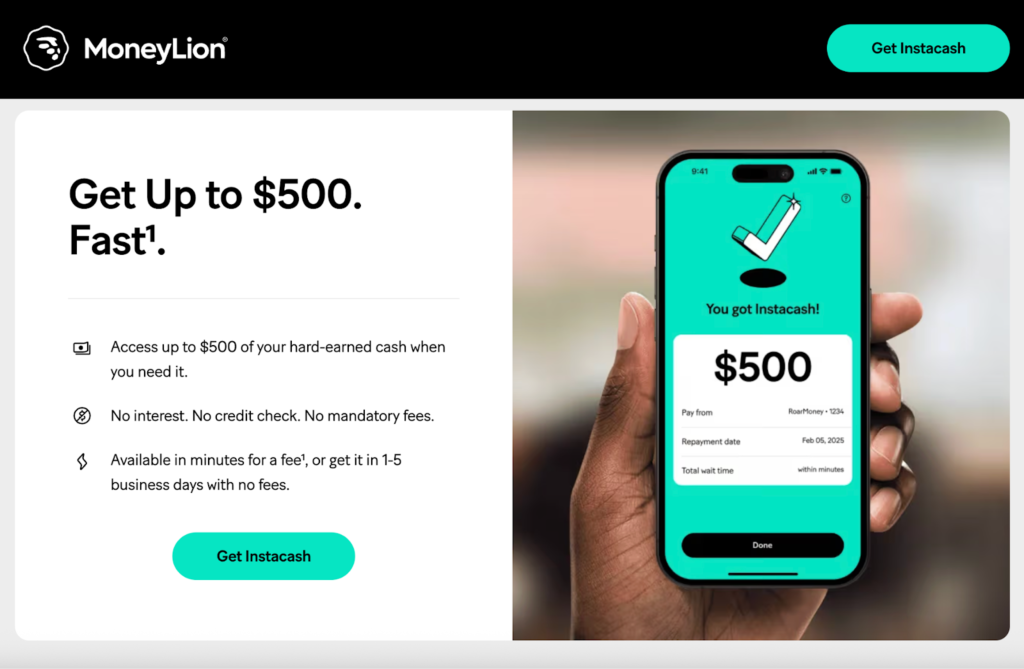

Getting a cash advance with MoneyLion Instacash®

Looking for one of the top places to get a cash advance? You’ll want to explore MoneyLion Instacash.

MoneyLion Instacash is one of the best ways for Social Security recipients to receive a cash advance on their future deposits. This service offers a convenient way for those on a fixed income to tap into their future payments (up to $500) without interest or a credit check.

Here’s how it works:

- If you already have the app, tap Instacash on the ‘Accounts’ tab.

- Link the bank account where you receive your paycheck to see if you qualify.

- Select the amount you want.

- Confirm, and voila! You’re done. Enjoy your cash.

MoneyLion’s Instacash® lets you access up to $500 with 0% interest: no credit check, no hidden fees*. Use it when you’re stuck between paychecks and need help avoiding a bigger financial hit.

👉 7 Best Cash Advance Apps for 2026

How to qualify for a cash advance on Social Security Income

Qualifying for a cash advance on Social Security Income may seem daunting, but it’s really a straightforward process. Before applying, just make sure you have the following information:

- Proof of income (Social Security/SSI/SSDI statement)

- Valid ID and Social Security number

- Active bank account or benefits debit card

- Direct deposit information and recent account activity

3 Alternatives to cash advances

Not sure if a cash advance app is right for you? Here are three other ways that you can get cash quickly.

1. Credit card advance

You can also get cash by using your credit card. However, credit card cash advances typically come with high fees, charging around 5% of the cash advance amount or $10, whichever is more. That means you’d pay about $10 on a $200 cash advance. Additionally, you’ll want to be sure to pay off your advance quickly to avoid high credit card interest rates.

👉 What is a Cash Advance on a Credit Card?

2. Personal loans

Personal loans offer another way for you to get cash quickly when you need it. These financial products allow borrowers to take a lump sum and repay in predictable monthly payments, easing budgeting concerns.

Common amounts range from about $500 to $10,000, with terms of 6 to 24 months. Many providers accept SSI/SSDI as income, and installment APRs are often lower than payday fees, with clearer amortization.

Personal loans can help you get the money you need, with clear repayment terms and a set interest rate. Depending on your credit score and history, you could qualify for personal loans from a few hundred dollars to many thousands.

Unlike MoneyLion Instacash or other cash advance apps, a personal loan will typically charge interest and require a credit check.

MoneyLion offers a service to help you find personal loan offers. Based on the information you provide, you can get matched with offers for up to $50,000 from our top providers. You can compare rates, terms, and fees from different lenders and choose the best offer for you.

3. Borrow from family and friends

A loan from a friend or family member for a short period of time can relieve financial strain without high fees. To avoid straining the relationship, write out the terms of repayment and stick to them. While they might want to charge a modest interest rate like 5%, they may also give it to you interest-free.

Getting a Cash Advance on Social Security

Cash advance options for Social Security recipients in 2026 are more flexible, accessible, and affordable than ever, offering a meaningful safety net when urgent expenses arise.

Whether you choose a cash advance tool like MoneyLion Instacash or an alternative, the key is selecting the option that aligns best with your income, timing, and financial comfort level.

FAQs

Can I get a cash advance or loan if Social Security is my only income?

Yes, many lenders accept Social Security, SSI, or disability benefits as valid income, so you can often qualify even if it’s your only source of income.

Are there cash advance products that don’t require a credit check for SSI recipients?

Many digital cash advance apps, including MoneyLion Instacash, provide advances without a hard credit check if you have steady SSI direct deposits going to your linked bank account.

Will taking a cash advance affect my Social Security or SSI benefits?

Many cash advance providers can send you a cash advance almost instantly (for a small fee) or within 1 to 5 business days for free.

What should I watch for to avoid scams or predatory lending?

Avoid upfront fees and “guaranteed approval” claims; always verify licensing and demand clear, transparent pricing before accepting any offer.

Can I get a loan on SSI?

Yes, you can usually get a loan on SSI because lenders are legally not allowed to discriminate against different income sources.