Facing financial hardship is tough enough without worrying about the long-term impact on your credit score. If you’re considering bankruptcy or have recently filed, you’re probably wondering: how long does bankruptcy stay on your credit report?

Simply put, Chapter 7 bankruptcy remains on your credit report for 10 years from the filing date, while Chapter 13 bankruptcy stays for 7 years. This timeline is set by the credit bureaus and affects how lenders view your creditworthiness during this period.

Now let’s explore what this means for your financial recovery and the steps you can take to rebuild your credit sooner.

Stay on top of your credit with easy, free tools designed to protect, monitor, and improve your score.

Table of contents

How long does bankruptcy last?

Short answer? Longer than you’d like, but not forever. A Chapter 7 bankruptcy sticks around for up to 10 years, while Chapter 13 hangs on for 7. Both show up as public records on your credit report, front and center, and they send your score into freefall fast.

But time’s on your side. The older the bankruptcy, the less it hurts your score, and once it hits the expiration date, the credit bureaus are supposed to drop it for good.

Chapter 7 bankruptcy

Chapter 7 bankruptcy, also known as “liquidation bankruptcy,” wipes out most unsecured debt. Think: credit cards and medical bills. But that financial fresh start comes at a cost: it lingers on your credit report for up to 10 years from the filing date.

The bankruptcy process for Chapter 7 is fast (relatively), typically wrapping up in 4 to 6 months, but the impact on your score is immediate and significant. Still, once discharged, you can start taking steps to rebuild.

Chapter 13 bankruptcy

Chapter 13 is the “slow and steady” version. You don’t erase your debts: you reorganize them, and commit to a 3- to 5-year repayment plan. Because you’re actively repaying, this version sticks around for 7 years from the filing date.

It hits your credit a little more gently than Chapter 7, but it’s still a black mark lenders notice. The upside? Creditors may see this type as a more responsible move compared to Chapter 7.

How to get a bankruptcy off your credit report

Under the Fair Credit Reporting Act, credit bureaus are legally required to remove expired bankruptcies automatically. In theory, you don’t need to do anything to get your bankruptcy taken off your credit reports after those 7 to 10 years have passed.

However, the truth is that failing to remove bankruptcies is one of the most common violations of the Fair Credit Reporting Act. Even after your bankruptcy has expired, you may still see the judgment as active.

If this happens to you, you’ll need to dispute the bankruptcy with the credit reporting agency. Each of the three credit reporting bureaus – Experian, Equifax, and TransUnion – are required to investigate any disputes you make.

👉 How to Dispute a Credit Report and Win: 5 Steps

First, get all three of your credit reports. You can get a free copy of each of your credit reports once every 12 months.

Check and make sure that the bankruptcy isn’t still on each of your reports. If it is, file a dispute with each reporting agency that still lists the bankruptcy. You’ll need to contact each bureau independently to have it totally removed from all reports. Keep copies of any court papers you receive on file so you can prove that the appropriate amount of time has passed if you need to.

Can you remove bankruptcy early?

Technically, credit bureaus are required to remove bankruptcies from your report once they expire: no action needed. But “technically” doesn’t always mean “in reality.”

If it’s been 7 or 10 years and that bankruptcy is still hanging around, you’ll need to:

- Pull all three of your credit reports at AnnualCreditReport.com

- File disputes with any bureau still showing the record (Equifax, Experian, TransUnion)

- Keep court documents handy to prove your case if needed.

Expired bankruptcies are among the most commonly reported errors. Always double-check.

How does bankruptcy affect your credit?

Brace yourself. A bankruptcy filing can drop your credit score anywhere from 150 to 240 points, depending on your starting score. If your score was already bruised, it could fall even more.

Bankruptcy also stays visible to lenders and landlords, meaning it could impact everything from loan approvals to apartment applications. Not forever, but for a while.

