Key findings:

- The US national debt surpassed $37 trillion in July 2025, making it the largest sovereign debt globally in absolute terms.

- The gross debt-to-GDP ratio is 140%, signaling that the US owes significantly more than it produces annually.

- The US debt grows by approximately $12.1 billion per day, driven by persistent deficits and rising interest costs.

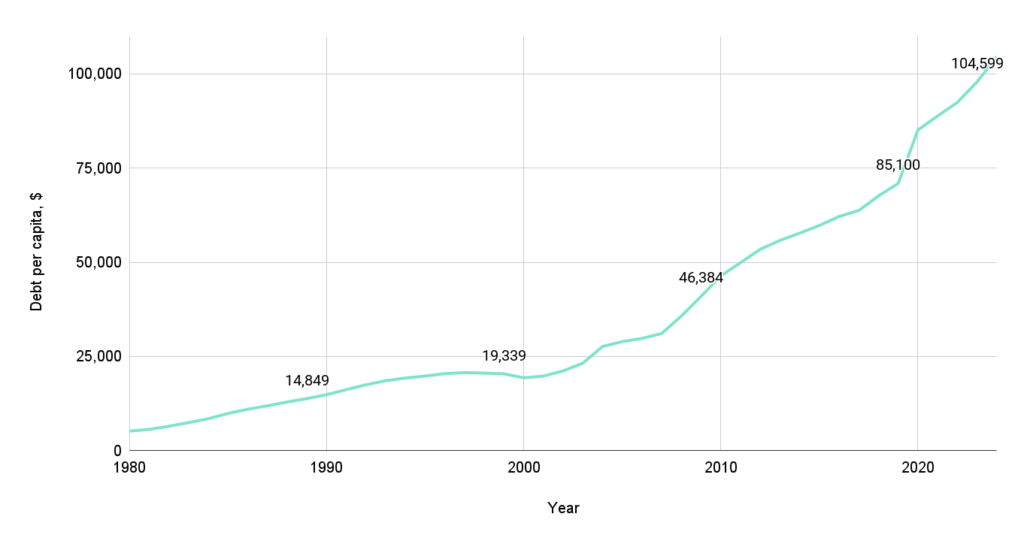

- Average national debt per citizen reached $104,599 in 2024 at current prices, nearly 20x higher than in 1980.

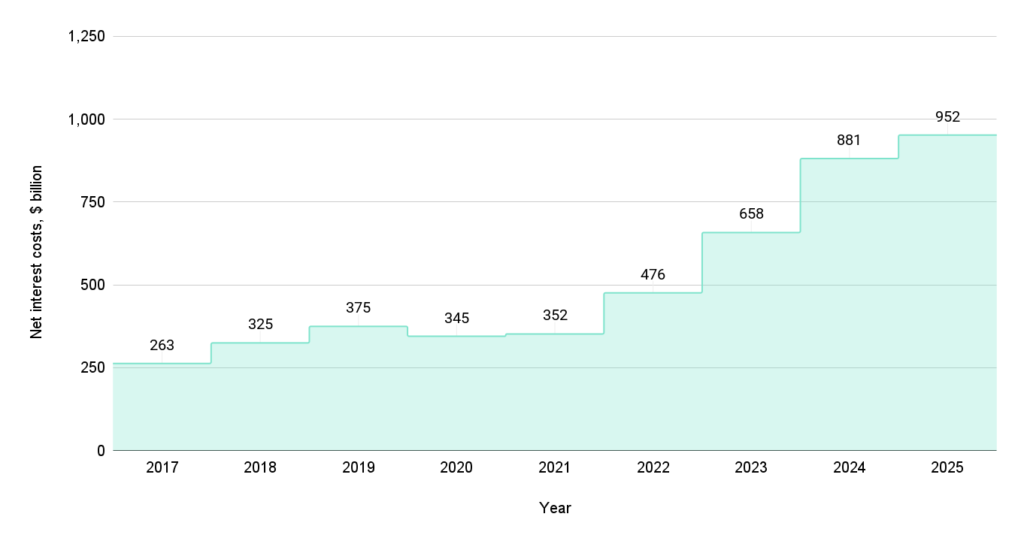

- Annual interest payments on the federal debt are projected to hit $952 billion in 2025, nearly 3.6% of GDP.

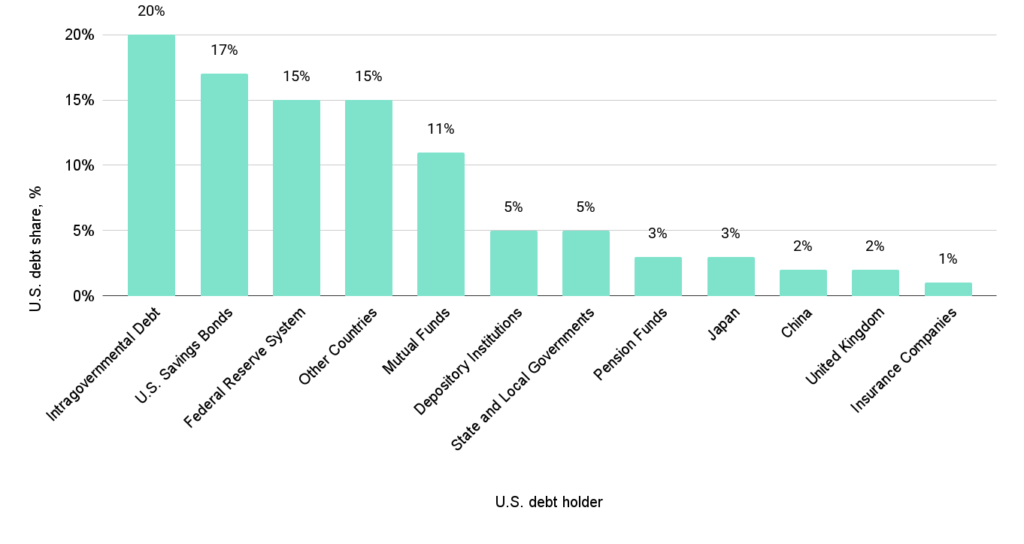

- The Federal Reserve holds over 15% of the US debt held by public holders.

What is the US national debt?

The US national debt refers to the total amount of money the federal government owes to creditors. This includes both federal debt held by the public and intragovernmental holdings. But what is debt, really, in this context? Simply put, it’s money borrowed by the government to cover expenses that exceed tax revenues.

The national debt’s meaning starts with recognizing the distinction between two categories: public debt, which is owed to external investors, and intragovernmental debt, which is borrowed from internal trust funds such as Social Security. The combined total makes up the national debt.

For those wondering about the national debt’s meaning, it’s more than just a financial figure. It reflects long-term fiscal policy choices, economic health, and future obligations. So, how does US debt work? Each year, if federal spending surpasses revenue, the government issues Treasury securities to finance the gap, thereby increasing the debt.

In short, the national debt is a cumulative result of annual budget deficits and policy decisions over time. Understanding how it functions helps illuminate broader debates around taxes, spending, and economic sustainability.

How big is the US national debt today?

- The US national debt is $37 trillion as of July 2025.

