Key findings:

- The average U.S. 30-year fixed mortgage interest rate in 2025 is 6.79%, down from post-pandemic peaks but still above pre-2020 levels.

- Historically, 30-year fixed mortgage rates peaked at 16.64% in 1981 and hit a record low of 2.96% in 2021, showing extreme long-term volatility.

- VA loans average 4.66%, lower than FHA (4.93%) and Jumbo (4.98%) rates, underscoring the cost advantage of government-backed mortgages.

- Mortgage rates closely follow inflation trends, with rates typically spiking during periods of inflation, such as 2021-2022.

- Forecasts from Fannie Mae and the Mortgage Bankers Association suggest 30-year fixed rates will remain elevated between 6.1% and 6.8% through 2026.

- Globally, the U.S. mortgage rate of 6.33% is higher than in most developed countries, where average rates often fall below 3%.

Mortgage rates play a crucial role in the home-buying process and overall housing affordability. Understanding what a typical mortgage interest rate is, how rates have changed over time, and what factors influence future mortgage rates can help borrowers make informed decisions. This guide provides a comprehensive overview of mortgage rates, including a historical year-by-year analysis, current trends, and forecasts influenced by economic factors such as inflation.

Additionally, we examine how mortgage rates vary by loan type and credit score, offering insight into the differences between fixed-rate and adjustable-rate mortgages, as well as specialized loans such as FHA and VA. Finally, we examine how mortgage interest rates differ across countries, reflecting diverse monetary policies and economic environments worldwide.

Whether you are a first-time buyer, an experienced mortgage borrower, or an investor, this comprehensive analysis will equip you with the knowledge to evaluate mortgage options based on available data and understand the broader financial landscape impacting borrowing costs.

Building on the understanding of how mortgage types differ, it’s equally important to examine how mortgage interest rates have evolved and what they currently look like across the U.S. market.

Mortgage rates overview & trends

The graph below presents a comprehensive look at the average mortgage interest rate in the U.S., focusing specifically on 2025 and its comparison to historical figures.

What is the mortgage interest rate?

- The average 30-year fixed mortgage interest rate in the U.S. in 2025 is 6.79%, reflecting a modest decline from earlier post-pandemic highs.

- Over a broader timeline, the weighted average 30-year fixed mortgage rate over time stands at 5.58% (see methodology section).

- Interest rates peaked above 8% in 2022, which contrasts sharply with the 2025 rate, signaling stabilizing mortgage trends.

The data reveals a clear downward correction from the 2022-2023 spike, when rates surged past 8% due to inflation and Federal Reserve tightening. As of 2025, borrowers benefit from comparatively lower interest rates, though still above pre-2020 levels.

The data also underscores a rising public curiosity around the question: What is the interest rate for mortgages, or what is a typical mortgage interest rate? Usually, people use tools like the mortgage rate calculator to answer these questions.

The steady decline suggests improving affordability, yet questions remain about average mortgage deposit requirements and how the average mortgage loan amount by state varies under these shifting conditions.

While national averages provide a useful benchmark, mortgage affordability in the U.S. can vary widely depending on location, making a state-by-state breakdown essential for deeper insight.

Mortgage rates by state

The data below presents the 30-year fixed mortgage rates by state in 2025.

Data taken from: Business Insider – https://www.businessinsider.com/personal-finance/mortgages/state-mortgage-rates#wisconsin-mortgage-calculator-502

- The lowest 30-year fixed mortgage rate is found in Texas at 6.44%, closely followed by Virginia and Tennessee, both at 6.43%.

- The 30-year FHA mortgage option is most affordable in Texas at 5.71%, indicating notable regional advantages for FHA borrowers.

- Vermont and New Hampshire have the highest 30-year fixed rates, both reaching 6.65%, underscoring regional disparities in borrowing costs.

State-by-state mortgage rate comparison in 2025

| State | 30-year fixed mortgage rate, % |

| Alabama | 6.45 |

| Alaska | 6.64 |

| Arizona | 6.43 |

| Arkansas | 6.58 |

| California | 6.43 |

| Colorado | 6.39 |

| Connecticut | 6.42 |

| Delaware | 6.58 |

| Florida | 6.58 |

| Georgia | 6.44 |

| Hawaii | 6.43 |

| Idaho | 6.54 |

| Illinois | 6.52 |

| Indiana | 6.56 |

| Iowa | 6.58 |

| Kansas | 6.62 |

| Kentucky | 6.42 |

| Louisiana | 6.37 |

| Maine | 6.55 |

| Maryland | 6.41 |

| Massachusetts | 6.39 |

| Michigan | 6.58 |

| Minnesota | 6.54 |

| Mississippi | 6.43 |

| Missouri | 6.62 |

| Montana | 6.53 |

| Nebraska | 6.57 |

| Nevada | 6.57 |

| New Hampshire | 6.65 |

| New Jersey | 6.43 |

| New Mexico | 6.55 |

| New York | 6.50 |

| North Carolina | 6.40 |

| North Dakota | 6.49 |

| Ohio | 6.55 |

| Oklahoma | 6.43 |

| Oregon | 6.46 |

| Pennsylvania | 6.48 |

| Rhode Island | 6.62 |

| South Carolina | 6.51 |

| South Dakota | 6.47 |

| Tennessee | 6.43 |

| Texas | 6.44 |

| Utah | 6.51 |

| Vermont | 6.65 |

| Virginia | 6.54 |

| Washington | 6.51 |

| Washington DC | 6.37 |

| West Virginia | 6.60 |

| Wisconsin | 6.43 |

| Wyoming | 6.43 |

Data taken from: Business Insider –https://www.businessinsider.com/personal-finance/mortgages/state-mortgage-rates#wisconsin-mortgage-calculator-502

This dataset demonstrates that mortgage rates are not uniform across the U.S., even for the same loan type. States like Texas, Virginia, and North Carolina consistently show lower rates across all categories, while Northeastern states tend to have higher borrowing costs.

The differences may reflect regional lender competition, property values, and borrower risk profiles. For potential homebuyers, this highlights the relevance of using tools like a mortgage rate calculator and comparing offers not just by loan type, but also by geography.

After comparing current mortgage rates by state, it’s helpful to place them within a broader historical context to better understand how today’s figures compare with long-term trends.