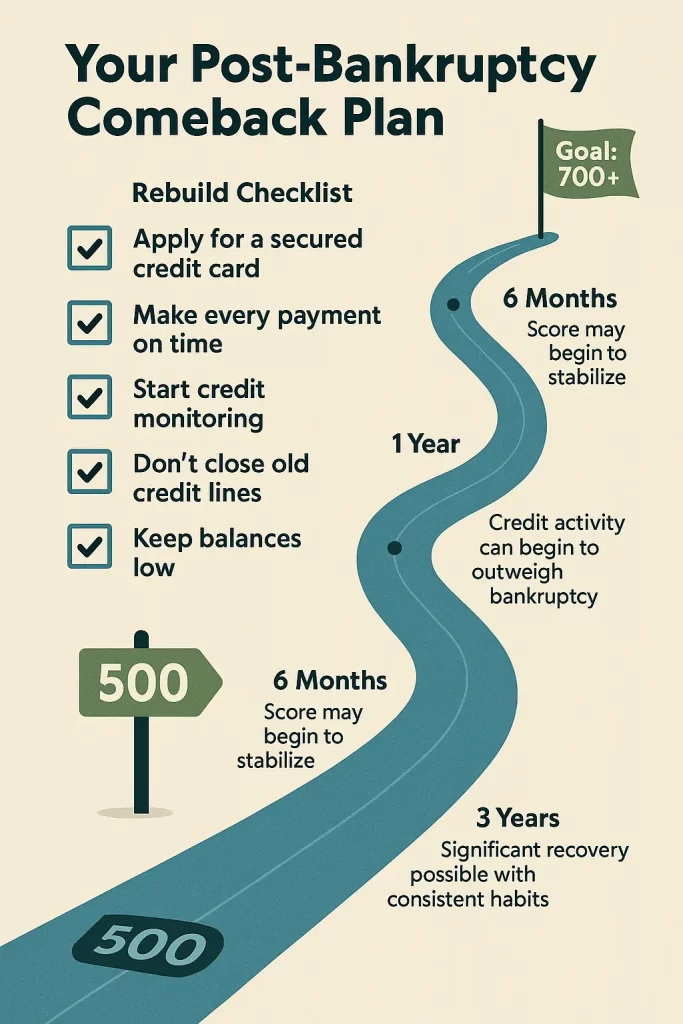

Tips for rebuilding credit after a bankruptcy

Rebuilding isn’t a sprint, it’s a habit. Here’s how to start getting back on track:

✅ Make on-time payments: Your payment history makes up the largest chunk of your credit score (about 35%). So even if you’re starting small, like on a utility bill, paying it on time matters. Set reminders, automate payments, or tattoo the due date on your arm (don’t actually do that).

✅ Open a secured credit card: These cards are designed for people rebuilding their credit. You put down a deposit, and your limit matches that deposit. No surprises, no big risks, and your responsible use gets reported to the credit bureaus. Just remember: it’s still a credit card. Use it like one, not like free money.

✅ Use credit monitoring tools: Don’t wait for surprises. Credit monitoring can help catch fraud early and track your credit rebuild.

Concerned about your credit? Knowledge is power. Join MoneyLion and monitor your credit with real-time alerts, personalized insights, and smart tips to help boost your score.

✅ Leave old credit lines open (even if you hide the card): Closing old accounts can hurt your credit utilization ratio. Instead, stash the card away—out of reach but still open.

👉 How to Rebuild Credit After Bankruptcy

What to Expect When It Comes to How Long Bankruptcies Last

Bankruptcy isn’t a life sentence. Yes, it lingers on your report for about 7 to 10 years. Yes, it dings your score. But it doesn’t disqualify you from credit forever, and it sure as hell (heck?) doesn’t define your financial future.

FAQs

How long does a bankruptcy stay on your credit report?

How long bankruptcy stays on your credit report depends on the type: Chapter 7 remains for 10 years, while Chapter 13 stays for 7 years from the filing date.

Can you remove Chapter 7 from your credit report before 10 years?

You cannot remove an accurately reported Chapter 7 bankruptcy before the 10-year mark unless there’s a reporting error that you can dispute with the credit bureaus.

How do I know my bankruptcy has ended?

Your bankruptcy case ends when you receive a discharge notice from the court, but remember this is different from when it falls off your credit report.

Who reports bankruptcies to the credit bureaus?

Bankruptcy filings are public records that are typically reported to credit bureaus by the courts themselves or third-party public records providers that monitor court filings.