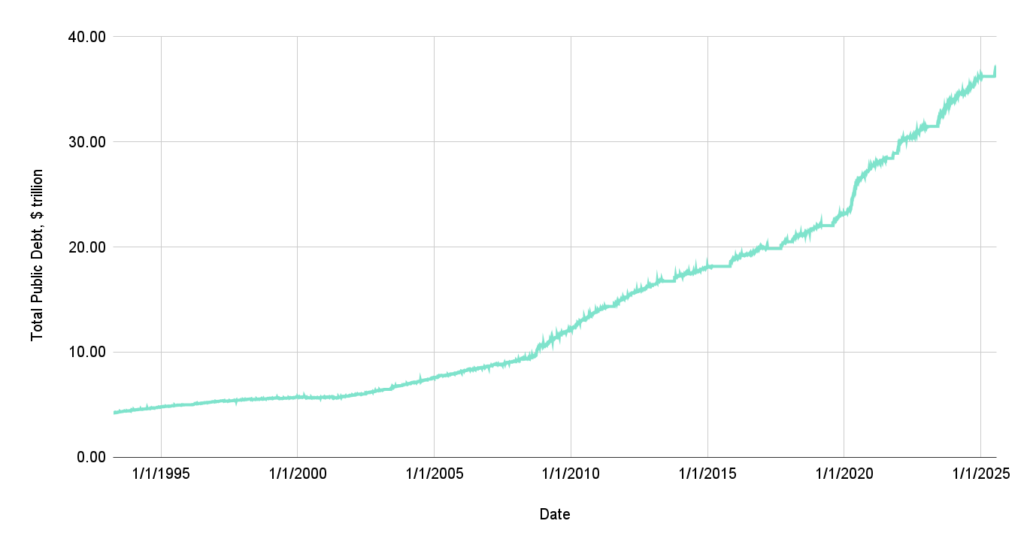

As of mid-2025, the US national debt has surpassed $37 trillion, continuing its upward trajectory at a rapid rate. The US debt clock updates in real-time, revealing just how fast the numbers climb, raising questions like how much US debt increases each day. While estimates vary, current figures suggest the debt grows by billions daily due to interest and spending commitments.

When we look at the national debt of the United States in a global context, it holds the title for the biggest national debt in the world by total dollar amount. This makes the US a consistent leader among the largest national debts, far exceeding countries with similarly large economies.

In terms of the average national debt per citizen, Americans now each effectively carry over $100,000 in federal obligations. The size of the US national debt not only reflects current fiscal policies but also decades of accumulated budget deficits, economic crises, and tax policy updates.

While the numbers can seem abstract, tools like the US debt clock provide an immediate, visual sense of scale and of urgency. With the largest recorded national debt, the US finds itself at the center of a global conversation about sustainability, inflation, and long-term economic strategy.

US debt compared to GDP

So, if the national debt exceeds $37 trillion, how does it compare to GDP?

- US nominal GDP is $26.5 trillion.

As of 2025, the current US nominal GDP is approximately $26.5 trillion, while the national debt surpasses $37 trillion. This puts the US gross debt-to-GDP ratio at 140%, meaning the country owes significantly more than it produces annually.

This US GDP vs debt imbalance raises concerns about sustainability and long-term economic resilience. Economists often use this ratio as a benchmark for evaluating a nation’s capacity to service its debt. A rising ratio can indicate mounting fiscal pressure, while a declining one may suggest improving balance.

In short, when comparing US GDP to the national debt, the numbers highlight a growing divergence that has both political and economic implications.

The debt-to-GDP ratio indicates the relative burden of debt on the economy, but to understand how the US arrived at this point, we must examine the historical accumulation of the national debt itself.

The history of US national debt

The US national debt by year

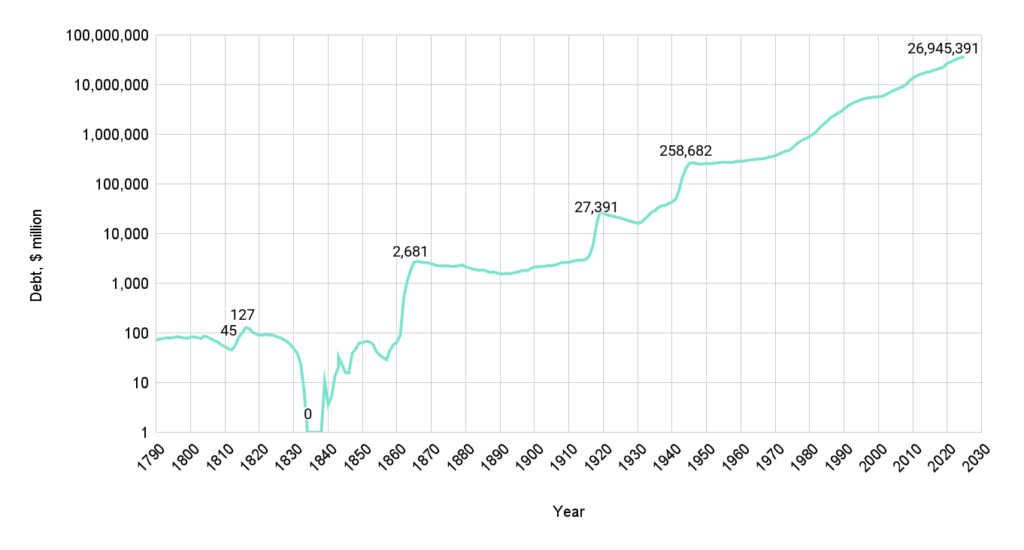

To understand how the national debt evolved into its current state, it’s crucial to look at its historical trajectory. This section presents a detailed US national debt by year chart, tracing changes over more than two centuries.

The US national debt by year graph below illustrates major changes driven by wars, recessions, and policy shifts.

Data taken from: U.S. Treasury Fiscal Data – https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding4

- In 1790, the US national debt stood at just $71 million; by 2025, it had risen to $37 trillion (as of July 2025).

- Between 2008 and 2025, the debt grew by over $26 trillion, largely due to stimulus spending and structural deficits.

- The largest single-year increase occurred in 2020, when the debt jumped by over $4.2 trillion amid the COVID-19 response.