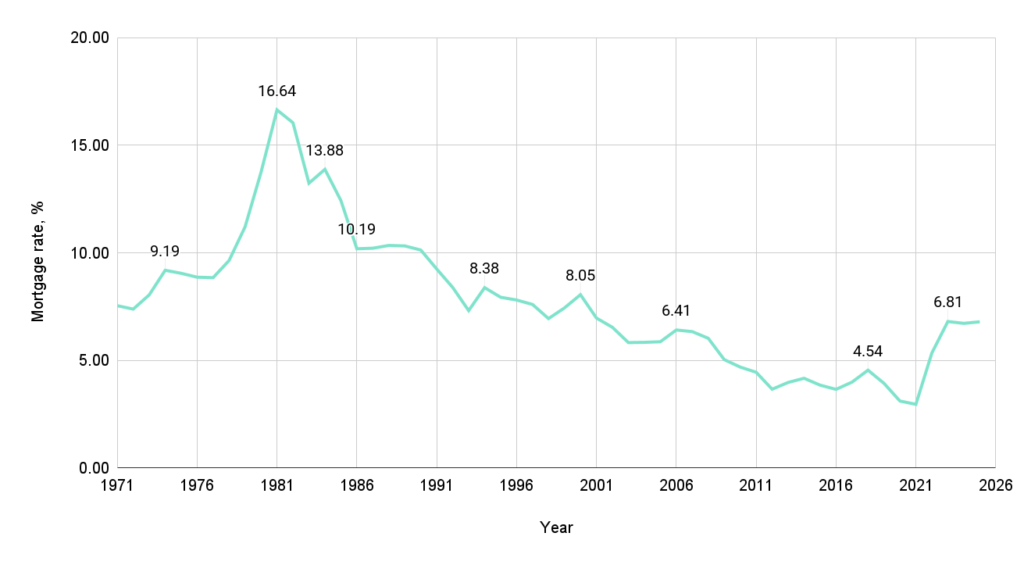

Mortgage rate history: year-by-year analysis

Average mortgage rate statistics

The following dataset tracks 30-year fixed mortgage rates by year from 1971 to 2025, offering an in-depth look at how rates have changed over the decades. This mortgage rate history by year provides a valuable reference for identifying patterns and market shifts tied to inflation, policy decisions, and broader economic cycles.

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6

- The highest mortgage rate on record was in 1981 at 16.64%, reflecting the aggressive anti-inflation policies of that period.

- The lowest rate occurred in 2021 at just 2.96%, offering a clear difference from the early 1980s.

- Mortgage rates have risen again in recent years, with 2025 showing a rate of 6.79%, compared to just 3.11% in 2020, more than doubling in five years.

Average mortgage rate by year

| Year | 30-year fixed mortgage rate, % |

| 1971 | 7.54 |

| 1972 | 7.38 |

| 1973 | 8.04 |

| 1974 | 9.19 |

| 1975 | 9.05 |

| 1976 | 8.87 |

| 1977 | 8.85 |

| 1978 | 9.64 |

| 1979 | 11.20 |

| 1980 | 13.74 |

| 1981 | 16.64 |

| 1982 | 16.04 |

| 1983 | 13.24 |

| 1984 | 13.88 |

| 1985 | 12.43 |

| 1986 | 10.19 |

| 1987 | 10.21 |

| 1988 | 10.34 |

| 1989 | 10.32 |

| 1990 | 10.13 |

| 1991 | 9.25 |

| 1992 | 8.39 |

| 1993 | 7.31 |

| 1994 | 8.38 |

| 1995 | 7.93 |

| 1996 | 7.81 |

| 1997 | 7.60 |

| 1998 | 6.94 |

| 1999 | 7.44 |

| 2000 | 8.05 |

| 2001 | 6.97 |

| 2002 | 6.54 |

| 2003 | 5.83 |

| 2004 | 5.84 |

| 2005 | 5.87 |

| 2006 | 6.41 |

| 2007 | 6.34 |

| 2008 | 6.03 |

| 2009 | 5.04 |

| 2010 | 4.69 |

| 2011 | 4.45 |

| 2012 | 3.66 |

| 2013 | 3.98 |

| 2014 | 4.17 |

| 2015 | 3.85 |

| 2016 | 3.65 |

| 2017 | 3.99 |

| 2018 | 4.54 |

| 2019 | 3.94 |

| 2020 | 3.11 |

| 2021 | 2.96 |

| 2022 | 5.34 |

| 2023 | 6.81 |

| 2024 | 6.72 |

| 2025 | 6.79 |

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6

- Mortgage interest rates over the last 20 years have fluctuated between a low of 2.96% in 2021 and a high of 6.81% in 2023, highlighting recent volatility in the housing market.

- The mortgage rates in the 1980s peaked at 16.64% in 1981, marking the most expensive decade for borrowers in modern U.S. history.

- During the mortgage rates in 1970s, mortgage rates rose steadily from 7.54% in 1971 to 11.20% in 1979, driven by persistent inflation and economic uncertainty.

- Mortgage interest rates during the 2008 recession averaged 6.03%, but quickly declined to 5.04% in 2009, reflecting aggressive Fed intervention.

- The mortgage rates during the financial crisis dropped significantly from 6.34% in 2007 to 4.69% in 2010, as part of efforts to stabilize the housing market.

The mortgage rate history clearly shows a pronounced fluctuation: from historically elevated rates in the 1980s, through a long-term decline into the 2010s, and then a significant rise again after 2021. These fluctuations reflect not only changes in monetary policy but also macroeconomic pressures like inflation and recession.

The post-pandemic spike, with rates climbing back above 6.5% in 2023-2025, marks the most significant upward trend in over a decade and indicates emerging affordability pressures for affordability.

Building on the year-by-year analysis of mortgage rates, examining monthly averages reveals subtle seasonal patterns that influence borrowing costs throughout the year.

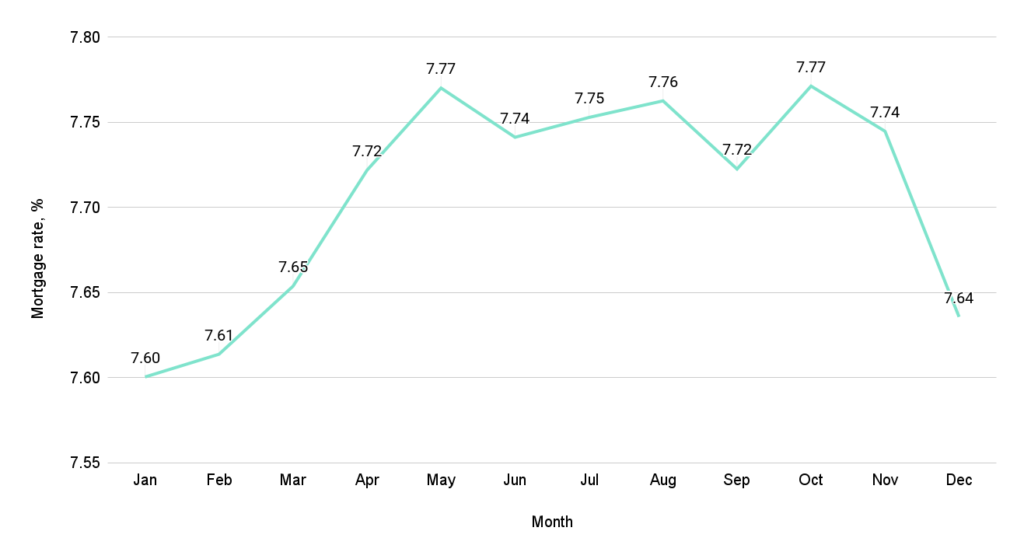

Average mortgage rates chart by month

This chart displays the average mortgage rate by month, aggregated across all years from 1970 to 2025. Tracking mortgage rate trends by month helps identify whether certain times of the year consistently show higher or lower rates.

These seasonal insights can be valuable for prospective borrowers trying to time their mortgage application or refinance.

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6

- The highest average mortgage rates occur in May and October, both at 7.77%, indicating slight seasonal peaks.

- The lowest average rate is in January at 7.60%, showing that the beginning of the year tends to have slightly lower borrowing costs.

