For investors, the new year is a time for reflection. There is much to consider from 2020, after the COVID-19 pandemic led to an economic collapse, bear market crash, historic government stimulus, plummeting interest rates and more — not to mention the impact on everyday life. Other events that added to investor concerns include a heated presidential election, cybersecurity breaches and government action against large tech companies, just to name a few. These events are a reminder that it is impossible to anticipate or predict every scenario.

2020, with all its challenges, still ends with all-time market highs

In 2020, those with the composure to endure months of uncertainty by staying invested were ultimately rewarded. Doing so was undoubtedly made easier with a sound financial plan, the right investment tools, an understanding of financial market history and a cushion of savings. After all, while plans are easy to make in good times when markets are rising, they truly become a necessity when times are tough. This is one of the most important jobs of an investor.

Only months after bear market declines across all major global indices, the S&P 500 ended 2020 at all-time highs with a return of 18.4% for the year (with dividends) which includes a historic 70% rebound from March lows. The NASDAQ rose 45% during the year while the Dow returned 9.7%. Fixed income investments also served their intended function as diversifiers in portfolios. All told, investors who remained diversified across stocks and bonds had a smoother ride and benefited from a mix of asset classes.

Staying diversified mattered in 2020

Sources: Clearnomics, Refinitiv, Standard & Poor’s.

Will life — and investing — return to “normal” in 2021?

As we begin 2021, the public health situation is mixed. In the short run, the pandemic rages on as new COVID-19 cases accelerate, pushing governments to enforce restrictions. In the long run, however, the deployment of vaccines and the ability to manage economic conditions are reasons for optimism.

Current consensus forecasts suggest that as life returns to some semblance of “normal” in the coming year, economic growth and corporate profits can return to pre-COVID levels by the end of 2021 or in early 2022. This depends on many factors including the successful roll-out of vaccines, their long-term efficacy, the ability to fully reopen businesses safely, the willingness of consumers and businesses to spend, etc. Despite these challenges, there appears to be a light at the end of the tunnel.

In 2021, as always, an appropriate mix of investments is key

Of course, the aggregate statistics hide the divergent outcomes among sectors, types of jobs, income levels and more. For this reason, the second half of the COVID-19 recovery, which will take place throughout 2021, is already proving to be more difficult.

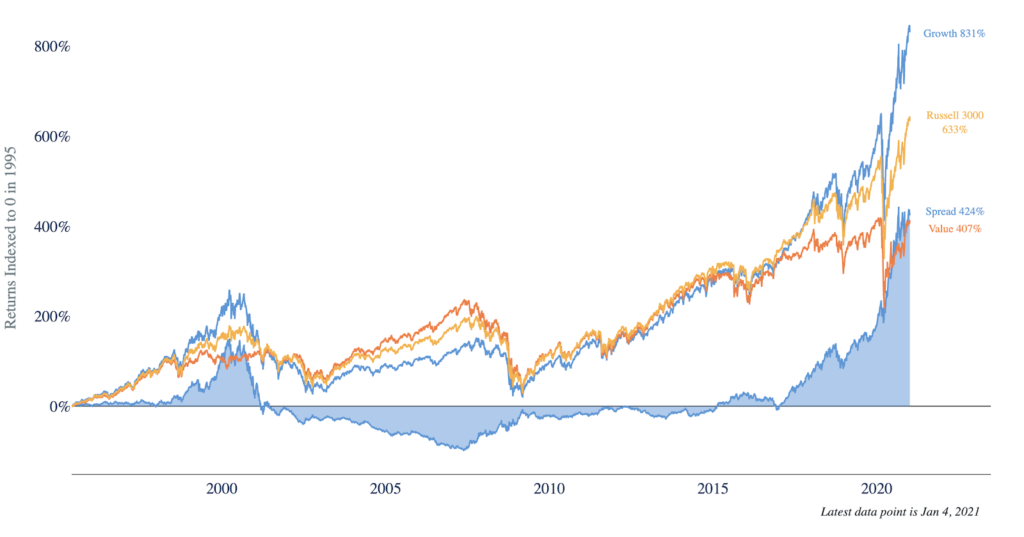

In spite of this, the stock market ended 2020 at new record-setting highs. Many of the trends from the past year could continue for some time as uncertainty continues. This has largely benefited growth and technology-driven sectors at the expense of value stocks and sectors directly harmed by economic restrictions, like the hospitality and travel industries.

However, there is already evidence that performance across regions, sectors, styles and stocks is broadening. Valuation differences between growth and value are at historic levels. Technology-driven stocks have already risen sharply since the recovery began. At some point, investors may prefer investments that will benefit from a full economic recovery. There are no guarantees that this will happen soon, nor does this need to be at the expense of what has already done well. Rather, it is a reminder that investors should stay broadly diversified as the world heals in the coming year.

Differences in sector performance in 2020

Unfortunately, expectations are that the early part of 2021 will resemble 2020 as the pandemic drags on and the recovery continues. What has worked for investors not only during the crisis but also over the full history of financial markets is to stay resilient and disciplined.

Invest in your future in 2021

Investing in your future automatically, even in small amounts, can really add up over time. Discover effortless investing at MoneyLion.