The US national debt by year since 1970

| Year | Debt, $ million |

| 1790 | 71 |

| 1791 | 75 |

| 1792 | 77 |

| 1793 | 80 |

| 1794 | 78 |

| 1795 | 81 |

| 1796 | 84 |

| 1797 | 82 |

| 1798 | 79 |

| 1799 | 78 |

| 1800 | 83 |

| 1801 | 83 |

| 1802 | 81 |

| 1803 | 77 |

| 1804 | 86 |

| 1805 | 82 |

| 1806 | 76 |

| 1807 | 69 |

| 1808 | 65 |

| 1809 | 57 |

| 1810 | 53 |

| 1811 | 48 |

| 1812 | 45 |

| 1813 | 56 |

| 1814 | 81 |

| 1815 | 100 |

| 1816 | 127 |

| 1817 | 123 |

| 1818 | 103 |

| 1819 | 96 |

| 1820 | 91 |

| 1821 | 90 |

| 1822 | 94 |

| 1823 | 91 |

| 1824 | 90 |

| 1825 | 84 |

| 1826 | 81 |

| 1827 | 74 |

| 1828 | 67 |

| 1829 | 58 |

| 1830 | 49 |

| 1831 | 39 |

| 1832 | 24 |

| 1833 | 7 |

| 1834 | 5 |

| 1835 | 0 |

| 1836 | 0 |

| 1837 | 0 |

| 1838 | 3 |

| 1839 | 10 |

| 1840 | 4 |

| 1841 | 5 |

| 1842 | 14 |

| 1843 | 20 |

| 1843 | 33 |

| 1844 | 23 |

| 1845 | 16 |

| 1846 | 16 |

| 1847 | 39 |

| 1848 | 47 |

| 1849 | 63 |

| 1850 | 63 |

| 1851 | 68 |

| 1852 | 66 |

| 1853 | 60 |

| 1854 | 42 |

| 1855 | 36 |

| 1856 | 32 |

| 1857 | 29 |

| 1858 | 45 |

| 1859 | 58 |

| 1860 | 65 |

| 1861 | 91 |

| 1862 | 524 |

| 1863 | 1,120 |

| 1864 | 1,816 |

| 1865 | 2,681 |

| 1866 | 2,773 |

| 1867 | 2,678 |

| 1868 | 2,612 |

| 1869 | 2,588 |

| 1870 | 2,481 |

| 1871 | 2,353 |

| 1872 | 2,253 |

| 1873 | 2,234 |

| 1874 | 2,252 |

| 1875 | 2,232 |

| 1876 | 2,180 |

| 1877 | 2,205 |

| 1878 | 2,256 |

| 1879 | 2,350 |

| 1880 | 2,120 |

| 1881 | 2,069 |

| 1882 | 1,918 |

| 1883 | 1,884 |

| 1884 | 1,831 |

| 1885 | 1,864 |

| 1886 | 1,775 |

| 1887 | 1,658 |

| 1888 | 1,693 |

| 1889 | 1,619 |

| 1890 | 1,552 |

| 1891 | 1,546 |

| 1892 | 1,588 |

| 1893 | 1,546 |

| 1894 | 1,632 |

| 1895 | 1,676 |

| 1896 | 1,770 |

| 1897 | 1,818 |

| 1898 | 1,797 |

| 1899 | 1,992 |

| 1900 | 2,137 |

| 1901 | 2,143 |

| 1902 | 2,159 |

| 1903 | 2,202 |

| 1904 | 2,264 |

| 1905 | 2,275 |

| 1906 | 2,337 |

| 1907 | 2,457 |

| 1908 | 2,627 |

| 1909 | 2,640 |

| 1910 | 2,653 |

| 1911 | 2,766 |

| 1912 | 2,868 |

| 1913 | 2,916 |

| 1914 | 2,912 |

| 1915 | 3,058 |

| 1916 | 3,609 |

| 1917 | 5,718 |

| 1918 | 14,592 |

| 1919 | 27,391 |

| 1920 | 25,952 |

| 1921 | 23,977 |

| 1922 | 22,963 |

| 1923 | 22,350 |

| 1924 | 21,251 |

| 1925 | 20,516 |

| 1926 | 19,643 |

| 1927 | 18,512 |

| 1928 | 17,604 |

| 1929 | 16,931 |

| 1930 | 16,185 |

| 1931 | 16,801 |

| 1932 | 19,487 |

| 1933 | 22,539 |

| 1934 | 27,053 |

| 1935 | 28,701 |

| 1936 | 33,779 |

| 1937 | 36,425 |

| 1938 | 37,165 |

| 1939 | 40,440 |

| 1940 | 42,968 |

| 1941 | 48,961 |

| 1942 | 72,422 |

| 1943 | 136,696 |

| 1944 | 201,003 |

| 1945 | 258,682 |

| 1946 | 269,422 |

| 1947 | 258,286 |

| 1948 | 252,292 |

| 1949 | 252,770 |

| 1950 | 257,357 |

| 1951 | 255,222 |

| 1952 | 259,105 |

| 1953 | 266,071 |

| 1954 | 271,260 |

| 1955 | 274,374 |

| 1956 | 272,751 |

| 1957 | 270,527 |

| 1958 | 276,343 |

| 1959 | 284,706 |

| 1960 | 286,331 |

| 1961 | 288,971 |

| 1962 | 298,201 |

| 1963 | 305,860 |

| 1964 | 311,713 |

| 1965 | 317,274 |

| 1966 | 319,907 |

| 1967 | 326,221 |

| 1968 | 347,578 |

| 1969 | 353,720 |

| 1970 | 370,919 |

| 1971 | 398,130 |

| 1972 | 427,260 |

| 1973 | 458,142 |

| 1974 | 475,060 |

| 1975 | 533,189 |

| 1976 | 620,433 |

| 1977 | 698,840 |

| 1978 | 771,544 |

| 1979 | 826,519 |

| 1980 | 907,701 |

| 1981 | 997,855 |

| 1982 | 1,142,034 |

| 1983 | 1,377,210 |

| 1984 | 1,572,266 |

| 1985 | 1,823,103 |

| 1986 | 2,125,303 |

| 1987 | 2,350,277 |

| 1988 | 2,602,338 |

| 1989 | 2,857,431 |

| 1990 | 3,233,313 |

| 1991 | 3,665,303 |

| 1992 | 4,064,621 |

| 1993 | 4,411,489 |

| 1994 | 4,692,750 |

| 1995 | 4,973,983 |

| 1996 | 5,224,811 |

| 1997 | 5,413,146 |

| 1998 | 5,526,193 |

| 1999 | 5,656,271 |

| 2000 | 5,674,178 |

| 2001 | 5,807,463 |

| 2002 | 6,228,236 |

| 2003 | 6,783,231 |

| 2004 | 7,379,053 |

| 2005 | 7,932,710 |

| 2006 | 8,506,974 |

| 2007 | 9,007,653 |

| 2008 | 10,024,725 |

| 2009 | 11,909,829 |

| 2010 | 13,561,623 |

| 2011 | 14,790,340 |

| 2012 | 16,066,241 |

| 2013 | 16,738,184 |

| 2014 | 17,824,071 |

| 2015 | 18,150,618 |

| 2016 | 19,573,445 |

| 2017 | 20,244,900 |

| 2018 | 21,516,058 |

| 2019 | 22,719,402 |

| 2020 | 26,945,391 |

| 2021 | 28,428,919 |

| 2022 | 30,928,912 |

| 2023 | 33,167,334 |

| 2024 | 35,464,674 |

| 2025 | 36,214,310 |

Data taken from: U.S. Treasury Fiscal Data – https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding4

The data from this US national debt by year graph reveals that debt accumulation is neither linear nor random; it reflects the nation’s major historical events. For instance, the US national debt during 1923 was just $22.3 billion, a modest figure compared to today’s trillions. At that time, the economy operated under a different monetary logic: the US issued silver certificates like the $5 note from 1923, which could be directly exchanged for physical silver.

- The US national debt during 1923 was $22,350 million.

From near-zero debt in the 1830s to wartime spikes in the 1940s and rapid increase after 2008, the chart shows how each crisis, policy shift, and global event leaves a permanent fiscal mark. The US national debt by year chart is not just a timeline; it’s a mirror of America’s evolving economic foundations and shifting financial priorities.