- Overall, the variation in mortgage rate trends by month is modest, with rates fluctuating within a narrow band of 7.60% to 7.77%.

Monthly average mortgage rates across decades

| Month | 30-year fixed average mortgage rate, % |

| Jan | 7.60 |

| Feb | 7.61 |

| Mar | 7.65 |

| Apr | 7.72 |

| May | 7.77 |

| Jun | 7.74 |

| Jul | 7.75 |

| Aug | 7.76 |

| Sep | 7.72 |

| Oct | 7.77 |

| Nov | 7.74 |

| Dec | 7.64 |

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6

Though mortgage rates vary significantly over longer periods, monthly averages reveal a subtle seasonal rhythm. Borrowers may find a slight advantage in locking rates early in the year when averages tend to be marginally lower.

However, the limited range in these averages suggests that mortgage rate trends by month have less impact than broader economic or policy shifts. Still, understanding these small but consistent monthly patterns adds another layer of nuance for those navigating the mortgage market.

Building on our earlier discussion about housing affordability, it is crucial to understand how mortgage interest rates have evolved and influenced borrowing costs.

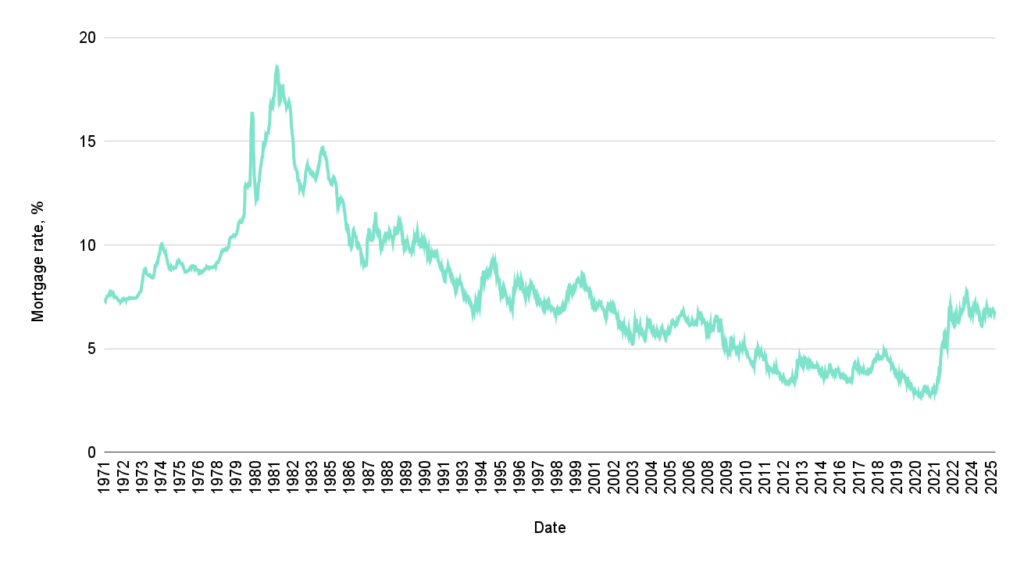

Mortgage rates by date

The chart illustrates the trends in mortgage interest rates for a 30-year fixed loan from 1971 through 2025. Notably, mortgage rates have experienced significant fluctuations, with peaks during the 1980s and a general decline in the early 2000s. Understanding these long-term patterns provides insight into the housing market dynamics and borrowing climate over the last five decades.

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6

- Mortgage rates reached their highest point in 1981 at 16.64%, reflecting the high inflation and monetary tightening of that era.

- Since 2000, mortgage interest rates have generally declined, hitting a historic low of 2.96% in 2021 before rising again to 6.79% in 2025.

- The financial crisis of 2008 coincided with a decline in mortgage rates, dropping from 6.03% in 2008 to 5.04% in 2009, showing the impact of recessionary monetary policy.

This data highlights the cyclical nature of mortgage interest rates and their sensitivity to broader economic conditions such as inflation, recessions, and monetary policy shifts. The 1980s stand out as a period of exceptionally high rates, which have generally trended downward over the last two decades, making home financing more accessible. However, recent years show an upward adjustment, signaling changing economic pressures that borrowers and lenders must navigate. Tracking mortgage interest rates over time remains essential for understanding the affordability and accessibility of home ownership.

Building on the previous overview of mortgage trends, we now examine the detailed dynamics of mortgage interest rates and general interest rates over time.

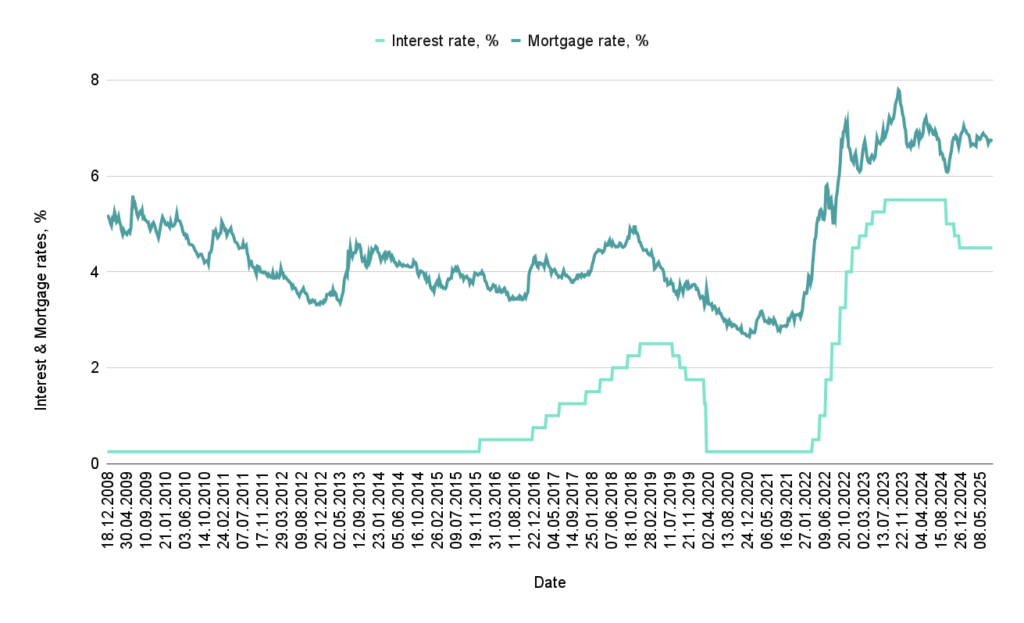

Mortgage & interest rates over time

This chart illustrates the progression of both interest rate (%) and mortgage rate (%) from late 2008 through mid-2020. It highlights how average mortgage interest rate movements closely follow the central interest rate, reflecting broader economic policies. Understanding these fluctuations is essential to assessing affordability and lending conditions in the housing market.

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6, https://fred.stlouisfed.org/series/DFEDTARU1

- The interest rate remained consistently low at 0.25% from December 2008 until early 2016, supporting a stable average mortgage interest rate of around 4% to 5%.

- Mortgage rates decreased steadily from 5.19% in December 2008 to a low of approximately 3.23% by May 2020, indicating improved borrowing conditions over this period.

- A slight upward trend in interest rates began in late 2016, rising to 1.75% by late 2018, which corresponded to a mortgage rate increase to nearly 4.9% in October 2018.

The data reveals a long period of historically low interest rates following the 2008 financial crisis, which contributed to declining average mortgage interest rates and more accessible home financing. However, after 2016, a gradual increase in interest rates signaled a tightening monetary environment that slightly pushed mortgage rates higher. These trends emphasize the sensitivity of mortgage affordability to central bank policies and the broader economic context, which remain critical factors for potential homebuyers and investors to monitor.

As mortgage rates fluctuate over time, understanding forecasts and economic factors that influence these rates is crucial for borrowers and investors alike. This section explores historical mortgage rate trends alongside forecasts provided by leading institutions to provide a clear picture of future mortgage rate expectations.

Mortgage rate predictions & economic influences

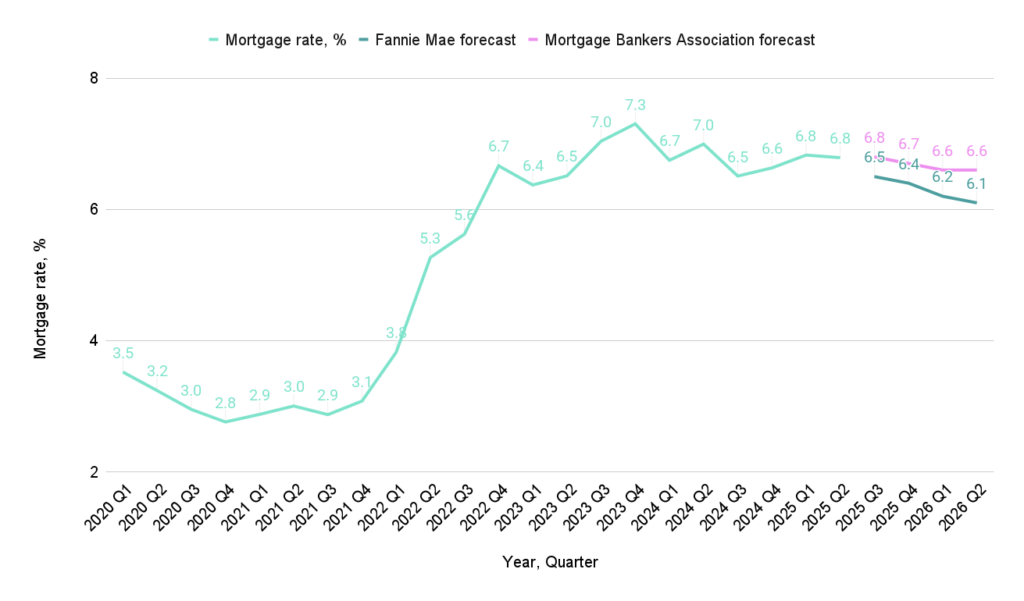

The chart below presents mortgage interest rates from 2015 through recent quarters, along with forecasts from Fannie Mae and the Mortgage Bankers Association for upcoming periods. Noticeable trends include a gradual rise in rates since 2022, reaching peaks in 2023, with forecasts suggesting moderately high rates persisting through 2026.

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6 and Nerdwallet – https://www.nerdwallet.com/article/mortgages/mortgage-outlook-august-20255

- The mortgage interest rate forecast indicates a steady increase from the low rates observed during 2020 and 2021, driven by changing economic conditions and inflationary pressures.

- According to the mortgage rate prediction by Fannie Mae and the Mortgage Bankers Association, rates are expected to remain elevated between 6.1% and 6.8% through 2026, reflecting cautious economic optimism.

- Understanding the future mortgage rate trend is necessary for planning home financing and refinancing decisions, as these projections directly impact borrowing costs.

Mortgage rate value and forecast

| Year, Quarter | Mortgage rate, % | Fannie Mae forecast | Mortgage Bankers Association forecast |

| 2015 Q1 | 3.7 | ||

| 2015 Q2 | 3.8 | ||

| 2015 Q3 | 4.0 | ||

| 2015 Q4 | 3.9 | ||

| 2016 Q1 | 3.7 | ||

| 2016 Q2 | 3.6 | ||

| 2016 Q3 | 3.4 | ||

| 2016 Q4 | 3.8 | ||

| 2017 Q1 | 4.2 | ||

| 2017 Q2 | 4.0 | ||

| 2017 Q3 | 3.9 | ||

| 2017 Q4 | 3.9 | ||

| 2018 Q1 | 4.3 | ||

| 2018 Q2 | 4.5 | ||

| 2018 Q3 | 4.6 | ||

| 2018 Q4 | 4.8 | ||

| 2019 Q1 | 4.4 | ||

| 2019 Q2 | 4.0 | ||

| 2019 Q3 | 3.7 | ||

| 2019 Q4 | 3.7 | ||

| 2020 Q1 | 3.5 | ||

| 2020 Q2 | 3.2 | ||

| 2020 Q3 | 3.0 | ||

| 2020 Q4 | 2.8 | ||

| 2021 Q1 | 2.9 | ||

| 2021 Q2 | 3.0 | ||

| 2021 Q3 | 2.9 | ||

| 2021 Q4 | 3.1 | ||

| 2022 Q1 | 3.8 | ||

| 2022 Q2 | 5.3 | ||

| 2022 Q3 | 5.6 | ||

| 2022 Q4 | 6.7 | ||

| 2023 Q1 | 6.4 | ||

| 2023 Q2 | 6.5 | ||

| 2023 Q3 | 7.0 | ||

| 2023 Q4 | 7.3 | ||

| 2024 Q1 | 6.7 | ||

| 2024 Q2 | 7.0 | ||

| 2024 Q3 | 6.5 | ||

| 2024 Q4 | 6.6 | ||

| 2025 Q1 | 6.8 | ||

| 2025 Q2 | 6.8 | ||

| 2025 Q3 | 6.5 | 6.8 | |

| 2025 Q4 | 6.4 | 6.7 | |

| 2026 Q1 | 6.2 | 6.6 | |

| 2026 Q2 | 6.1 | 6.6 |

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6 and Nerdwallet – https://www.nerdwallet.com/article/mortgages/mortgage-outlook-august-20255

Mortgage rates have experienced significant fluctuations over the past decade, influenced by macroeconomic factors such as inflation, monetary policy, and market demand. The recent rise and forecasts for continued elevated rates suggest that borrowers should prepare for higher borrowing costs in the near term. Staying informed on mortgage rate predictions enables better timing of loan decisions, helping homeowners and investors optimize financing strategies amid changing economic conditions.