How much does the US debt increase each day?

The US national debt increases by approximately $12 billion every day in 2024. This rapid rate highlights how deeply government spending continues to exceed revenue.

Data taken from: U.S. Treasury Fiscal Data – https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny1

The US national debt statistics:

- Average daily increase: $12.1 billion.

- Weekly increase: $84.7 billion.

- Monthly increase: ~$368 billion.

- Yearly pace: $4.4-4.5 trillion.

Despite seeing ршпр nominal increases in recent years, it’s essential to examine the national debt through the lens of inflation-adjusted figures to understand its real growth over time.

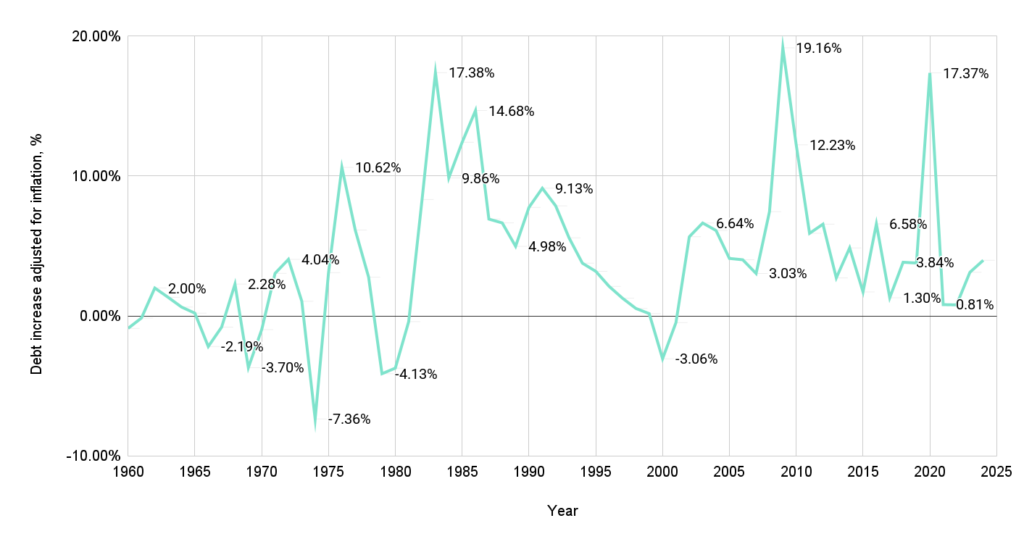

US national debt by year, adjusted for inflation

The chart below reveals how the US national debt has changed year by year when accounting for inflationary effects, offering a clearer perspective than raw dollar figures alone.

Data taken from: U.S. Treasury Fiscal Data – https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding4, Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/FPCPITOTLZGUSA5

- In 1983, the debt increase adjusted for inflation reached +17.38%, one of the largest real expansions of the modern era.

- During 2009, amid the Great Recession, inflation-adjusted debt rose by 19.16%, the highest postwar jump.

- In contrast, in 1974, real debt declined by 7.36%, highlighting periods where inflation outpaced debt growth.

US national debt growth adjusted for inflation

| Year | Debt increase rate, % | Inflation rate, % | Debt increase adjusted for inflation, % |

| 1960 | 0.57 | 1.46 | -0.89 |

| 1961 | 0.92 | 1.07 | -0.15 |

| 1962 | 3.19 | 1.20 | 2.00 |

| 1963 | 2.57 | 1.24 | 1.33 |

| 1964 | 1.91 | 1.28 | 0.63 |

| 1965 | 1.78 | 1.59 | 0.20 |

| 1966 | 0.83 | 3.02 | -2.19 |

| 1967 | 1.97 | 2.77 | -0.80 |

| 1968 | 6.55 | 4.27 | 2.28 |

| 1969 | 1.77 | 5.46 | -3.70 |

| 1970 | 4.86 | 5.84 | -0.98 |

| 1971 | 7.34 | 4.29 | 3.04 |

| 1972 | 7.32 | 3.27 | 4.04 |

| 1973 | 7.23 | 6.18 | 1.05 |

| 1974 | 3.69 | 11.05 | -7.36 |

| 1975 | 12.24 | 9.14 | 3.09 |

| 1976 | 16.36 | 5.74 | 10.62 |

| 1977 | 12.64 | 6.50 | 6.14 |

| 1978 | 10.40 | 7.63 | 2.77 |

| 1979 | 7.13 | 11.25 | -4.13 |

| 1980 | 9.82 | 13.55 | -3.73 |

| 1981 | 9.93 | 10.33 | -0.40 |

| 1982 | 14.45 | 6.13 | 8.32 |

| 1983 | 20.59 | 3.21 | 17.38 |

| 1984 | 14.16 | 4.30 | 9.86 |

| 1985 | 15.95 | 3.55 | 12.41 |

| 1986 | 16.58 | 1.90 | 14.68 |

| 1987 | 10.59 | 3.66 | 6.92 |

| 1988 | 10.72 | 4.08 | 6.65 |

| 1989 | 9.80 | 4.83 | 4.98 |

| 1990 | 13.15 | 5.40 | 7.76 |

| 1991 | 13.36 | 4.23 | 9.13 |

| 1992 | 10.89 | 3.03 | 7.87 |

| 1993 | 8.53 | 2.95 | 5.58 |

| 1994 | 6.38 | 2.61 | 3.77 |

| 1995 | 5.99 | 2.81 | 3.19 |

| 1996 | 5.04 | 2.93 | 2.11 |

| 1997 | 3.60 | 2.34 | 1.27 |

| 1998 | 2.09 | 1.55 | 0.54 |

| 1999 | 2.35 | 2.19 | 0.17 |

| 2000 | 0.32 | 3.38 | -3.06 |

| 2001 | 2.35 | 2.83 | -0.48 |

| 2002 | 7.25 | 1.59 | 5.66 |

| 2003 | 8.91 | 2.27 | 6.64 |

| 2004 | 8.78 | 2.68 | 6.11 |

| 2005 | 7.50 | 3.39 | 4.11 |

| 2006 | 7.24 | 3.23 | 4.01 |

| 2007 | 5.89 | 2.85 | 3.03 |

| 2008 | 11.29 | 3.84 | 7.45 |

| 2009 | 18.80 | -0.36 | 19.16 |

| 2010 | 13.87 | 1.64 | 12.23 |

| 2011 | 9.06 | 3.16 | 5.90 |

| 2012 | 8.63 | 2.07 | 6.56 |

| 2013 | 4.18 | 1.46 | 2.72 |

| 2014 | 6.49 | 1.62 | 4.87 |

| 2015 | 1.83 | 0.12 | 1.71 |

| 2016 | 7.84 | 1.26 | 6.58 |

| 2017 | 3.43 | 2.13 | 1.30 |

| 2018 | 6.28 | 2.44 | 3.84 |

| 2019 | 5.59 | 1.81 | 3.78 |

| 2020 | 18.60 | 1.23 | 17.37 |

| 2021 | 5.51 | 4.70 | 0.81 |

| 2022 | 8.79 | 8.00 | 0.79 |

| 2023 | 7.24 | 4.12 | 3.12 |

| 2024 | 6.93 | 2.95 | 3.98 |

Data taken from: U.S. Treasury Fiscal Data – https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding4, Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/FPCPITOTLZGUSA5

The history of US debt is a story of economic transformation, global shocks, and evolving fiscal policy. From postwar surpluses to pandemic-driven spikes, the US debt timeline reveals how political decisions and global events shaped long-term borrowing trends. Analyzing the US national debt over the years, both in nominal and inflation-adjusted terms, highlights periods of restraint, such as the 1990s, and episodes of rapid expansion, like the 1980s or 2020s. Understanding the history of national debt isn’t just about numbers; it’s essential context for today’s policy debates and future economic resilience. In sum, the US debt history is more than a chart; it provides context for analyzing the nation’s priorities, crises, and fiscal choices over generations.