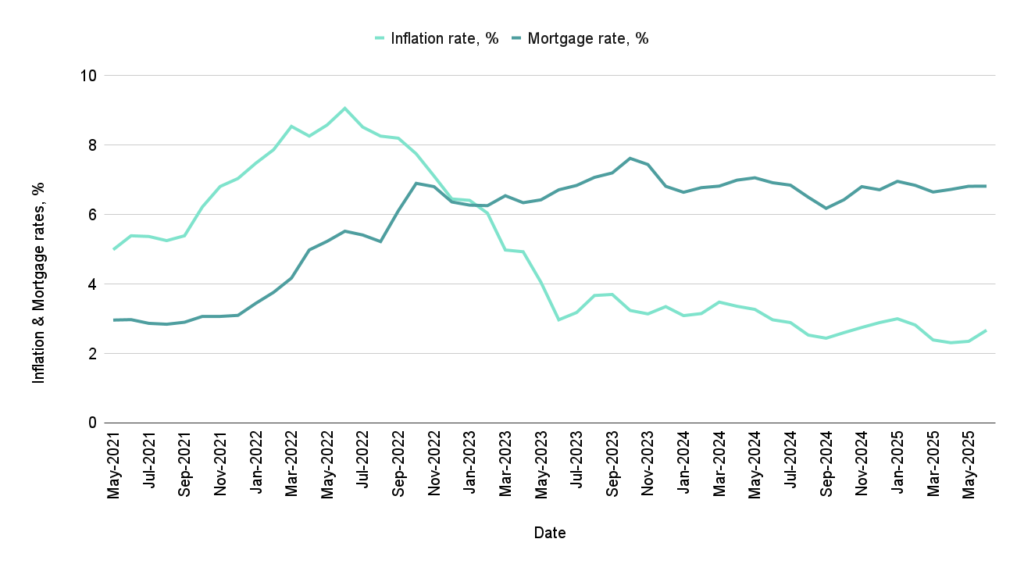

Understanding the relationship between inflation and mortgage interest rates is critical for assessing future borrowing costs and economic trends. This section analyzes monthly inflation rates alongside mortgage rates, highlighting their correlation and economic implications.

Mortgage rates vs inflation

The chart below illustrates inflation and mortgage rate trends from May 2021 to June 2025. Despite occasional divergences, mortgage rates generally move in response to inflation dynamics, reflecting monetary policy adjustments and market expectations.

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6 and Ycharts – https://ycharts.com/indicators/us_inflation_rate4

- The correlation between inflation and mortgage rates fluctuates but remains significant, demonstrating that rising inflation often leads to higher mortgage rates as lenders price in increased economic risk.

- The inflation effect on interest rates is evident in the significant rise of mortgage rates during periods of accelerating inflation in 2021 and 2022.

- The graph of interest rates and inflation reveals a lagged response, where mortgage rates adjust gradually to sustained inflation changes, influenced by central bank policies and economic outlooks.

Mortgage and inflation rates in dynamics

| Date | Inflation rate, % | Mortgage rate, % |

| 31.05.2021 | 4.99 | 2.96 |

| 30.06.2021 | 5.39 | 2.98 |

| 31.07.2021 | 5.37 | 2.87 |

| 31.08.2021 | 5.25 | 2.84 |

| 30.09.2021 | 5.39 | 2.90 |

| 31.10.2021 | 6.22 | 3.07 |

| 30.11.2021 | 6.81 | 3.07 |

| 31.12.2021 | 7.04 | 3.10 |

| 31.01.2022 | 7.48 | 3.45 |

| 28.02.2022 | 7.87 | 3.76 |

| 31.03.2022 | 8.54 | 4.17 |

| 30.04.2022 | 8.26 | 4.98 |

| 31.05.2022 | 8.58 | 5.23 |

| 30.06.2022 | 9.06 | 5.52 |

| 31.07.2022 | 8.52 | 5.41 |

| 31.08.2022 | 8.26 | 5.22 |

| 30.09.2022 | 8.20 | 6.11 |

| 31.10.2022 | 7.75 | 6.90 |

| 30.11.2022 | 7.11 | 6.81 |

| 31.12.2022 | 6.45 | 6.36 |

| 31.01.2023 | 6.41 | 6.27 |

| 28.02.2023 | 6.04 | 6.26 |

| 31.03.2023 | 4.98 | 6.54 |

| 30.04.2023 | 4.93 | 6.34 |

| 31.05.2023 | 4.05 | 6.43 |

| 30.06.2023 | 2.97 | 6.71 |

| 31.07.2023 | 3.18 | 6.84 |

| 31.08.2023 | 3.67 | 7.07 |

| 30.09.2023 | 3.70 | 7.20 |

| 31.10.2023 | 3.24 | 7.62 |

| 30.11.2023 | 3.14 | 7.44 |

| 31.12.2023 | 3.35 | 6.82 |

| 31.01.2024 | 3.09 | 6.64 |

| 29.02.2024 | 3.15 | 6.78 |

| 31.03.2024 | 3.48 | 6.82 |

| 30.04.2024 | 3.36 | 6.99 |

| 31.05.2024 | 3.27 | 7.06 |

| 30.06.2024 | 2.97 | 6.92 |

| 31.07.2024 | 2.89 | 6.85 |

| 31.08.2024 | 2.53 | 6.50 |

| 30.09.2024 | 2.44 | 6.18 |

| 31.10.2024 | 2.6 | 6.43 |

| 30.11.2024 | 2.75 | 6.81 |

| 31.12.2024 | 2.89 | 6.72 |

| 31.01.2025 | 3.00 | 6.96 |

| 28.02.2025 | 2.82 | 6.84 |

| 31.03.2025 | 2.39 | 6.65 |

| 30.04.2025 | 2.31 | 6.73 |

| 31.05.2025 | 2.35 | 6.82 |

| 30.06.2025 | 2.67 | 6.82 |

Data taken from: Federal Reserve Bank of St. Louis – https://fred.stlouisfed.org/series/MORTGAGE30US6 and Ycharts – https://ycharts.com/indicators/us_inflation_rate4

Mortgage rates are strongly influenced by inflation trends, as lenders and policymakers adjust rates to maintain economic stability and control inflationary pressures. Monitoring the interplay between these indicators provides informative data points for future mortgage cost trajectories and informs decisions on borrowing and investment strategies in an evolving economic environment.

Mortgage rates vary significantly depending on loan type, borrower credit score, and regional factors. This section examines current average rates for the most common 30-year loan products: fixed-rate, FHA, and VA loans across U.S. states, highlighting notable differences.

Mortgage rates by loan type

The table displays the latest mortgage rates by loan type in various states. Fixed-rate mortgages tend to have slightly higher rates compared to FHA and VA loans, reflecting differences in risk, loan guarantees, and borrower eligibility. For example, FHA loans generally offer lower rates to assist first-time buyers or those with less-than-perfect credit, while VA loans provide competitive rates for eligible veterans.

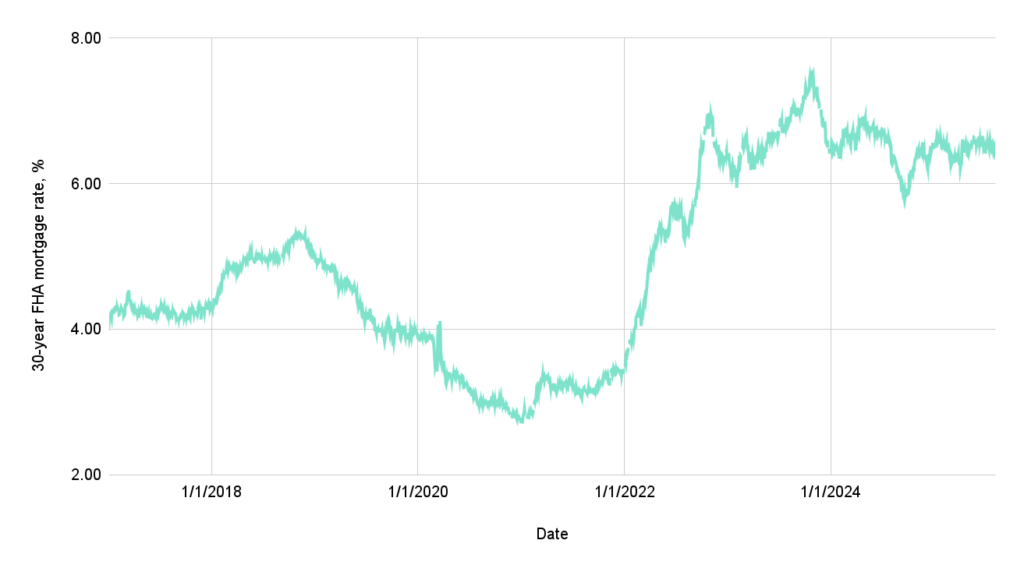

30-year FHA mortgage rate

Data taken from: Business Insider – https://www.businessinsider.com/personal-finance/mortgages/state-mortgage-rates#wisconsin-mortgage-calculator-502

- 30-year FHA mortgage with an average rate of 4.93%, FHA loans provide competitive options for borrowers with moderate credit profiles or smaller down payments.

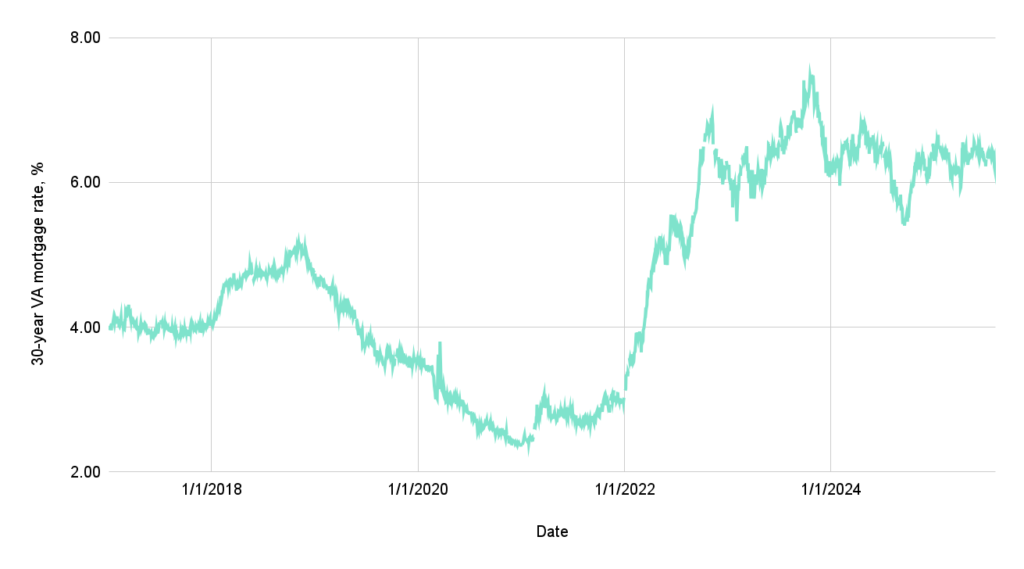

30-year VA mortgage rate

Data taken from: Business Insider – https://www.businessinsider.com/personal-finance/mortgages/state-mortgage-rates#wisconsin-mortgage-calculator-502

- 30-year VA mortgage averaging 4.66%, VA loan mortgage rates history shows the lowest rates among the compared mortgage types, reinforcing their advantage for eligible veterans and service members.

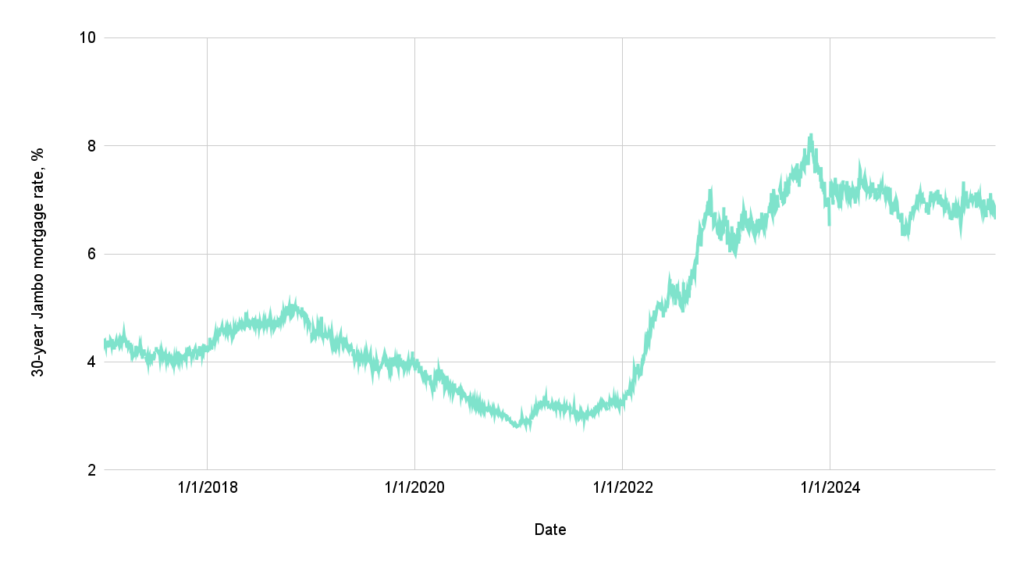

30-year Jumbo mortgage rate chart

Data taken from: Business Insider – https://www.businessinsider.com/personal-finance/mortgages/state-mortgage-rates#wisconsin-mortgage-calculator-502

- 30-year Jumbo mortgage averaging 4.98%, Jumbo loans typically carry the highest rates, reflecting the increased risk associated with high-value loan amounts exceeding conforming limits.

Mortgage rates differ by loan type and borrower profile, with fixed-rate loans providing long-term payment certainty, while FHA and VA loans offer accessible options at generally lower rates. Understanding these distinctions is crucial for borrowers to select the best mortgage product tailored to their financial situation and creditworthiness.

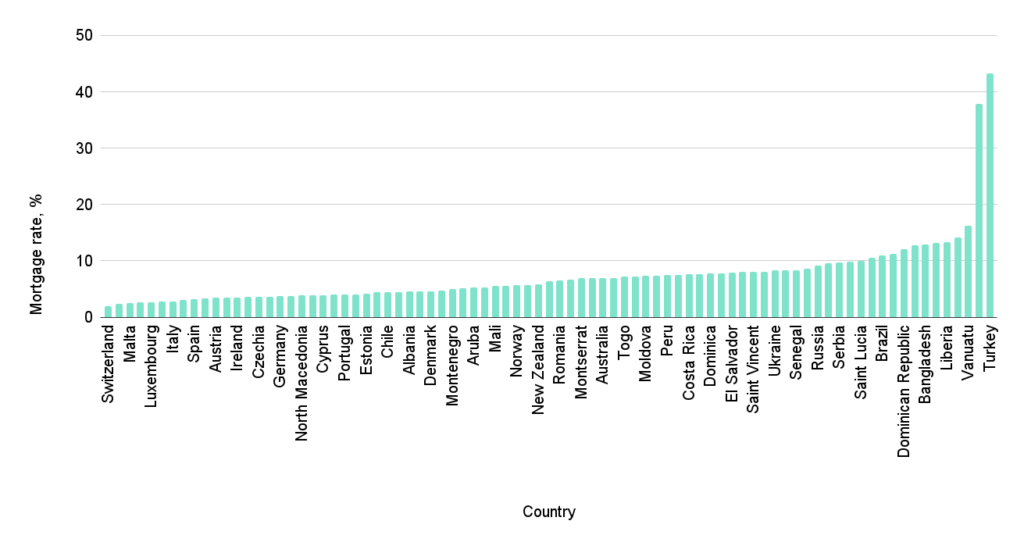

Mortgage rates in different countries

Mortgage interest rates vary widely across countries, reflecting differences in monetary policy, economic conditions, and housing market dynamics. This global comparison highlights the latest mortgage rates, revealing significant disparities between regions.