How the national debt has grown over time

The growth of the US national debt reflects more than just numbers; it reveals political choices, economic challenges, and national priorities across generations. To fully grasp where we are today, we must trace this evolution through time.

What is the national debt today?

Before diving into the history of US debt, it’s worth noting what the national debt is today: as of 2025, the figure has exceeded $36 trillion, a record high. This staggering amount underscores the long-term trend of rising federal obligations.

National debt growth since 2000

Looking at the US national debt by year since 2000, we observe a significant upward trend driven by tax cuts, wars, recessions, and emergency spending. The US national debt growth chart reveals that from about $5.6 trillion in 2000, debt climbed steadily through the Bush and Obama years before accelerating sharply in the 2020s.

- US national debt tripling over 20 years: $11 trillion to $36 trillion.

- US national debt growth over the last decade: 86%.

- US federal debt has increased since 2015: 121%.

These shifts are visible in the us national debt growth by year datasets and summarized in the national debt growth chart, showing how government borrowing has scaled far beyond historical norms.

The US debt increased under the president

Analyzing the US debt by the president offers insight into how leadership has influenced borrowing. During the Trump administration, spending rose due to tax reforms and COVID relief:

- The US debt growth during Trump’s administration: $10 trillion increase

Under President Biden, aggressive fiscal packages and continued stimulus further increased the debt:

- The US national debt under the Biden administration: $7 trillion increase

These increases are reflected in the US national debt by month, which shows consistent month-over-month growth in recent years.

The Impact of the COVID-19 Pandemic

The global pandemic brought about exceptionally high government spending. According to US debt historical data and the US national debt growth chart, debt leaped in 2020, with emergency relief and stimulus driving the spike.

- The US federal debt during the COVID‑19 pandemic was $30.9 trillion

The sudden accumulation is often referred to as pandemic debt, a term that highlights the extraordinary fiscal response and its long-term consequences.

Debt Growth Since 2015 and 2016

The national debt growth rate has accelerated sharply since 2015. From $19 trillion in 2016, the number has significantly increased.

- The US federal debt has increased since 2016 from $19 trillion to $33 trillion.

These figures illustrate a rapid expansion pace. If we ask, How much does the US debt increase per year, the answer is now well above $1.5-2 trillion on average, depending on the year. According to the national debt increase per year data, the last five years have been among the most aggressive periods of debt accumulation in US history.

As we’ve seen, the total US national debt has risen significantly over time. But debt in isolation doesn’t tell the full story. To gauge the real weight of this financial burden, it’s essential to measure it against the country’s economic output.

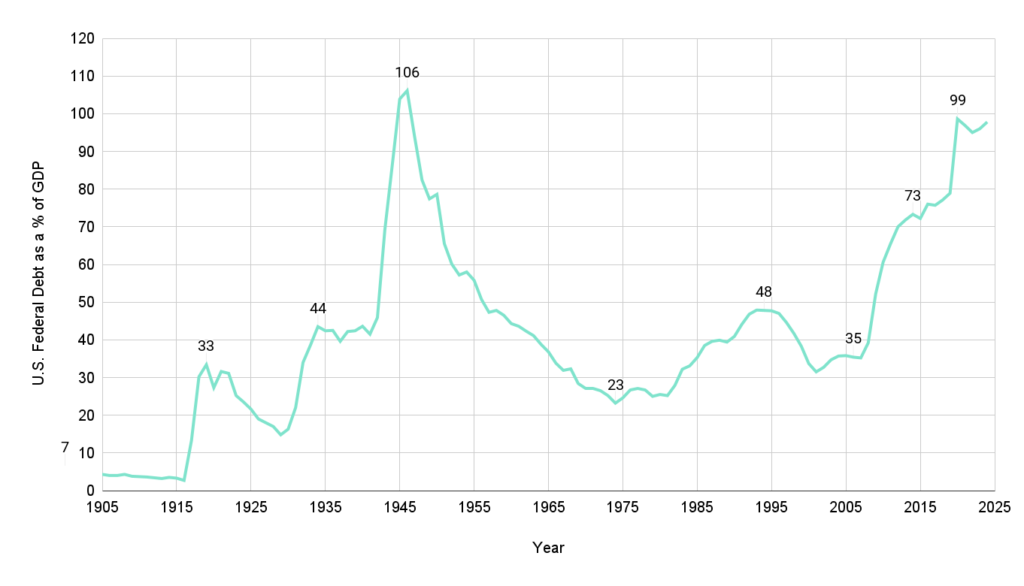

Debt-to-GDP Ratio: How much is too much?

- The current gross debt-to-GDP ratio is 140% as of July 2025.

Understanding the US debt-to-GDP dynamic is critical for evaluating the country’s financial health. The US debt-to-GDP ratio helps answer a key question: how sustainable is the national debt when compared to the size of the economy? This section analyzes the US debt-to-GDP ratio by year to understand long-term patterns and potential risks.

Data taken from: Peterson Foundation – https://www.pgpf.org/national-debt-clock/10

- In 1946, after World War II, the US debt reached 106% of GDP, the highest level until the COVID-19 era.

- By 2007, that ratio had dropped to just 35%, before surging again due to the 2008 crisis and later the pandemic.

- As of 2024, US gross debt-to-GDP stands at 98%, with projections showing a rise to 119% by 2035.

- The maximum US national debt‑to‑GDP ratio is expected to be 119% in 2035 (in terms of gross debt).

Debt-to-GDP ratio by year

| Year | US Federal Debt as a % of GDP |

| 1900 | 7 |

| 1901 | 6 |

| 1902 | 5 |

| 1903 | 5 |

| 1904 | 5 |

| 1905 | 4 |

| 1906 | 4 |

| 1907 | 4 |

| 1908 | 4 |

| 1909 | 4 |

| 1910 | 4 |

| 1911 | 4 |

| 1912 | 3 |

| 1913 | 3 |

| 1914 | 4 |

| 1915 | 3 |

| 1916 | 3 |

| 1917 | 13 |

| 1918 | 30 |

| 1919 | 33 |

| 1920 | 27 |

| 1921 | 32 |

| 1922 | 31 |

| 1923 | 25 |

| 1924 | 24 |

| 1925 | 22 |

| 1926 | 19 |

| 1927 | 18 |

| 1928 | 17 |

| 1929 | 15 |

| 1930 | 16 |

| 1931 | 22 |

| 1932 | 34 |

| 1933 | 39 |

| 1934 | 44 |

| 1935 | 42 |

| 1936 | 43 |

| 1937 | 40 |

| 1938 | 42 |

| 1939 | 42 |

| 1940 | 44 |

| 1941 | 42 |

| 1942 | 46 |

| 1943 | 69 |

| 1944 | 86 |

| 1945 | 104 |

| 1946 | 106 |

| 1947 | 94 |

| 1948 | 82 |

| 1949 | 77 |

| 1950 | 79 |

| 1951 | 66 |

| 1952 | 60 |

| 1953 | 57 |

| 1954 | 58 |

| 1955 | 56 |

| 1956 | 51 |

| 1957 | 47 |

| 1958 | 48 |

| 1959 | 47 |

| 1960 | 44 |

| 1961 | 44 |

| 1962 | 42 |

| 1963 | 41 |

| 1964 | 39 |

| 1965 | 37 |

| 1966 | 34 |

| 1967 | 32 |

| 1968 | 32 |

| 1969 | 28 |

| 1970 | 27 |

| 1971 | 27 |

| 1972 | 27 |

| 1973 | 25 |

| 1974 | 23 |

| 1975 | 25 |

| 1976 | 27 |

| 1977 | 27 |

| 1978 | 27 |

| 1979 | 25 |

| 1980 | 26 |

| 1981 | 25 |

| 1982 | 28 |

| 1983 | 32 |

| 1984 | 33 |

| 1985 | 35 |

| 1986 | 39 |

| 1987 | 40 |

| 1988 | 40 |

| 1989 | 39 |

| 1990 | 41 |

| 1991 | 44 |

| 1992 | 47 |

| 1993 | 48 |

| 1994 | 48 |

| 1995 | 48 |

| 1996 | 47 |

| 1997 | 45 |

| 1998 | 42 |

| 1999 | 38 |

| 2000 | 34 |

| 2001 | 32 |

| 2002 | 33 |

| 2003 | 35 |

| 2004 | 36 |

| 2005 | 36 |

| 2006 | 35 |

| 2007 | 35 |

| 2008 | 39 |

| 2009 | 52 |

| 2010 | 61 |

| 2011 | 66 |

| 2012 | 70 |

| 2013 | 72 |

| 2014 | 73 |

| 2015 | 72 |

| 2016 | 76 |

| 2017 | 76 |

| 2018 | 77 |

| 2019 | 79 |

| 2020 | 99 |

| 2021 | 97 |

| 2022 | 95 |

| 2023 | 96 |

| 2024 | 98 |

| 2025P | 100 |

| 2026P | 102 |

| 2027P | 103 |

| 2028P | 105 |

| 2029P | 107 |

| 2030P | 109 |

| 2031P | 111 |

| 2032P | 113 |

| 2033P | 115 |

| 2034P | 117 |

| 2035P | 119 |

Data taken from: Peterson Foundation – https://www.pgpf.org/national-debt-clock/10

This US debt-to-GDP trend illustrates that major spikes align with periods of war, recession, or large-scale fiscal stimulus. For example, debt rose sharply during WWII, the Great Recession, and the COVID-19 pandemic.

But what percentage of GDP is the US debt today? Nearly equal to the entire annual economic output, raising concerns about long-term fiscal resilience.

So, what is a good debt-to-GDP ratio? Economists often consider 60% or below as a sustainable benchmark for advanced economies, though this varies. The US has been well above that threshold since 2010, signaling structural imbalances that may require policy action.

US national debt per person

How much is the national debt per person?

- The US national debt per person is $104,599 at current prices.

While the total US national debt offers a big-picture view of the country’s financial obligations, the debt per person metric reveals how much of this burden falls on each citizen.

Data taken from: Countryeconomy.Com – https://countryeconomy.com/national-debt/usa7

- In 1980, the national debt per person was just $5,188, but by 2024, it had ballooned to $104,599 at current prices, reflecting a 20x increase over four decades.

- The sharpest single-year spike occurred between 2019 and 2020, jumping from $70,935 to $85,100 at current prices, an increase of $14,165, largely driven by COVID-19 stimulus measures.

- Since 2020, the debt per capita has continued to grow annually by around $4,000-$7,000, highlighting sustained fiscal pressures.

The US national debt per capita, at current prices

| Year | US national debt per capita, $ |

| 1980 | 5,188 |

| 1981 | 5,643 |

| 1982 | 6,495 |

| 1983 | 7,446 |

| 1984 | 8,484 |

| 1985 | 9,882 |

| 1986 | 10,995 |

| 1987 | 11,915 |

| 1988 | 12,921 |

| 1989 | 13,817 |

| 1990 | 14,849 |

| 1991 | 16,197 |

| 1992 | 17,489 |

| 1993 | 18,576 |

| 1994 | 19,275 |

| 1995 | 19,802 |

| 1996 | 20,455 |

| 1997 | 20,719 |

| 1998 | 20,584 |

| 1999 | 20,395 |

| 2000 | 19,339 |

| 2001 | 19,804 |

| 2002 | 21,173 |

| 2003 | 23,222 |

| 2004 | 27,654 |

| 2005 | 28,948 |

| 2006 | 29,792 |

| 2007 | 31,107 |

| 2008 | 35,742 |

| 2009 | 40,959 |

| 2010 | 46,384 |

| 2011 | 49,893 |

| 2012 | 53,444 |

| 2013 | 55,799 |

| 2014 | 57,722 |

| 2015 | 59,779 |

| 2016 | 62,142 |

| 2017 | 63,746 |

| 2018 | 67,613 |

| 2019 | 70,935 |

| 2020 | 85,100 |

| 2021 | 88,837 |

| 2022 | 92,433 |

| 2023 | 97,881 |

| 2024 | 104,599 |

Data taken from: Countryeconomy.Com – https://countryeconomy.com/national-debt/usa7

The latest figures show that the average national debt per US citizen continues to rise in tandem with the overall debt trajectory. As of 2024, the national debt per person exceeds $100,000, illustrating how the burden of federal borrowing translates on an individual level.

Understanding how much the US debt is per person provides a clearer picture of the debt’s scale: for every American, the share has grown substantially over the past two decades. Tracking US national debt per person by year reveals a steep acceleration since 2008, with new milestones reached after major economic disruptions.