Switzerland and the Euro area exhibit some of the lowest mortgage rates globally, around 2%, due to stable economic environments and accommodative central bank policies. Countries in Western Europe, such as the Netherlands, Luxembourg, and Italy, also maintain relatively low rates below 3%. On the other hand, countries like the USA and Canada have moderately higher rates near 4-6%, influenced by Federal Reserve decisions and local market factors.

Emerging markets and developing countries tend to experience much higher mortgage rates, often exceeding 7%, with some nations like Argentina and Turkey reporting rates above 30%, primarily due to inflationary pressures and currency risks.

Data taken from: TheGlobalEconomy.Com – https://www.theglobaleconomy.com/rankings/mortgage_interest_rate/ 3

- The global mortgage interest rates comparison reveals a clear divide between developed and developing economies, with the former benefiting from lower, more stable rates.

- The Federal Reserve’s mortgage rates and their impact on U.S. mortgage costs show how central bank policies directly influence domestic borrowing costs.

- The European interest rate trends demonstrate consistently low rates across the Eurozone, supported by the European Central Bank’s accommodative stance.

Mortgage rates in different countries

| Country | Mortgage rate (latest value), % |

| Switzerland | 1.97 |

| Euro area | 2.42 |

| Malta | 2.56 |

| Netherlands | 2.68 |

| Luxembourg | 2.69 |

| Bulgaria | 2.74 |

| Italy | 2.79 |

| Croatia | 3.07 |

| Spain | 3.13 |

| Belgium | 3.29 |

| Austria | 3.42 |

| France | 3.43 |

| Ireland | 3.52 |

| Slovenia | 3.54 |

| Czechia | 3.65 |

| Greece | 3.65 |

| Germany | 3.68 |

| Slovakia | 3.81 |

| North Macedonia | 3.84 |

| Sweden | 3.93 |

| Cyprus | 3.94 |

| South Korea | 3.98 |

| Portugal | 3.99 |

| Finland | 4.07 |

| Estonia | 4.11 |

| Canada | 4.39 |

| Chile | 4.39 |

| Bosnia and Herzegovina | 4.43 |

| Albania | 4.53 |

| Lithuania | 4.54 |

| Denmark | 4.58 |

| United Kingdom | 4.76 |

| Montenegro | 4.95 |

| Bahrain | 5.19 |

| Aruba | 5.20 |

| Bahamas | 5.24 |

| Mali | 5.59 |

| Niger | 5.59 |

| Norway | 5.65 |

| Hungary | 5.73 |

| New Zealand | 5.84 |

| USA | 6.33 |

| Romania | 6.52 |

| Ivory Coast | 6.61 |

| Montserrat | 6.88 |

| Benin | 6.93 |

| Australia | 7.00 |

| Grenada | 7.00 |

| Togo | 7.21 |

| Trinidad and Tobago | 7.25 |

| Moldova | 7.35 |

| Poland | 7.37 |

| Peru | 7.44 |

| Jamaica | 7.53 |

| Costa Rica | 7.61 |

| Burkina Faso | 7.67 |

| Dominica | 7.75 |

| Latvia | 7.75 |

| El Salvador | 7.88 |

| Antigua and Barbuda | 8.00 |

| Saint Vincent and the Grenadines | 8.00 |

| Tonga | 8.01 |

| Ukraine | 8.28 |

| Nepal | 8.33 |

| Senegal | 8.36 |

| Kazakhstan | 8.66 |

| Russia | 9.20 |

| Guinea-Bissau | 9.60 |

| Serbia | 9.69 |

| Paraguay | 9.81 |

| Saint Lucia | 10.00 |

| Bhutan | 10.54 |

| Brazil | 10.91 |

| South Africa | 11.25 |

| Dominican Republic | 12.12 |

| Armenia | 12.71 |

| Bangladesh | 12.92 |

| Georgia | 13.12 |

| Liberia | 13.38 |

| Suriname | 14.10 |

| Vanuatu | 16.25 |

| Argentina | 37.84 |

| Turkey | 43.23 |

Data taken from: TheGlobalEconomy.Com – https://www.theglobaleconomy.com/rankings/mortgage_interest_rate/ 3

Understanding mortgage interest rates by country is essential for international investors and borrowers considering cross-border financing. Central bank policies like those of the Federal Reserve play a crucial role in shaping national mortgage costs, while economic stability and inflation heavily influence rates in emerging markets. This comparative view underscores the importance of macroeconomic factors in mortgage affordability worldwide.

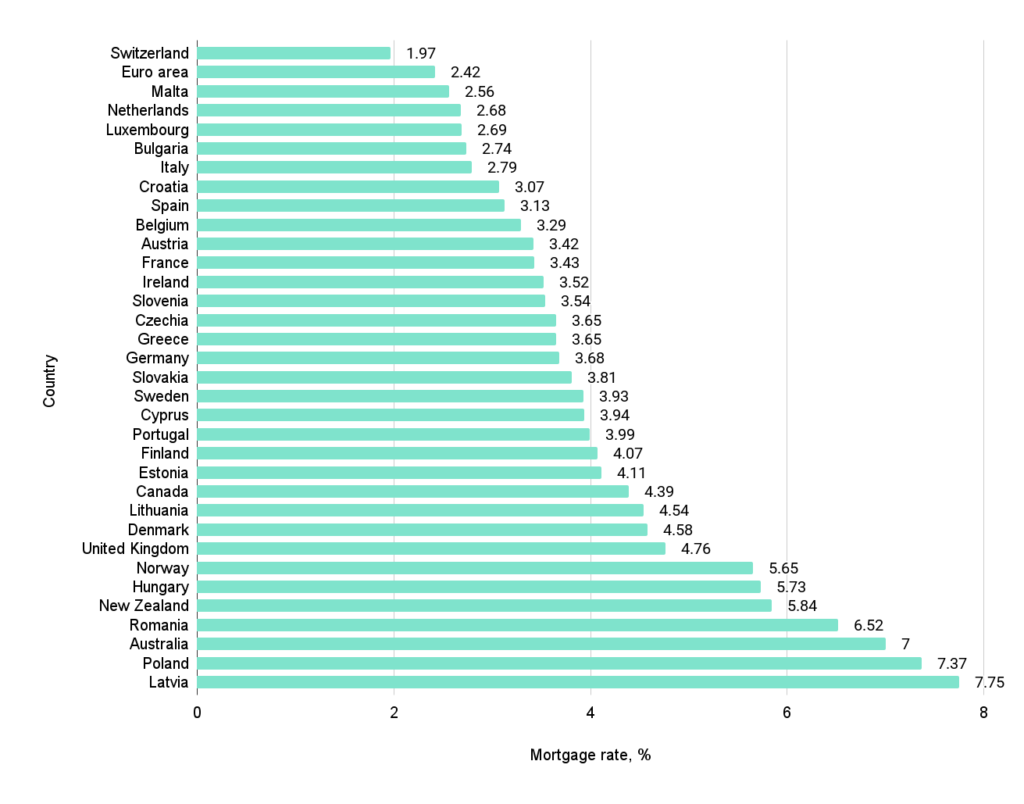

Building on our previous analysis of housing markets, we now turn to examining mortgage rates across developed countries.