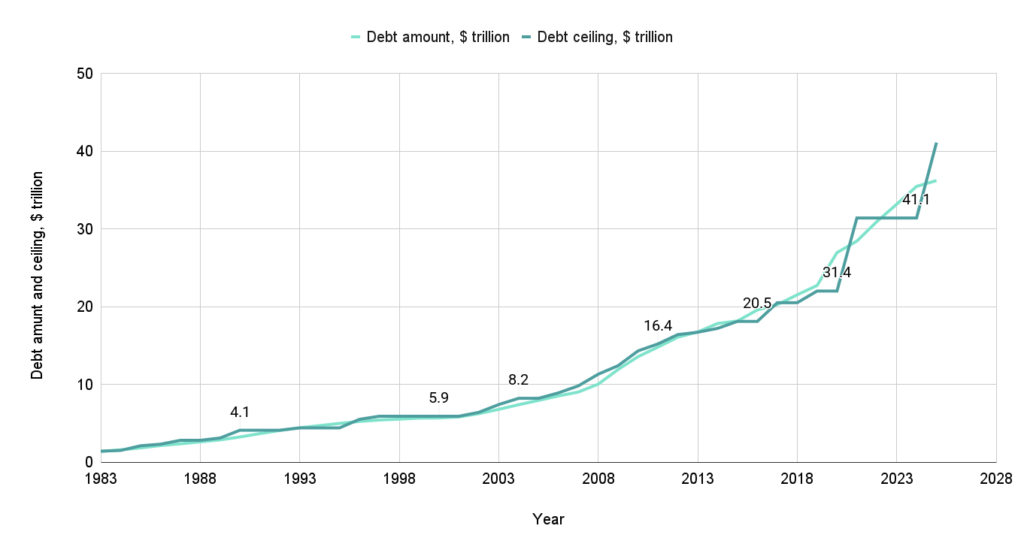

What is the US debt ceiling, and why does it matter?

The US debt ceiling is a legal limit set by Congress on how much money the federal government can borrow to meet its existing financial obligations. In simple terms, it caps the total amount of government debt the US Treasury can issue. But why is the debt ceiling important? Hitting this limit without congressional action can trigger a default, risking severe economic consequences both domestically and globally.

Data taken from: Statista – https://www.statista.com/statistics/246405/federal-debt-limit-of-the-united-states/6

What is the debt ceiling right now?

- The US debt ceiling is $41.1 trillion.

The US debt ceiling over the years

| Year | Debt amount, $ trillion | Debt ceiling, $ trillion |

| 1983 | 1.4 | 1.4 |

| 1984 | 1.6 | 1.5 |

| 1985 | 1.8 | 2.1 |

| 1986 | 2.1 | 2.3 |

| 1987 | 2.4 | 2.8 |

| 1988 | 2.6 | 2.8 |

| 1989 | 2.9 | 3.1 |

| 1990 | 3.2 | 4.1 |

| 1991 | 3.7 | 4.1 |

| 1992 | 4.1 | 4.1 |

| 1993 | 4.4 | 4.4 |

| 1994 | 4.7 | 4.4 |

| 1995 | 5.0 | 4.4 |

| 1996 | 5.2 | 5.5 |

| 1997 | 5.4 | 5.9 |

| 1998 | 5.5 | 5.9 |

| 1999 | 5.7 | 5.9 |

| 2000 | 5.7 | 5.9 |

| 2001 | 5.8 | 5.9 |

| 2002 | 6.2 | 6.4 |

| 2003 | 6.8 | 7.4 |

| 2004 | 7.4 | 8.2 |

| 2005 | 7.9 | 8.2 |

| 2006 | 8.5 | 8.9 |

| 2007 | 9.0 | 9.8 |

| 2008 | 10.0 | 11.3 |

| 2009 | 11.9 | 12.4 |

| 2010 | 13.6 | 14.3 |

| 2011 | 14.8 | 15.2 |

| 2012 | 16.1 | 16.4 |

| 2013 | 16.7 | 16.7 |

| 2014 | 17.8 | 17.2 |

| 2015 | 18.2 | 18.1 |

| 2016 | 19.6 | 18.1 |

| 2017 | 20.2 | 20.5 |

| 2018 | 21.5 | 20.5 |

| 2019 | 22.7 | 22 |

| 2020 | 26.9 | 22 |

| 2021 | 28.4 | 31.4 |

| 2022 | 30.9 | 31.4 |

| 2023 | 33.2 | 31.4 |

| 2024 | 35.5 | 31.4 |

| 2025 | 37.0 | 41.1 |

Data taken from: Statista – https://www.statista.com/statistics/246405/federal-debt-limit-of-the-united-states/6

The national debt ceiling has been raised dozens of times over the years. The debt ceiling history shows repeated bipartisan compromises to prevent financial crises, though often accompanied by political gridlock. Understanding this history is crucial to grasping the recurring debates around federal borrowing limits.

Ultimately, the government debt ceiling serves as a mechanism to control spending, but in practice, it has become a recurring flashpoint in fiscal policy, with real-world impacts on credit ratings, markets, and public trust in US economic governance.

As the size of the US national debt continues to climb, the cost of maintaining that debt has become a central issue in fiscal discussions.

How much does the US pay in interest on its debt?

What is the interest rate on the national debt?

- The average interest rate on the US national debt in 2024 was 3.32%.

The US debt interest payments by year

One of the most immediate consequences of rising government borrowing is the growing amount the US must pay in interest each year. This chart tracks the US debt interest cost from 2017 to 2025, reflecting both increases in borrowing and changes in interest rates. These national debt interest payments are now consuming a larger share of the federal budget than ever before.

Data taken from: Peterson Foundation – https://www.pgpf.org/programs-and-projects/fiscal-policy/monthly-interest-tracker-national-debt/11

- In 2017, the interest on national debt totaled $263 billion; by 2023, it had risen to $658 billion.

- The biggest year-over-year increase occurred between 2022 and 2023, when net interest jumped by $182 billion.

- By 2025, the projected US debt interest cost is expected to reach $952 billion, nearly quadrupling the 2017 figure.

The US interest payments on debt

| Year | Net interest costs, $ billion |

|---|---|

| 2017 | 263 |

| 2018 | 325 |

| 2019 | 375 |

| 2020 | 345 |

| 2021 | 352 |

| 2022 | 476 |

| 2023 | 658 |

| 2024 | 881 |

| 2025 | 952 |

Data taken from: Peterson Foundation – https://www.pgpf.org/programs-and-projects/fiscal-policy/monthly-interest-tracker-national-debt/11

How much money does the US Treasury Department pay as interest on its debt?

- During the 2024 FY, US federal debt interest expenses were $1.133 trillion

Thus, the US government is paying $1 trillion a year in interest on its debt. The federal government pays less net interest because it is offset by interest income it collects through the trust funds it operates and other sources.

How much did the federal government pay out in 2024?

- The US debt service costs in 2024 were $900 billion.

The data on the US debt interest payments by year numbers underscore how rising interest rates and ballooning federal borrowing amplify the financial burden on the US government. As the US debt price grows, more public funds are diverted from essential services to cover interest obligations. Without structural reforms or fiscal restraint, national debt interest payments are poised to become one of the largest recurring expenses in the federal budget. This trend not only limits policy flexibility but also heightens the long-term risks associated with sustaining high levels of public debt.

In 2025, the US debt interest payments as a percentage of GDP reached a notable threshold, totaling approximately 3.6% of the national economy.

- The US debt interest payments as a percentage of GDP are 3.6%.

With the US GDP at $26.5 trillion and net interest costs hitting $952 billion, the growing burden of servicing debt highlights increasing pressure on the federal budget.

- The US debt interest payments per day are $2.6 billion.

This marks one of the highest proportions in recent decades, raising concerns about long-term fiscal sustainability and the government’s ability to fund essential programs without expanding borrowing even further.

While discussions often focus on the size of the US national debt, it’s equally important to understand who holds US debt. The composition of debt holders reveals key dynamics of fiscal policy and global financial interdependence.

Who owns the US debt?

The US national debt structure

The US national debt is divided among a variety of holders, ranging from domestic government entities to foreign governments and private institutions. Understanding the structure helps clarify the influence of internal versus external stakeholders in American fiscal affairs.

Data taken from: Visual Capitalist – https://www.visualcapitalist.com/charted-heres-who-owns-u-s-debt/12

How much debt does the Federal Reserve hold?

- The US national debt held by the Federal Reserve is 15% of the amount of debt held by public holders.

- Intragovernmental debt accounts for the largest share of the national debt structure, totaling 20% of the total.

The structure of the US national debt reflects a balanced mix of domestic and international holders. Intragovernmental holdings and US savings bonds show strong internal financing mechanisms, while the presence of major foreign creditors highlights America’s global financial ties. This layered composition adds both stability and vulnerability to US debt policy, depending on geopolitical and market conditions.

The US national debt holders

As discussions around fiscal policy intensify, understanding who owns the national debt is key to grasping broader economic dynamics. This section breaks down the various holders of US federal debt, offering a closer look at both domestic and foreign stakeholders.

The table below shows a detailed breakdown of who owns the US federal debt held by the public, which totals $28.9 trillion. It distinguishes between domestic entities, such as the Federal Reserve, mutual funds, and pension systems, and overseas holders like Japan and China. It also includes intragovernmental debt, which accounts for a significant share of the total.

| Holder | Category | Amount as of 2023 | Share | Type |

| Federal Reserve System | Public Debt | $5.2T | 15% | Domestic |

| Mutual Funds | Public Debt | $3.7T | 11% | Domestic |

| Depository Institutions | Public Debt | $1.6T | 5% | Domestic |

| State and Local Governments | Public Debt | $1.7T | 5% | Domestic |

| Pension Funds | Public Debt | $1.0T | 3% | Domestic |

| Insurance Companies | Public Debt | $0.5T | 1% | Domestic |

| US Savings Bonds | Public Debt | $5.7T | 17% | Domestic |

| Japan | Public Debt | $1.1T | 3% | Overseas |

| China | Public Debt | $0.8T | 2% | Overseas |

| United Kingdom | Public Debt | $0.7T | 2% | Overseas |

| Other Countries | Public Debt | $5.3T | 15% | Overseas |

| Intragovernmental Debt | Intragovernmental Debt | $7.0T | 20% | Domestic |

Data taken from: Visual Capitalist – https://www.visualcapitalist.com/charted-heres-who-owns-u-s-debt/12

- US federal debt held by the public is $28.9 trillion.

- The Federal Reserve holds $5.2 trillion, making up 15% of the US federal debt held by the public.

- US savings bonds represent $5.7 trillion, or 17%, the largest single domestic category.

- Foreign countries collectively hold $7.9 trillion, with Japan being the top foreign holder at $1.1 trillion.

The question “how much does the US owe in national debt” leads to a complex picture. While the total debt is massive, the distribution shows a diverse range of holders, with domestic institutions still dominating. Notably, how much debt the Federal Reserve holds is a recurring concern in financial debates; at 15%, the Fed’s role remains highly influential. Foreign ownership, though significant, is more dispersed, highlighting the global interconnectedness of US debt markets.

Conclusions

- In July 2025, the U.S. national debt surpassed $37 trillion, an all-time high that reflects not only emergency responses to crises like COVID-19 but also long-standing structural deficits and bipartisan unwillingness to curb spending or raise sufficient revenues. This rising debt burden is no longer just a future concern; it’s a present-day economic constraint.

- The gross debt-to-GDP ratio has climbed to 140%, meaning the U.S. owes far more than it produces annually. This imbalance raises serious questions about long-term fiscal sustainability, creditworthiness, and the government’s capacity to respond to future economic shocks without triggering inflation or undermining investor confidence.

- With annual interest payments projected to reach $952 billion in 2025, nearly 3.6% of GDP, servicing the debt is rapidly becoming one of the largest federal expenditures. This diverts public funds away from critical areas such as education, healthcare, and infrastructure, reducing the government’s fiscal flexibility in addressing social and economic needs.

- The average national debt per citizen has reached $104,599, a staggering increase from under $6,000 in 1980 (at current prices). This steep rise reflects a shift in fiscal responsibility from collective national management to the individual taxpayer, exacerbating concerns about intergenerational equity and economic opportunity for younger Americans.

- Despite foreign countries holding nearly $8 trillion in U.S. debt, led by Japan and China, the majority is still domestically held. However, growing international exposure means that geopolitical tensions or global market instability could directly impact the cost and sustainability of U.S. borrowing.

- Ultimately, the story of U.S. national debt is not just about large numbers; it’s about long-term trade-offs. As the federal government continues to borrow at historic levels, the risks compound: slower economic growth, rising inequality, limited policy options, and the potential erosion of global trust in America’s financial leadership.

Sources

- “Debt to the Penny | U.S. Treasury Fiscal Data.” U.S. Treasury Fiscal Data, https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/. Accessed 4 August 2025.

- Eyermann, Craig. “Exploding Interest on the National Debt: News Article – Independent Institute.” Independent Institute, 2 Aug. 2025, https://www.independent.org/article/2024/10/22/exploding-interest-on-the-national-debt/. Accessed 4 August 2025.

- “Federal Debt: Total Public Debt.” FRED Homepage, 3 June 2025, https://fred.stlouisfed.org/series/GFDEBTN. Accessed 4 August 2025.

- “Historical Debt Outstanding | U.S. Treasury Fiscal Data.” U.S. Treasury Fiscal Data, https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/. Accessed 4 August 2025.

- “Inflation, Consumer Prices for the United States.” FRED Homepage, 16 Apr. 2025, https://fred.stlouisfed.org/series/FPCPITOTLZGUSA. Accessed 4 August 2025.

- Tierney, Abigail. “Debt Ceiling U.S. 2021| Statista.” Statista, 5 July 2024, https://www.statista.com/statistics/246405/federal-debt-limit-of-the-united-states/. Accessed 4 August 2025.

- “United States National Debt 2024.” Countryeconomy.Com, https://countryeconomy.com/national-debt/usa. Accessed 4 August 2025.

- Wessel, David. “What Is the Federal Debt Ceiling? | Brookings.” Brookings, 16 Oct. 2015, https://www.brookings.edu/articles/the-hutchins-center-explains-the-debt-limit/.. Accessed 4 August 2025.

- “Why the National Debt Matters for the Energy Sector”. Bipartisan Policy Center. https://bipartisanpolicy.org/explainer/why-the-national-debt-matters-for-the-energy-sector/. Accessed 4 August 2025.

- “National Debt Clock: What Is the National Debt Right Now?” Peterson Foundation, https://www.pgpf.org/national-debt-clock/. Accessed 8 July 2025. Accessed 4 August 2025.

- “Interest Costs on the National Debt.” Peterson Foundation, 23 Apr. 2025, https://www.pgpf.org/programs-and-projects/fiscal-policy/monthly-interest-tracker-national-debt/. Accessed 4 August 2025.

- “Charted: Here’s Who Owns U.S. Debt” Visual Capitalist, https://www.visualcapitalist.com/charted-heres-who-owns-u-s-debt/. Accessed 4 August 2025.