Mortgage rates in developed countries

This chart displays the mortgage rates (%) in a selection of developed countries, highlighting the variation in borrowing costs for homebuyers. Mortgage rates range from below 2% in Switzerland to nearly 8% in Latvia, reflecting differing economic conditions and monetary policies across these nations.

Data taken from: TheGlobalEconomy.Com – https://www.theglobaleconomy.com/rankings/mortgage_interest_rate/ 3

- Switzerland has the lowest mortgage rate at 1.97%, significantly below the group average.

- The average mortgage rate across these developed countries is approximately 4.3%.

- Latvia has the highest mortgage rate at 7.75%, nearly four times that of Switzerland.

Mortgage rate comparison in developed economies

| Country | Mortgage rate, % |

| Switzerland | 1.97 |

| Euro area | 2.42 |

| Malta | 2.56 |

| Netherlands | 2.68 |

| Luxembourg | 2.69 |

| Bulgaria | 2.74 |

| Italy | 2.79 |

| Croatia | 3.07 |

| Spain | 3.13 |

| Belgium | 3.29 |

| Austria | 3.42 |

| France | 3.43 |

| Ireland | 3.52 |

| Slovenia | 3.54 |

| Czechia | 3.65 |

| Greece | 3.65 |

| Germany | 3.68 |

| Slovakia | 3.81 |

| Sweden | 3.93 |

| Cyprus | 3.94 |

| Portugal | 3.99 |

| Finland | 4.07 |

| Estonia | 4.11 |

| Canada | 4.39 |

| Lithuania | 4.54 |

| Denmark | 4.58 |

| United Kingdom | 4.76 |

| Norway | 5.65 |

| Hungary | 5.73 |

| New Zealand | 5.84 |

| Romania | 6.52 |

| Australia | 7.00 |

| Poland | 7.37 |

| Latvia | 7.75 |

Data taken from: TheGlobalEconomy.Com – https://www.theglobaleconomy.com/rankings/mortgage_interest_rate/ 3

Mortgage rates among developed countries show considerable disparity, with rates clustering around an average of 4.3%. Such variation may impact housing affordability and borrowing behavior, influencing real estate markets differently across regions. The relatively low rates in countries like Switzerland contrast sharply with higher rates seen in Latvia and Poland, pointing to underlying economic and policy differences that deserve closer examination.

Conclusions

- In 2025, the average U.S. mortgage rate stands at 6.79%, reflecting a moderate decline from the post-pandemic highs of over 8%, yet remaining well above the historically low rates of the early 2020s. This sustained elevation signals a new era of borrowing costs shaped by inflationary pressure, tighter monetary policy, and evolving market expectations.

- Over the last five decades, mortgage rates have experienced extreme cycles, soaring to 16.64% in 1981 and falling to a historic low of 2.96% in 2021. These shifts underscore how deeply mortgage affordability is tied to macroeconomic forces, particularly Federal Reserve actions, inflation trends, and systemic shocks like recessions and pandemics.

- While national averages offer important context, state-level data reveal significant geographic disparities. States like Texas and Virginia offer more favorable mortgage terms, while rates in Northeastern states remain elevated. These regional differences affect not only affordability but also migration patterns, housing market dynamics, and long-term wealth-building opportunities.

- Loan type also plays a critical role: FHA and VA mortgages continue to offer lower rates than conventional fixed-rate loans, highlighting the importance of government-backed options for first-time buyers, veterans, and borrowers with moderate credit scores. In contrast, fixed-rate mortgages, though slightly more expensive, provide stability amid rate volatility.

- International comparisons show the U.S. mortgage rate at 6.33%, substantially higher than in most developed economies, where rates often remain below 3%. This gap reflects not only divergent monetary policies but also deeper structural differences in housing finance systems and central bank strategies.

- Looking ahead, forecasts from Fannie Mae and the Mortgage Bankers Association suggest rates will remain elevated through 2026. For borrowers and investors, this means adapting to a longer-term environment of higher mortgage costs, rethinking timing and loan structures, and incorporating economic signals like inflation more closely into decision-making.

- Ultimately, the story of mortgage rates is not just a matter of percentages; it is a window into broader economic health, household financial resilience, and the accessibility of homeownership in a changing global economy.

Methodology

To calculate the historical weighted average interest rate for 30-year fixed-rate mortgages in the United States, we used annual data on total mortgage origination volumes and average 30-year fixed mortgage rates from 1990 to 2021. Since 30-year fixed-rate loans consistently account for approximately 88% of all residential mortgage originations in the U.S., we adjusted the total annual origination volumes by this share to better isolate the portion attributable to 30-year fixed products. The weighted average interest rate was then derived by combining these adjusted volumes with the corresponding annual average rates, resulting in a figure that accurately reflects the effective borrowing cost across the 30-year fixed mortgage market over time.

Sources

- “Federal Funds Target Range – Upper Limit.” FRED Homepage, 6 Aug. 2025, https://fred.stlouisfed.org/series/DFEDTARU. Accessed 6 August 2025.

- Molly Grace, Sophia. “Mortgage Rates by State: Get the Latest for Your Location.” Business Insider, 10 Feb. 2025, https://www.businessinsider.com/personal-finance/mortgages/state-mortgage-rates. Accessed 6 August 2025.

- “Mortgage Credit Interest Rate around the World | TheGlobalEconomy.Com.” TheGlobalEconomy.Com, https://www.theglobaleconomy.com/rankings/mortgage_interest_rate/. Accessed 6 August 2025.

- “US Inflation Rate – Real-Time & Historical Trends.” YCharts, 31 July 2025, https://ycharts.com/indicators/us_inflation_rate. Accessed 6 August 2025.

- Holden Lewis, Jeanette Margle. “August Mortgage Outlook: Rates May Slumber, but Buyers Dream of a Big Drop”. https://www.nerdwallet.com/article/mortgages/mortgage-outlook-august-2025. Accessed 6 August 2025.

- “30-Year Fixed Rate Mortgage Average in the United States.” FRED Homepage, 31 July 2025, https://fred.stlouisfed.org/series/MORTGAGE30US. Accessed 6 August 2025.

- Daily, Mortgage. “Mortgage Origination Statistics | MortgageDaily.Com.” Mortgage Daily | Mortgage News, Rates & Financial Education, 1 Jan. 1970, https://www.mortgagedaily.com/news/residentialstatistics/. Accessed 6 August 2025.